Tax

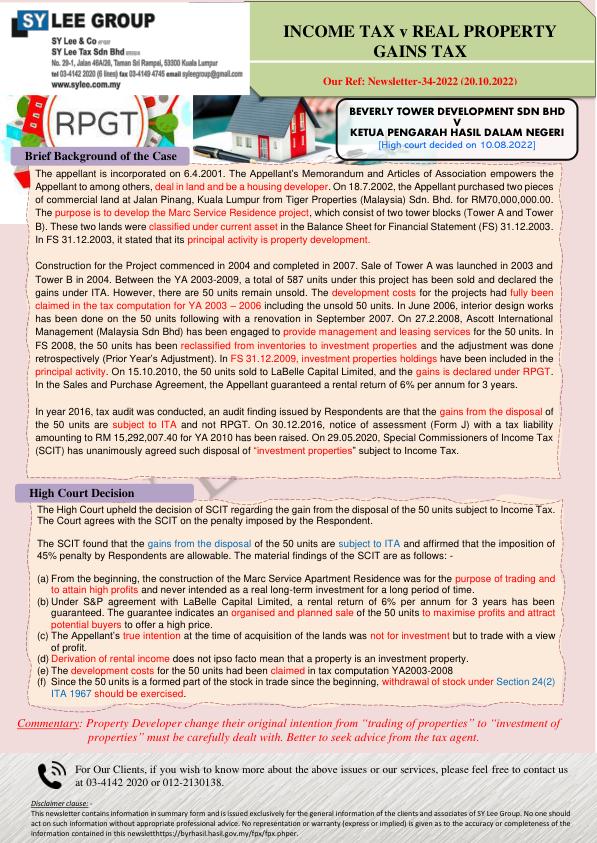

Newsletter-34-2022- Income Tax v RPGT

20.Dec.2023

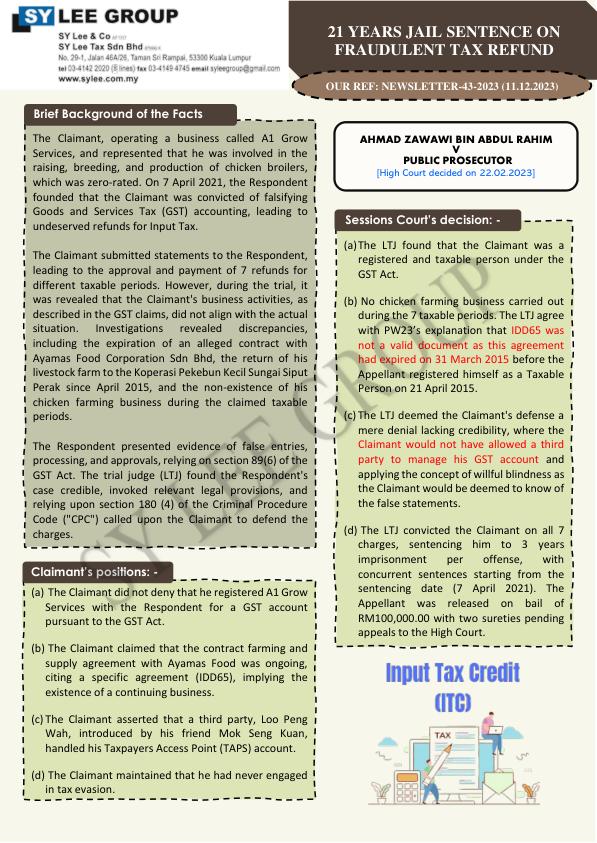

Newsletter-43-2023- 21 Years Jail Sentence for Fraudulent Tax Refund

11.Dec.2023

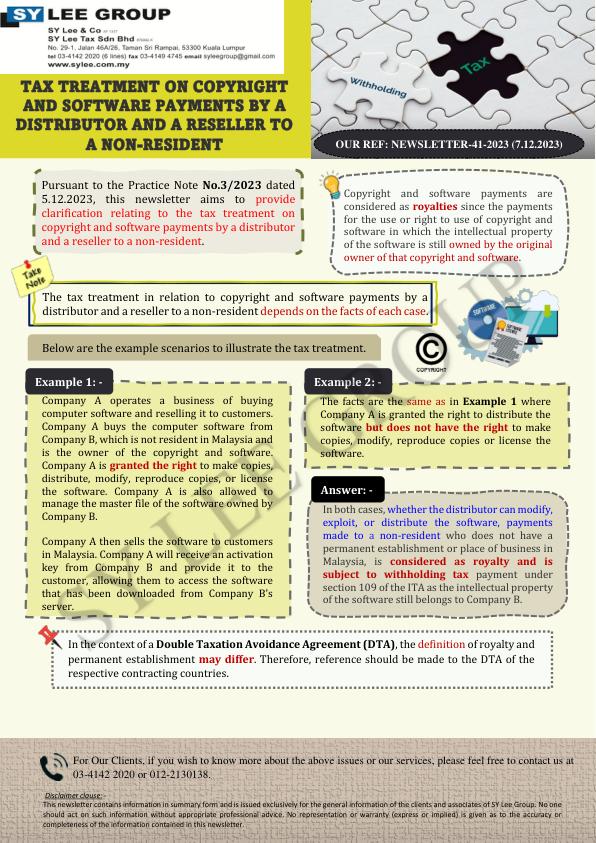

Newsletter-41-2023 - Tax Treatment on Copyright and Software Payments by a Distributor and a Reseller to a Non-Resident

07.Dec.2023

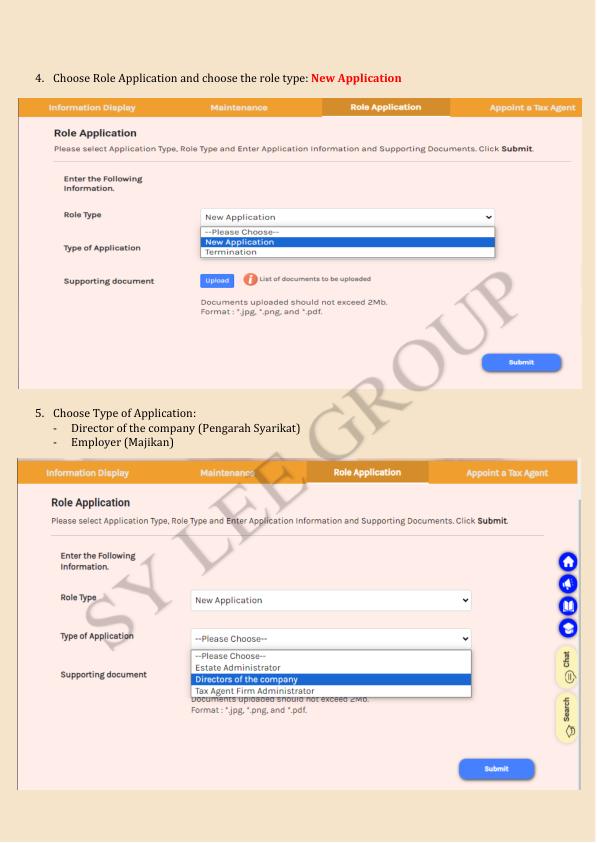

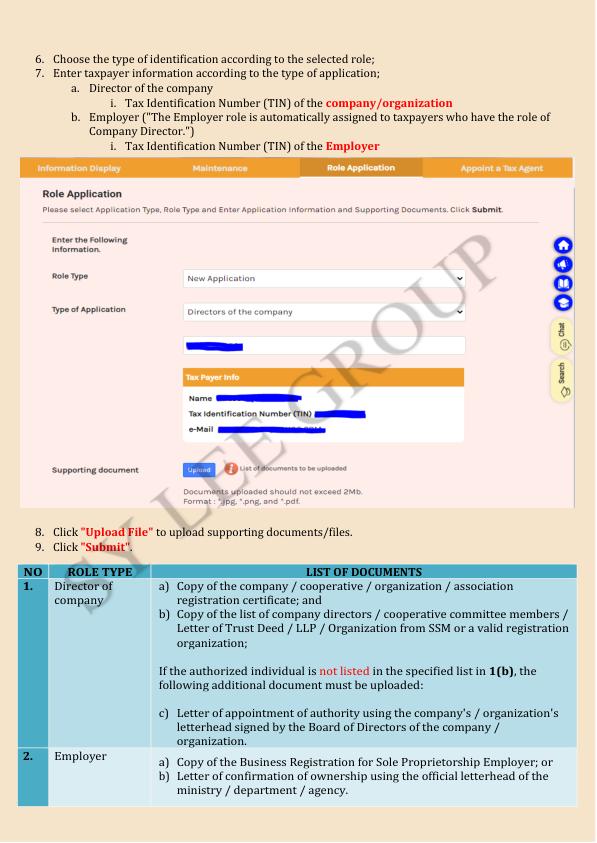

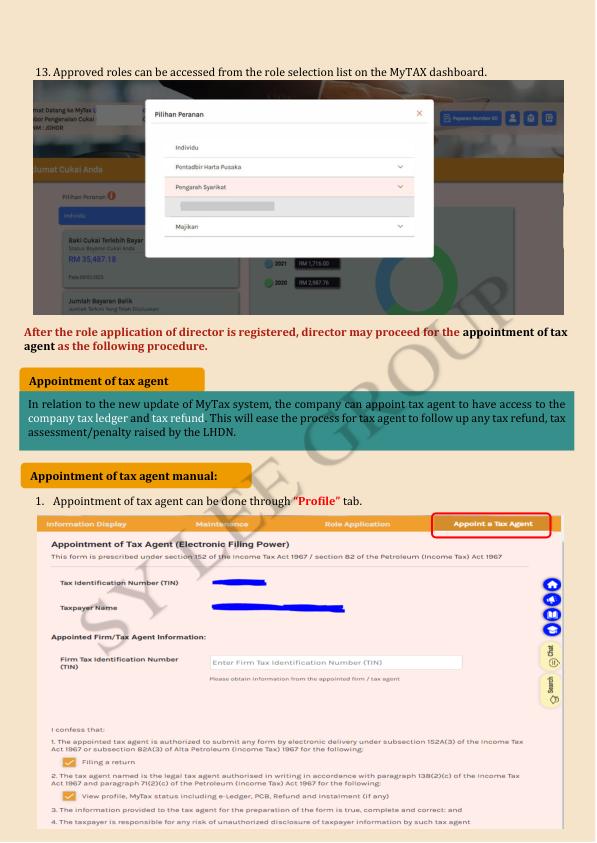

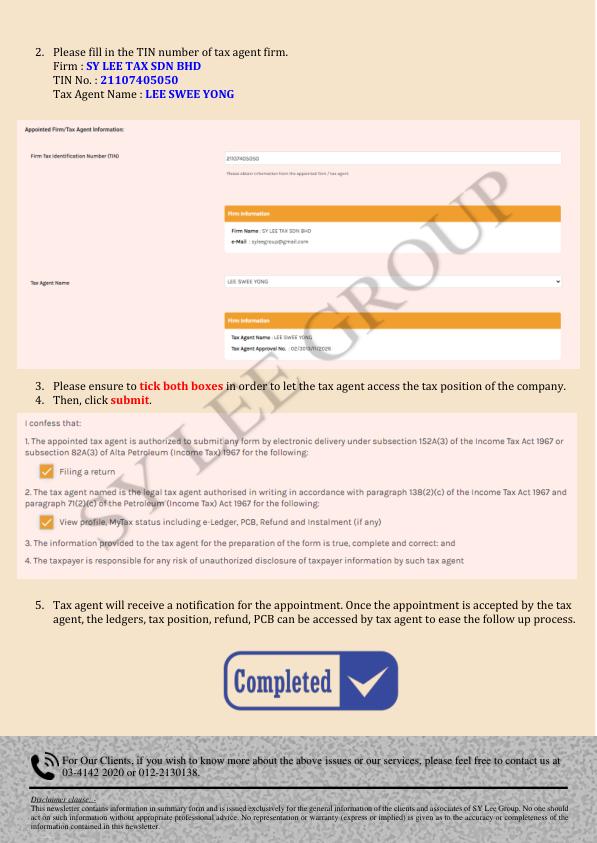

Newsletter-40-2023 - Application for director"s role & Appointment of Tax Agent

22.Nov.2023

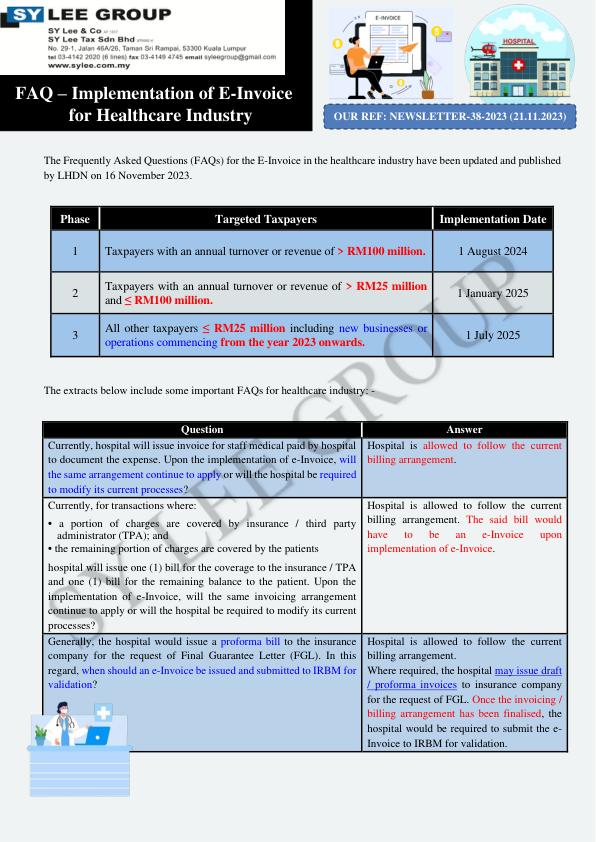

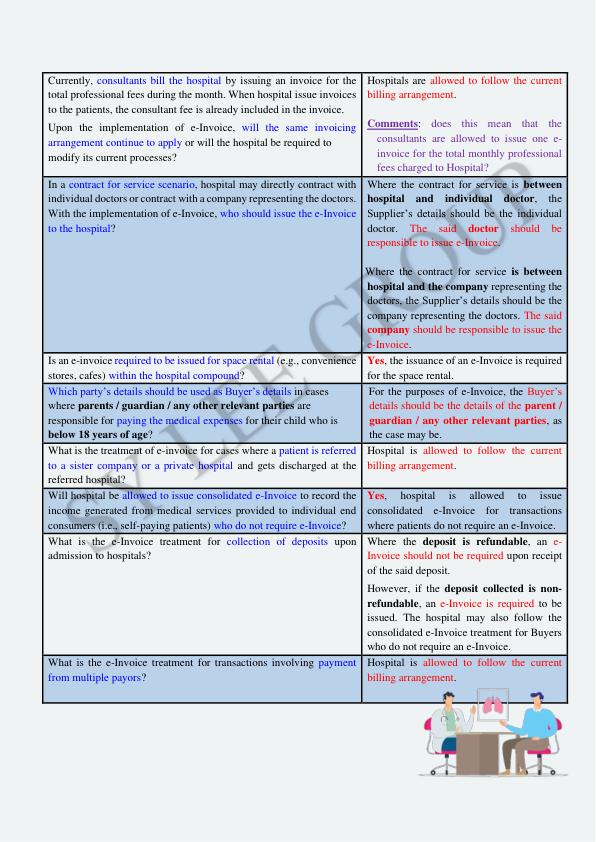

Newsletter-38-2023 - FAQ - Implementation of E-Invoice for Healthcare Industry

21.Nov.2023

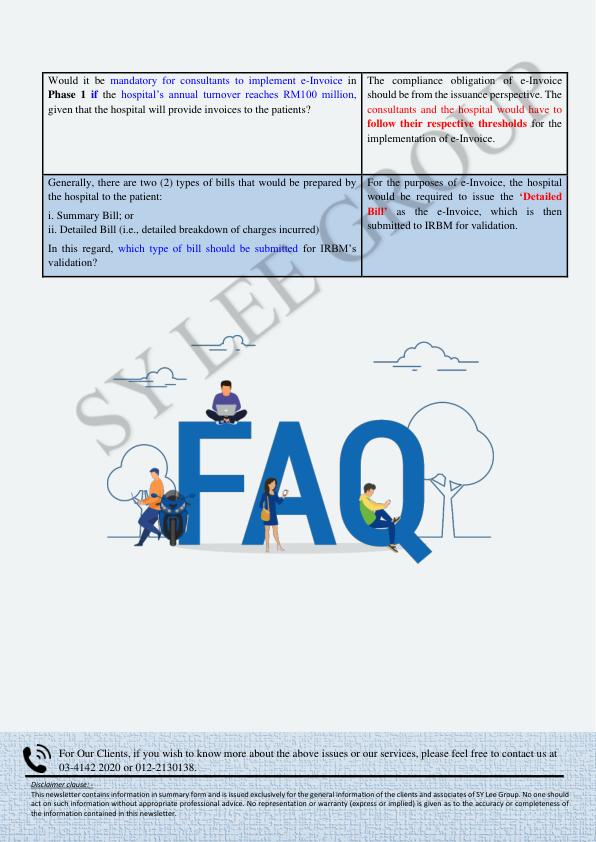

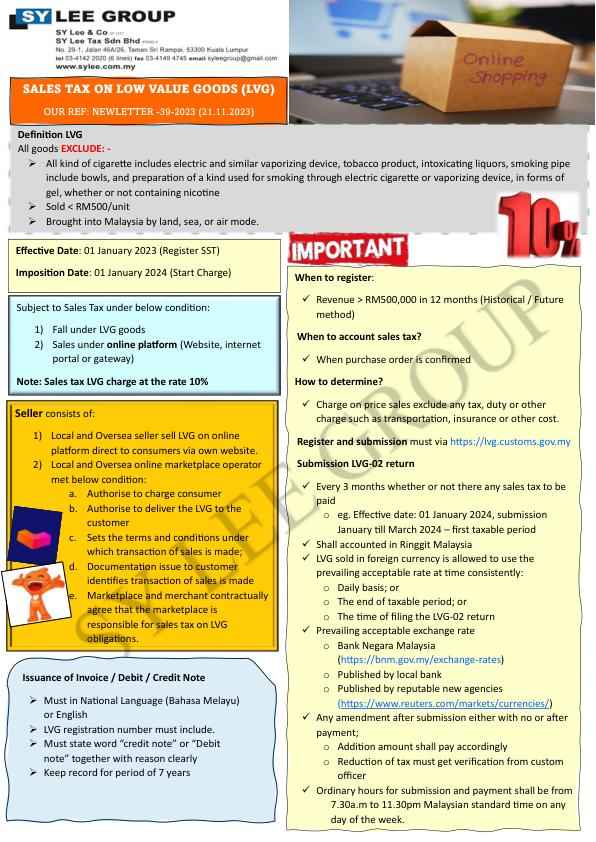

Newsletter-39-2023 - Sales Tax On Low Value Goods _LVG

21.Nov.2023

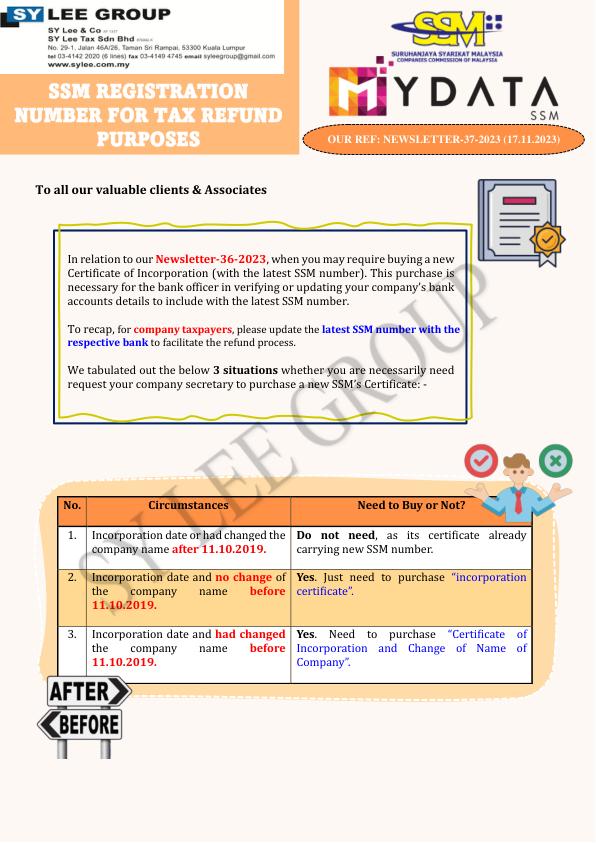

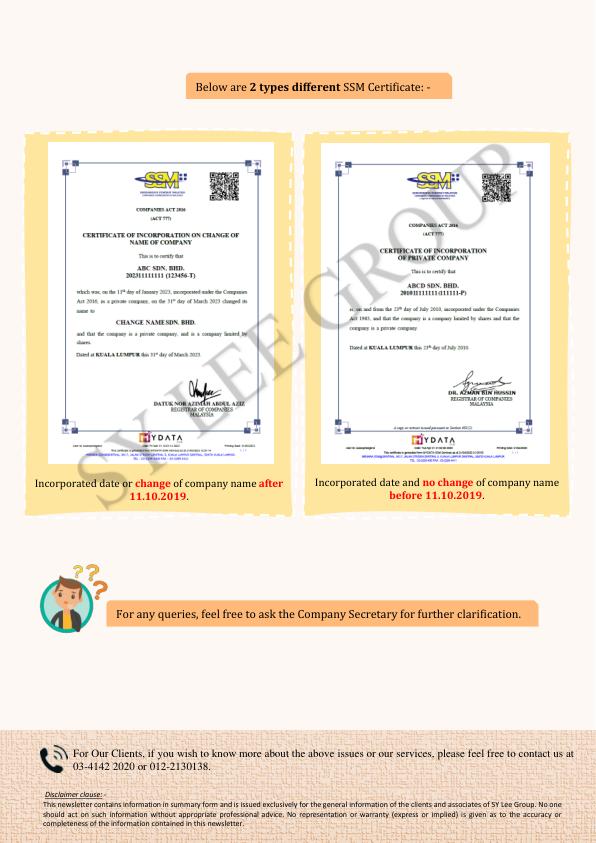

Newsletter-37-2023 - SSM Registration Number for Tax Refund Purposes

17.Nov.2023

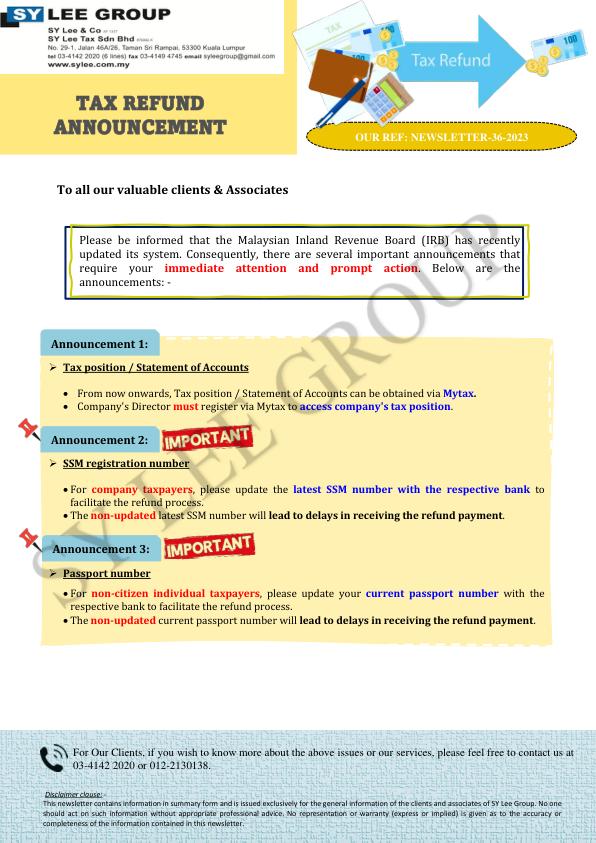

Newsletter-36-2023 - Tax Refund Announcement

15.Nov.2023

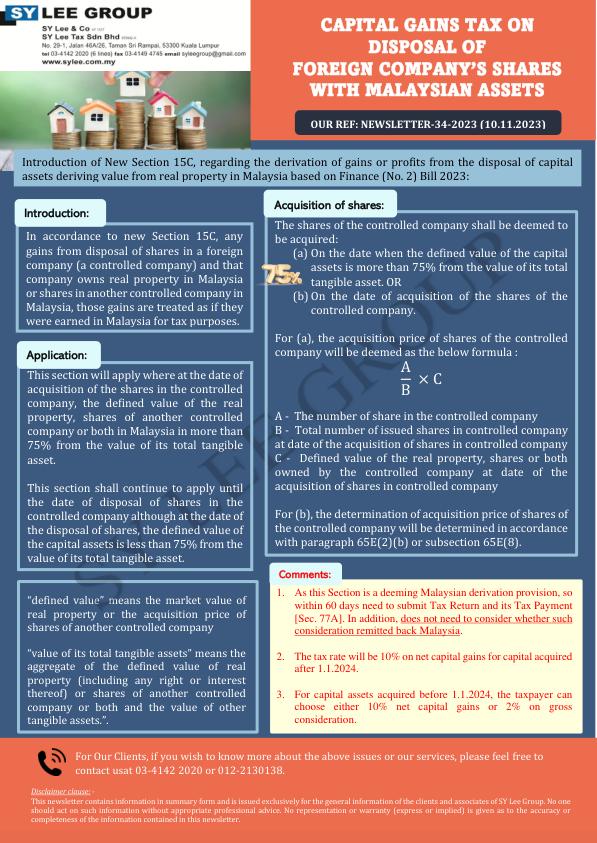

Newsletter-34-2023 - Capital Gain Tax on Disposal of Foreign Company_s Shares with Malaysian Assets

10.Nov.2023

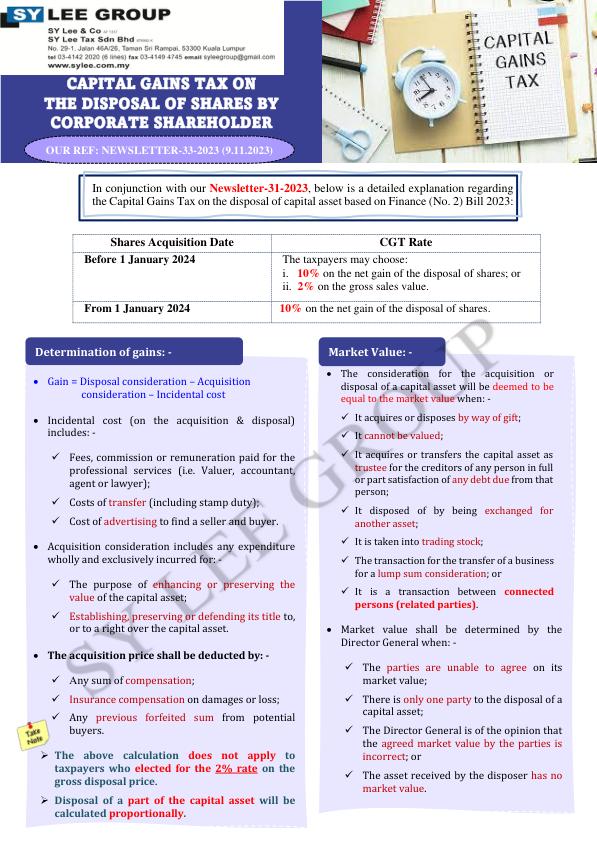

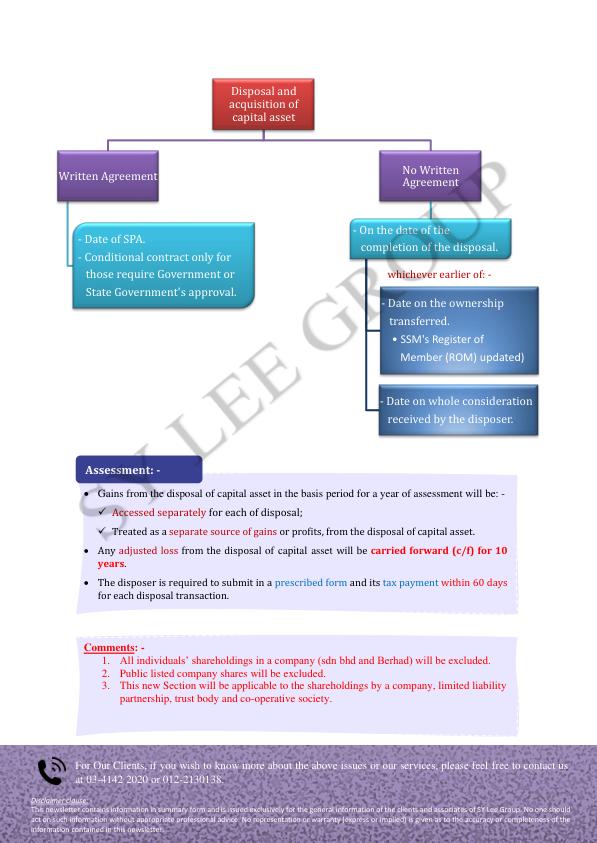

Newsletter-33-2023 - Capital Gains Tax on Disposal of Shares by Corporate Shareholder

09.Nov.2023

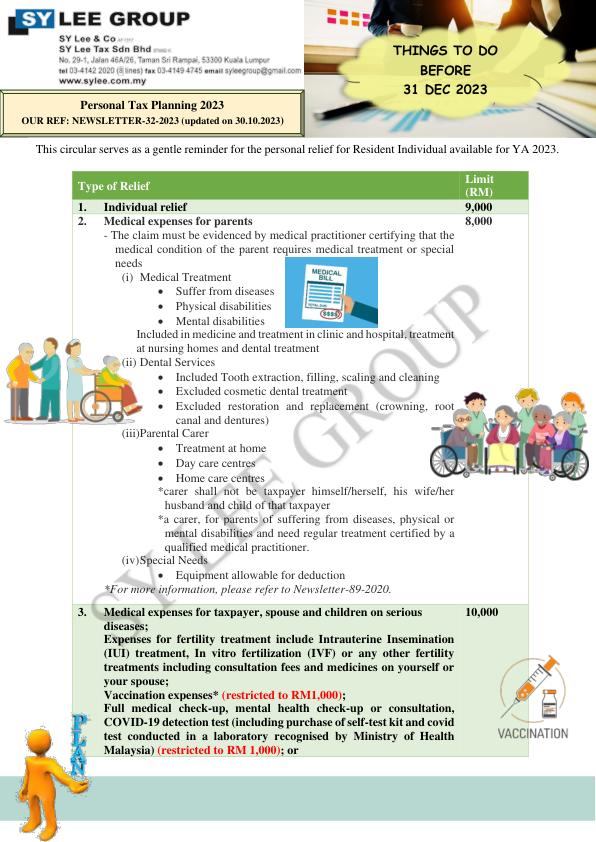

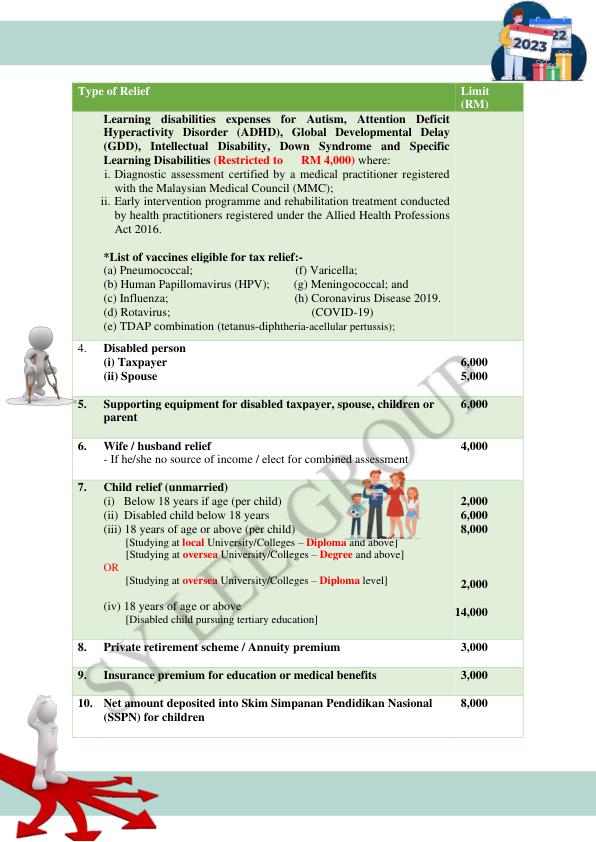

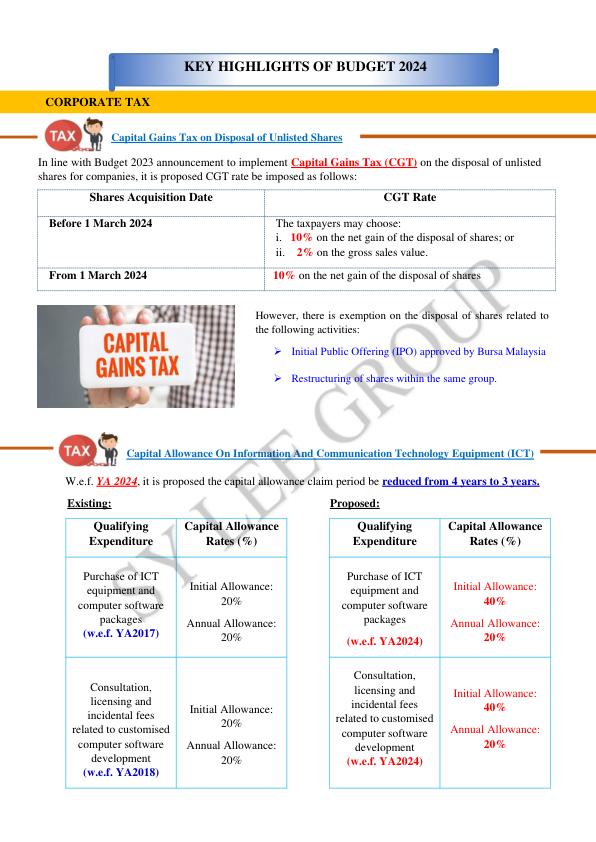

Newsletter-32-2023- Personal Tax Planning 2023

30.Oct.2023

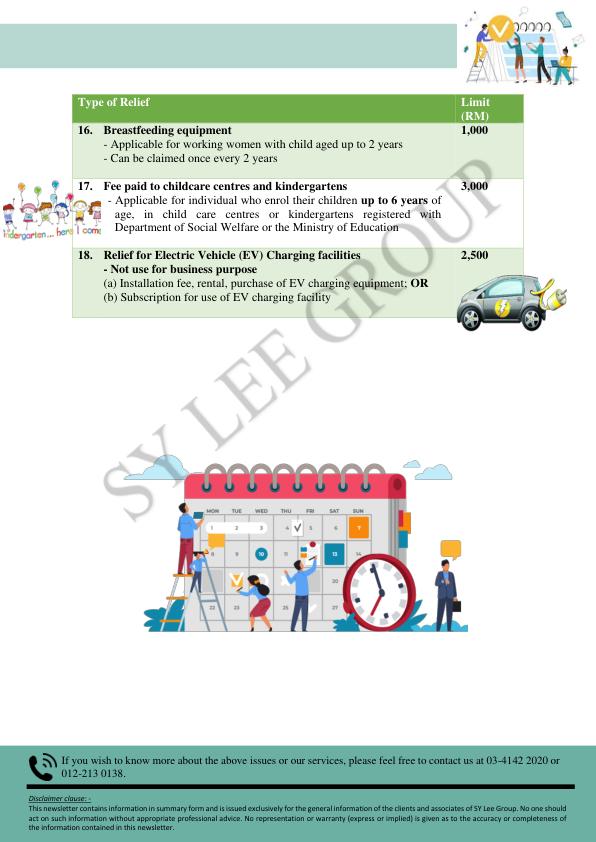

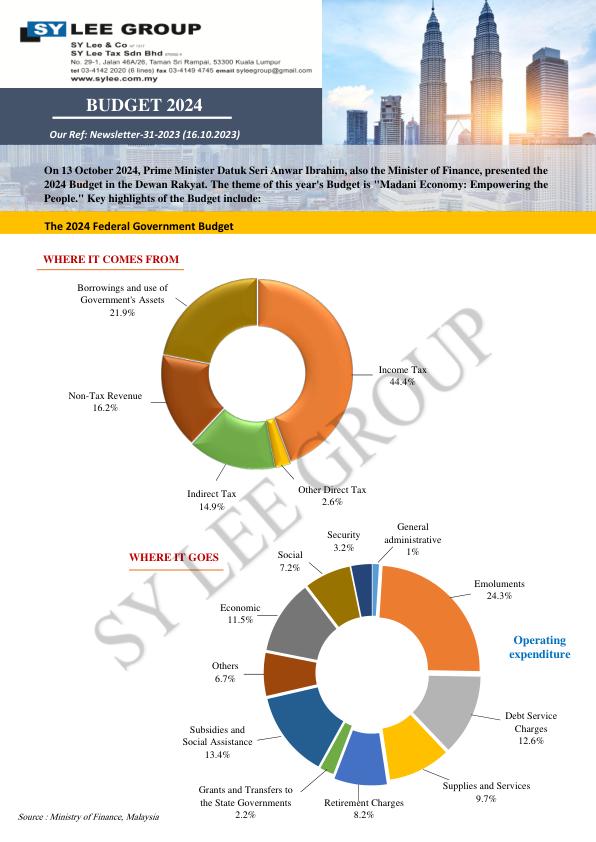

Newsletter-31-2023 - Budget 2024

16.Oct.2023

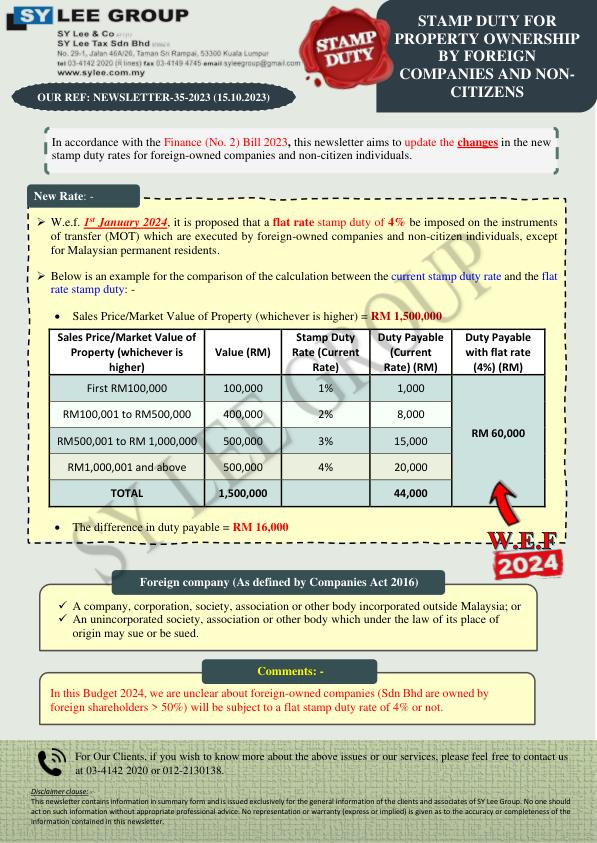

Newsletter-35-2023 - Stamp Duty for Property Ownership by Foreign Companies and Non-Citizen

15.Oct.2023

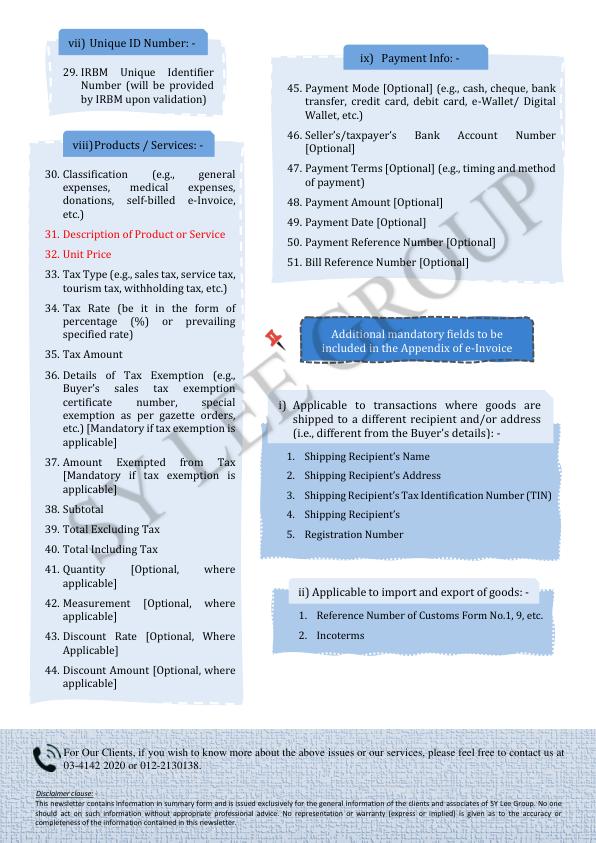

Newsletter-30-2023 - Information _Data Fields_ Required In e-Invoice

05.Oct.2023

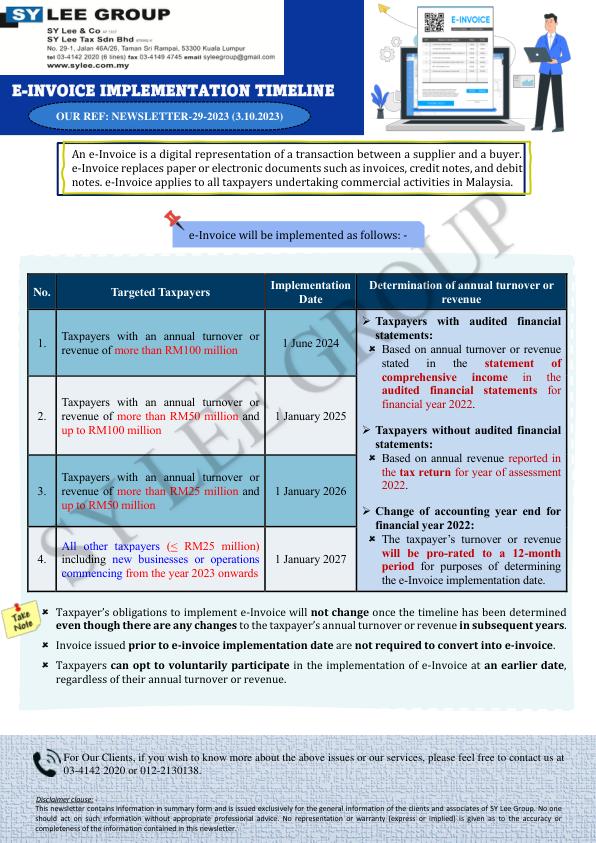

Newsletter-29-2023 - E-Invoice Implementation Timeline

03.Oct.2023

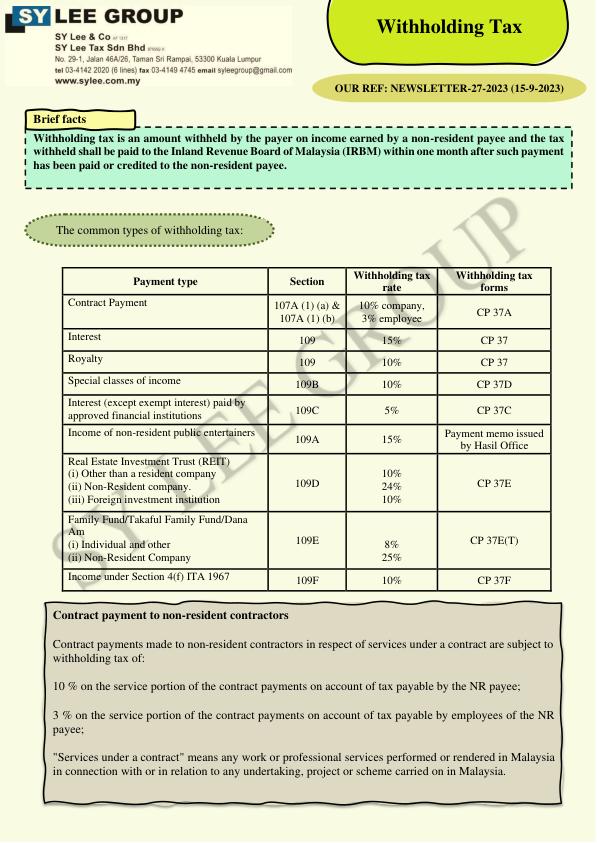

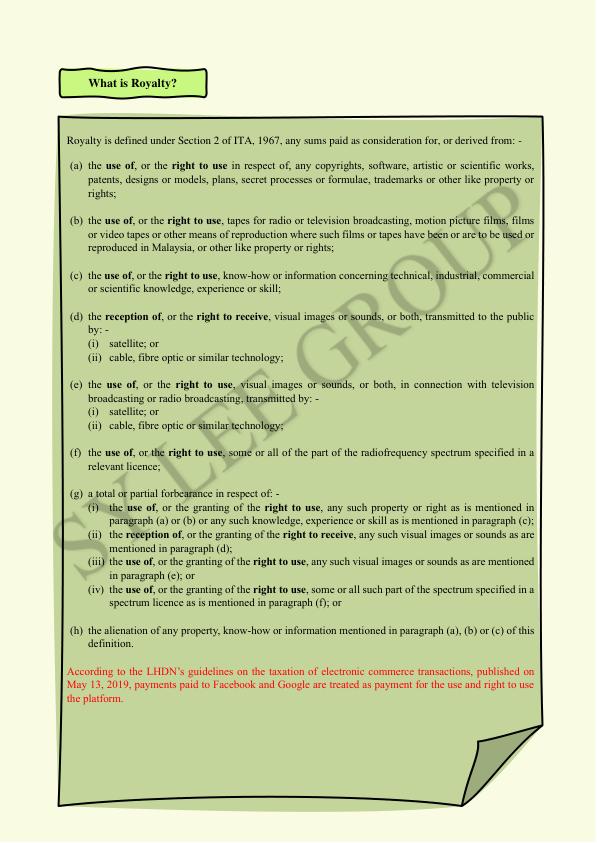

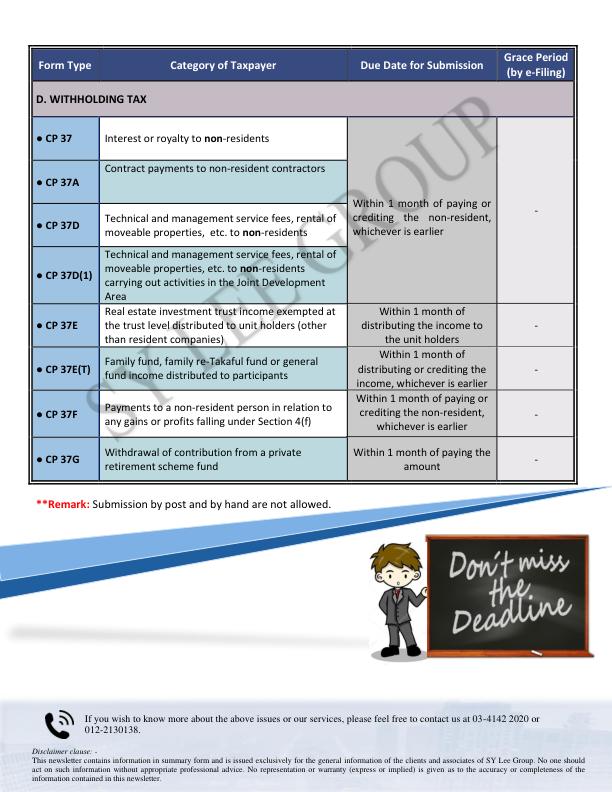

Newsletter-27-2023 - Withholding Tax

15.Sep.2023

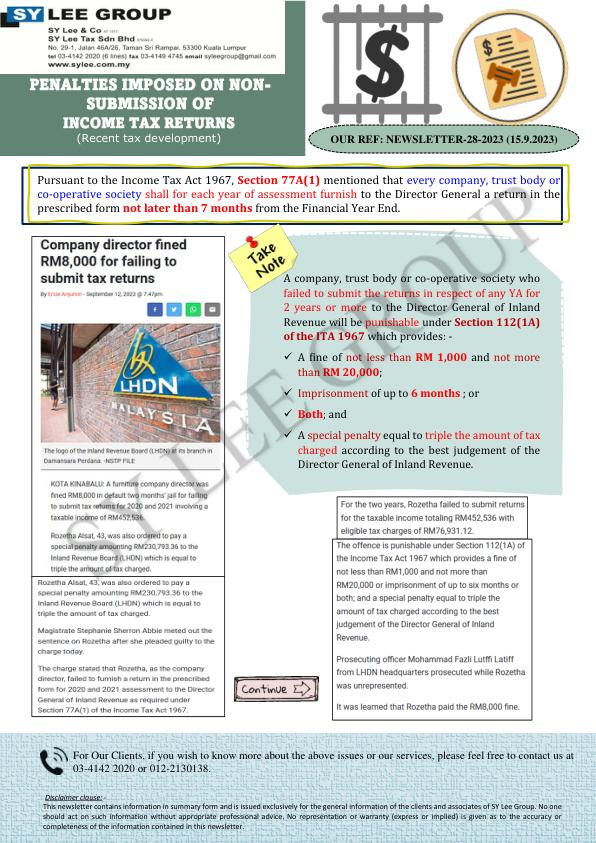

Newsletter-28-2023 - Fined of Offenses Under Section 77A(1) of The ITA 1967

15.Sep.2023

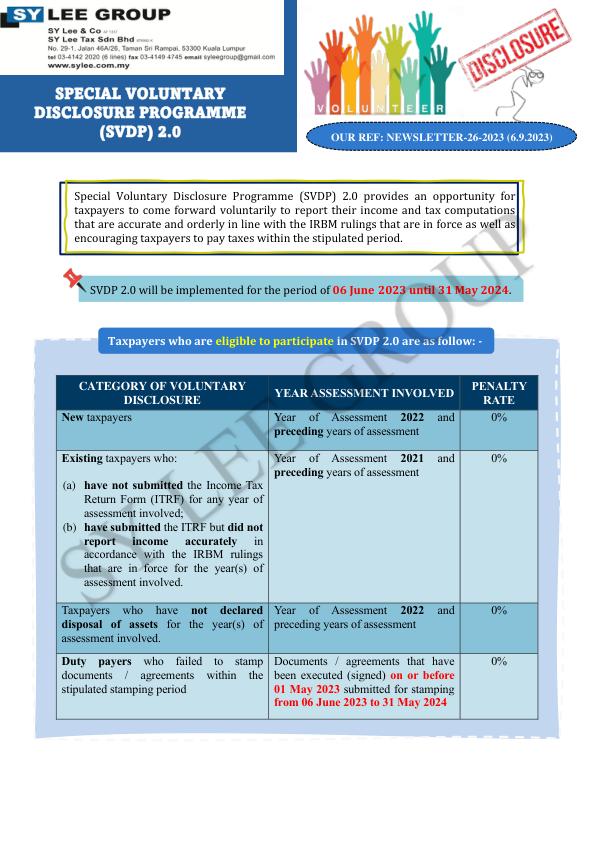

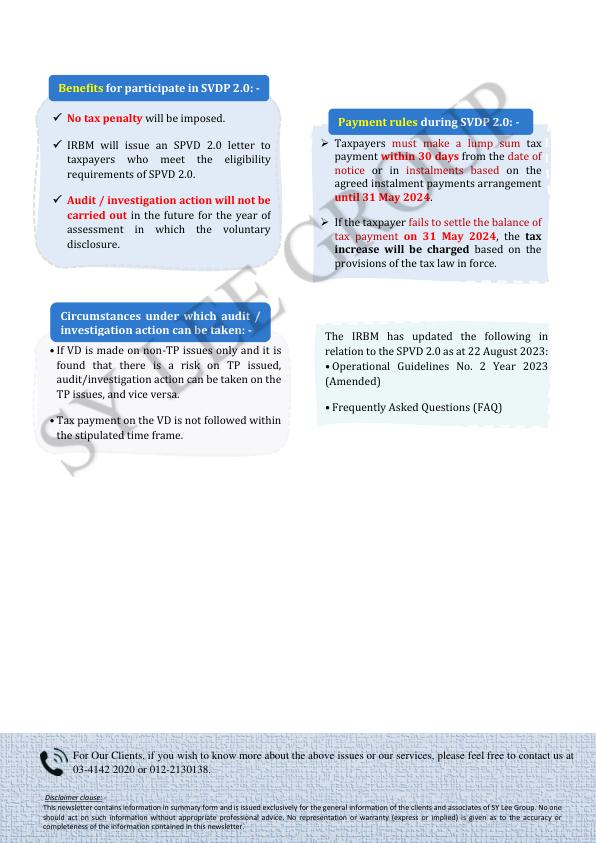

Newsletter-26-2023 - Special Voluntary Disclosure Programme SVDP 2.0

06.Sep.2023

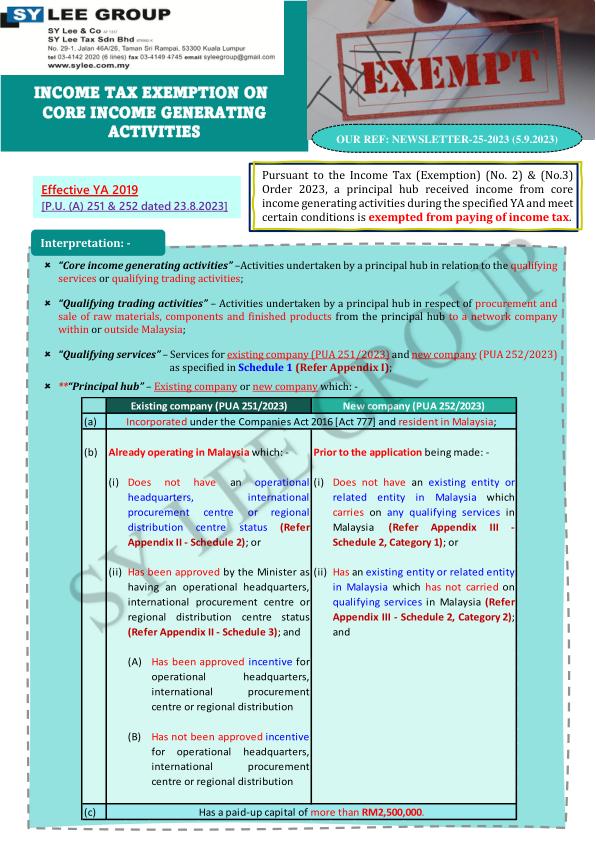

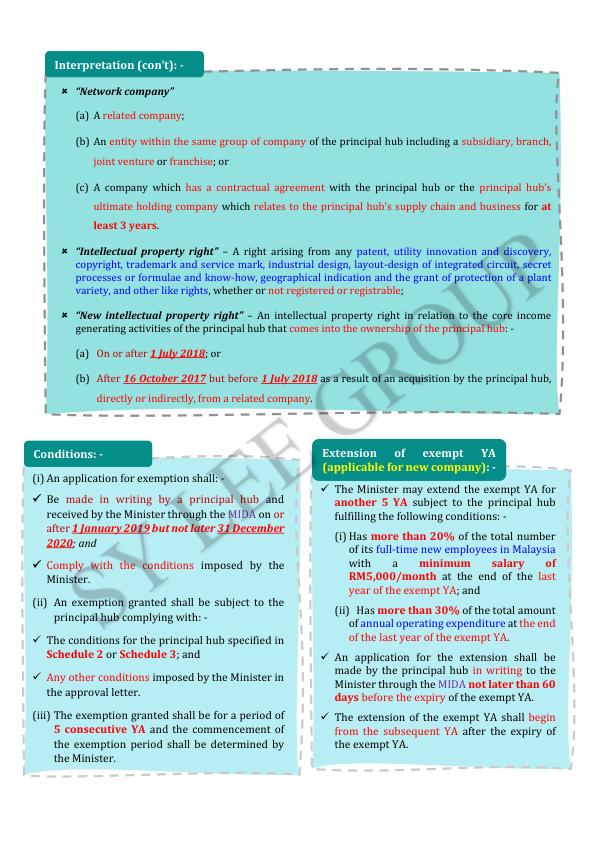

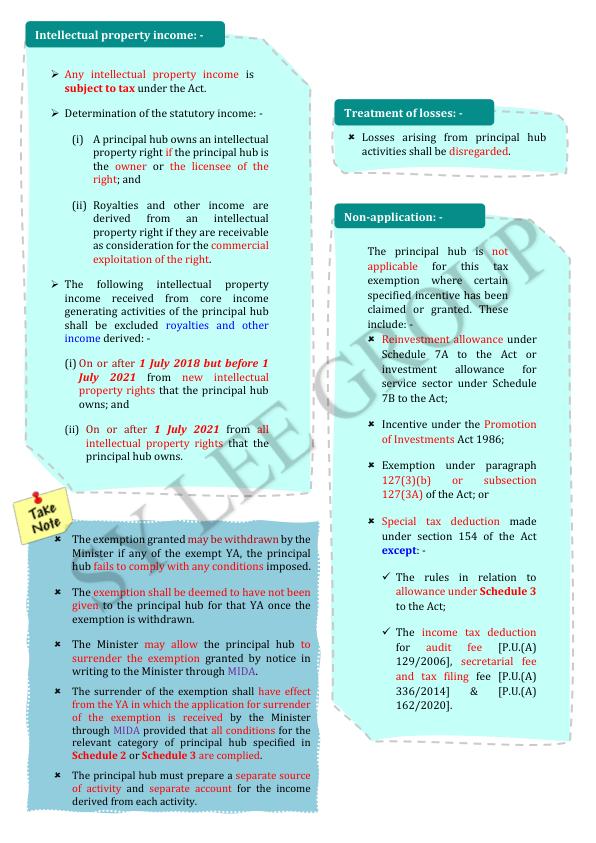

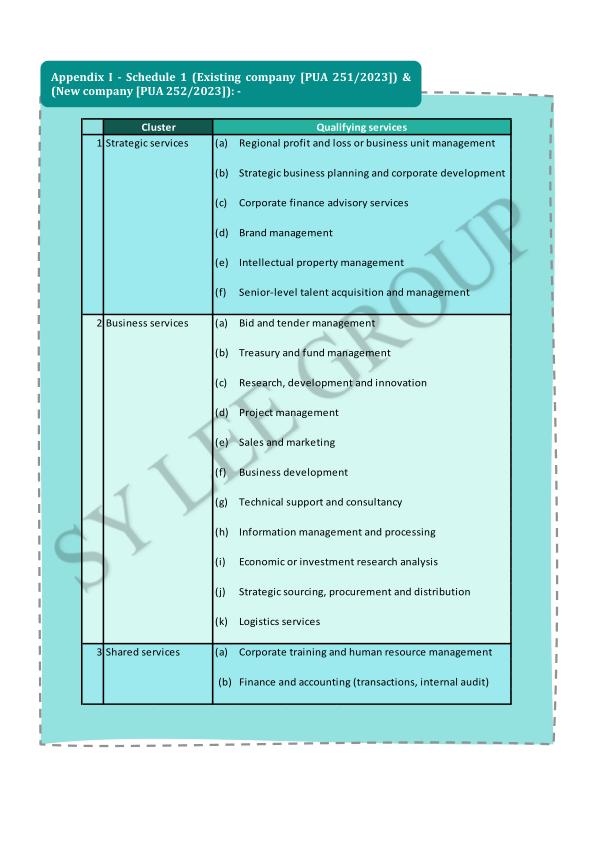

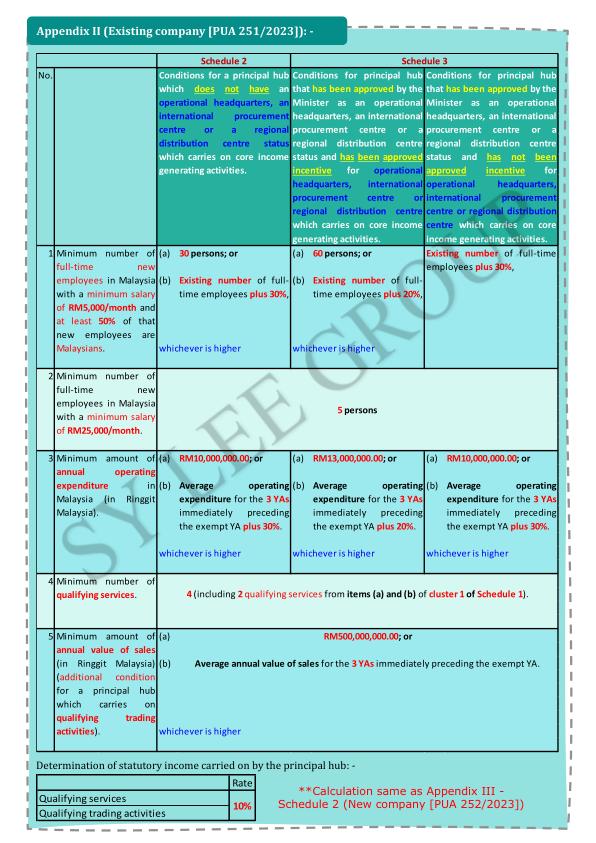

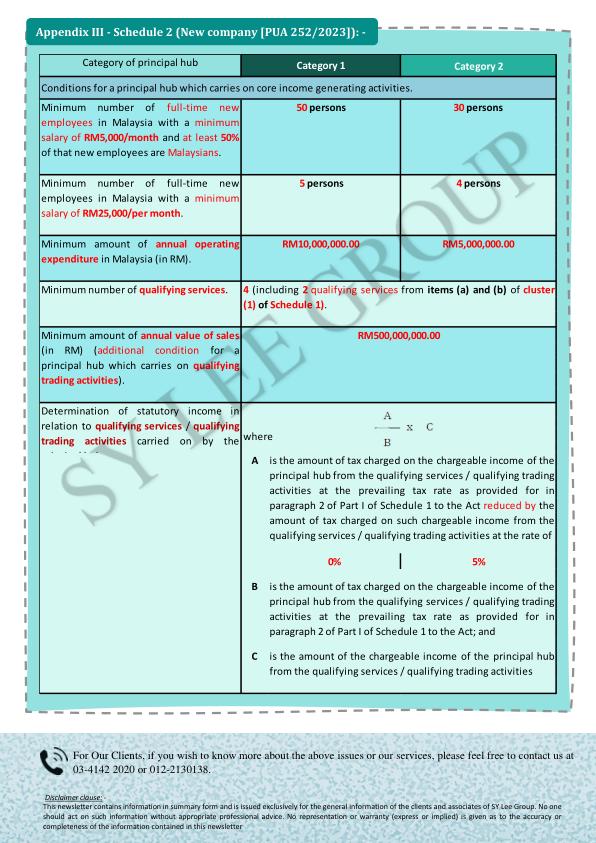

Newsletter-25-2023 - Income Tax Exemption on Core Income Generating Activities

23.Aug.2023

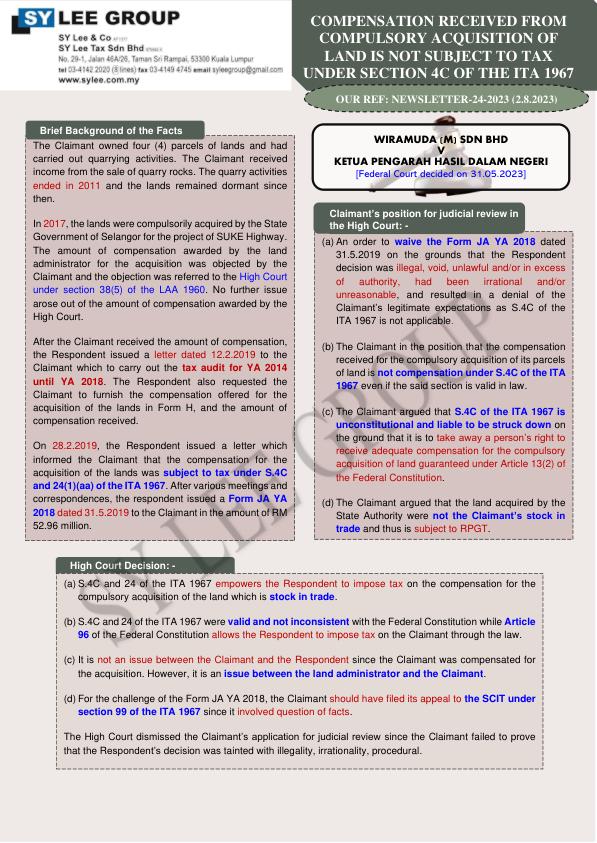

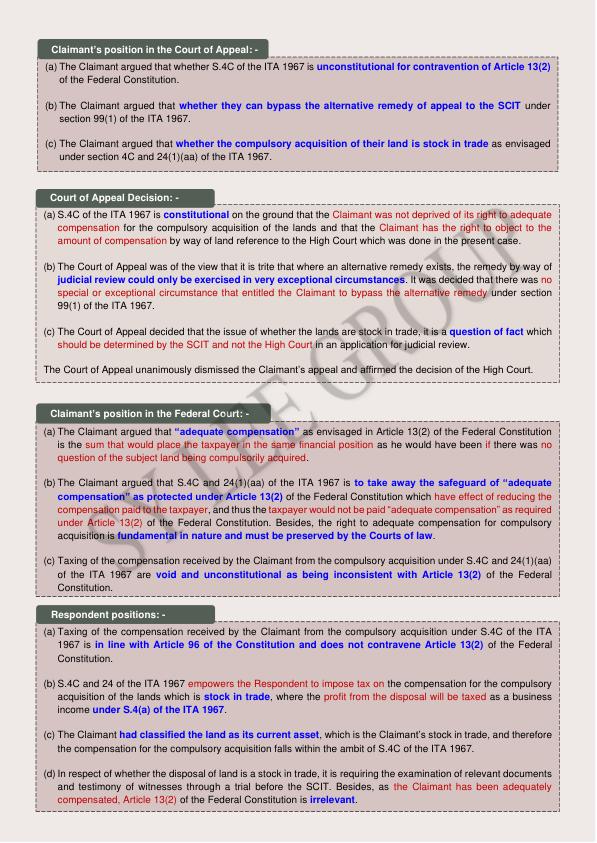

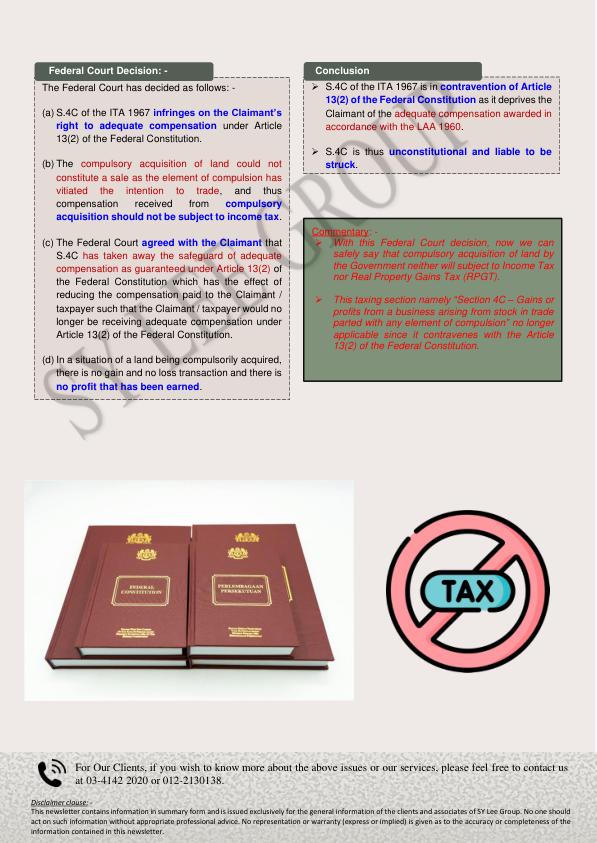

Newsletter-24-2023 - Compensation Received From The Compulsory Acquisition of Land Is Not Subject to Tax Under S_4C of The ITA

02.Aug.2023

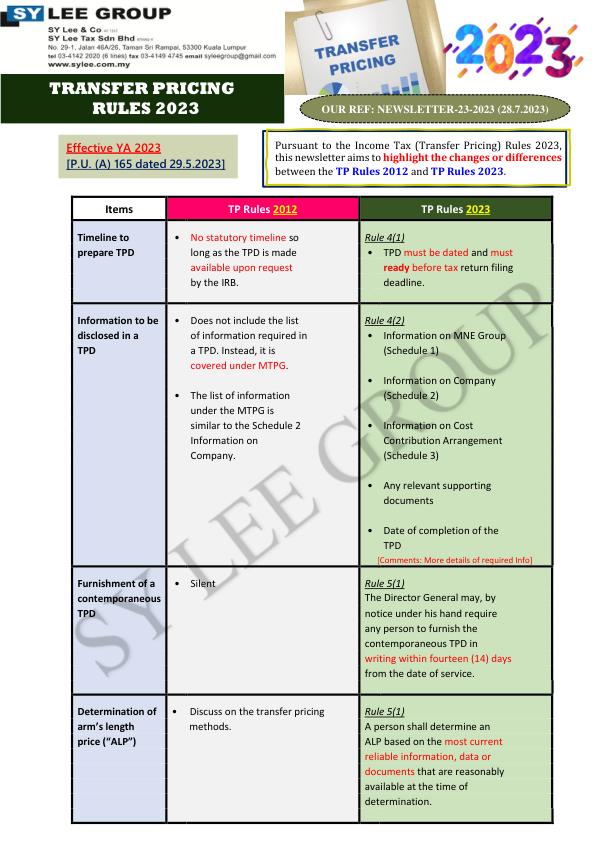

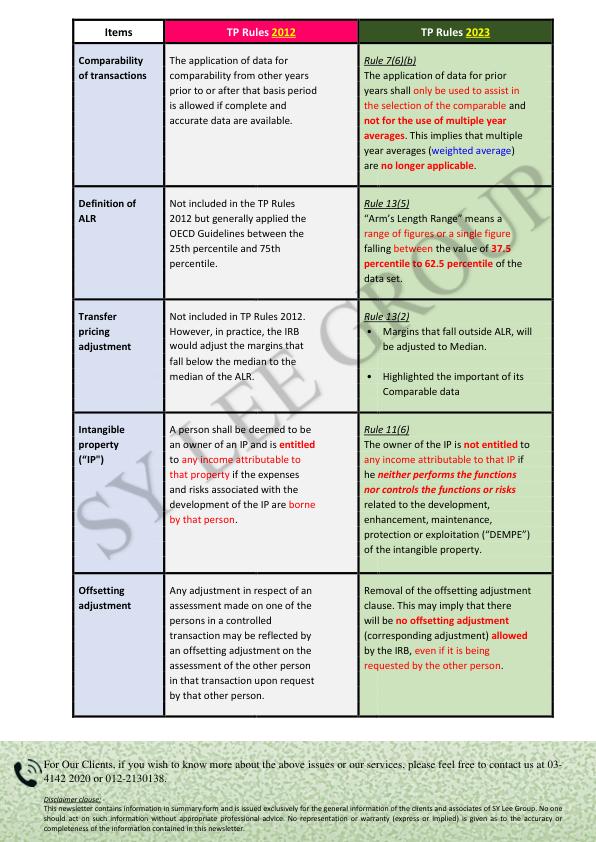

Newsletter-23-2023 - Transfer Pricing Rules 2023

28.Jul.2023

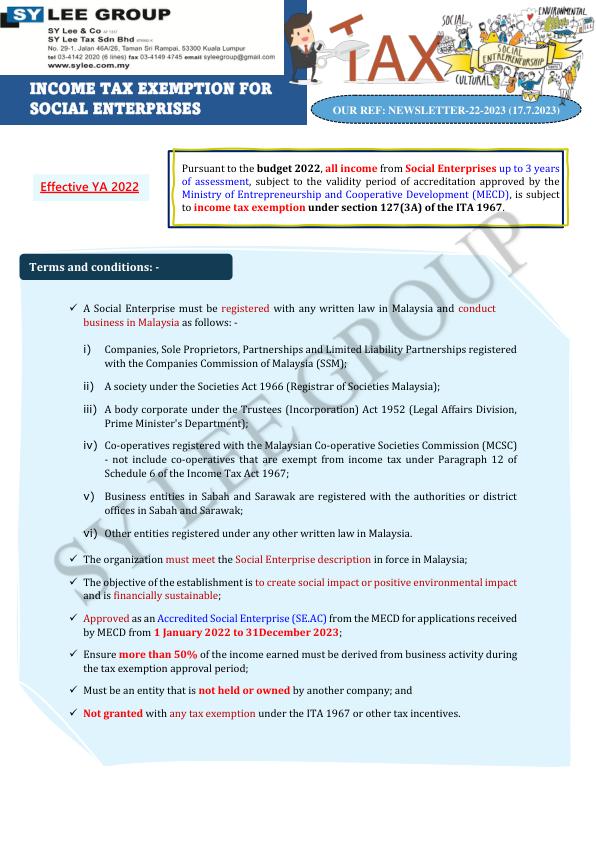

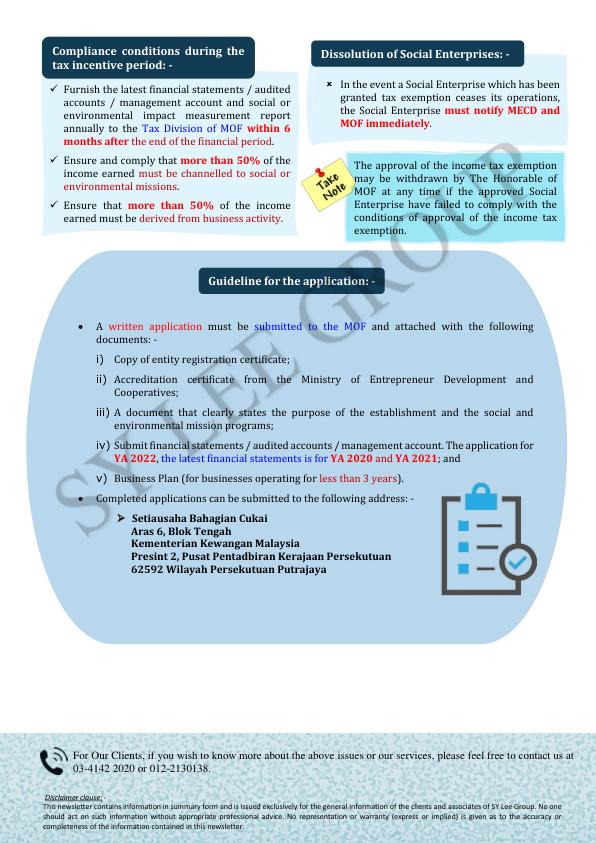

Newsletter-22-2023 - Income Tax Exemption for Social Enterprises

17.Jul.2023

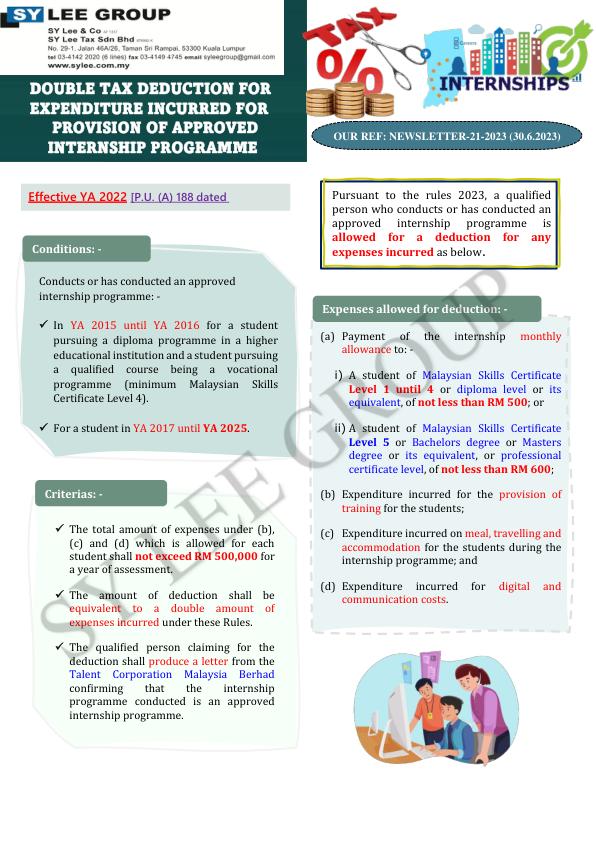

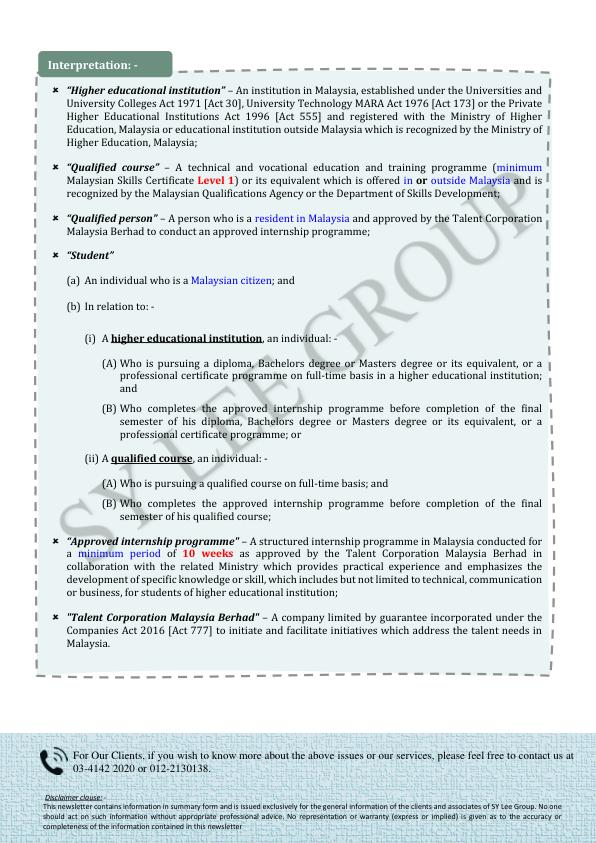

Newsletter-21-2023 - Double Deduction for Expenditure Incurred for The Provision of Approved Internship Prgramme

30.Jun.2023

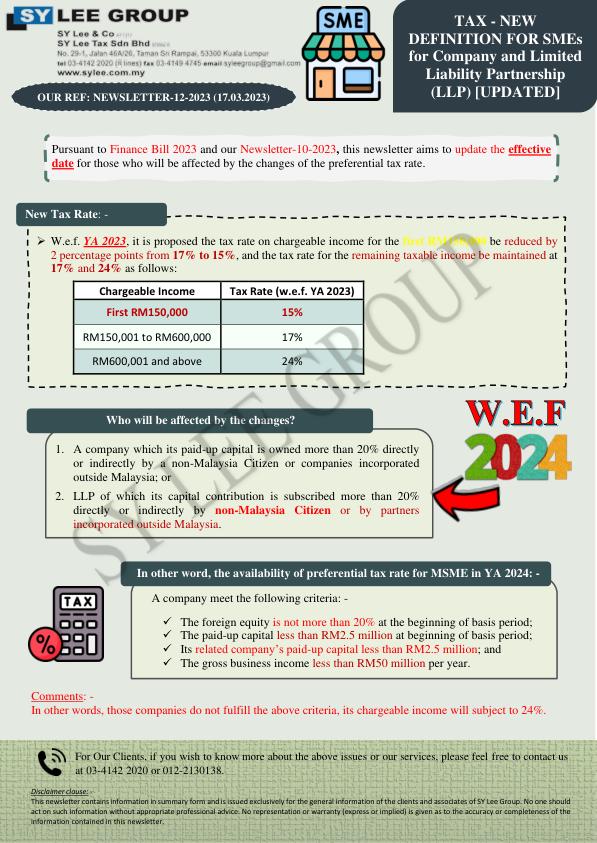

Newsletter-12-2023 - New Definition of SME for Tax Purpose UPDATED

17.Mar.2023

Newsletter-11-2023 - Tax Relief on Voluntary Contribution to EPF

08.Mar.2023

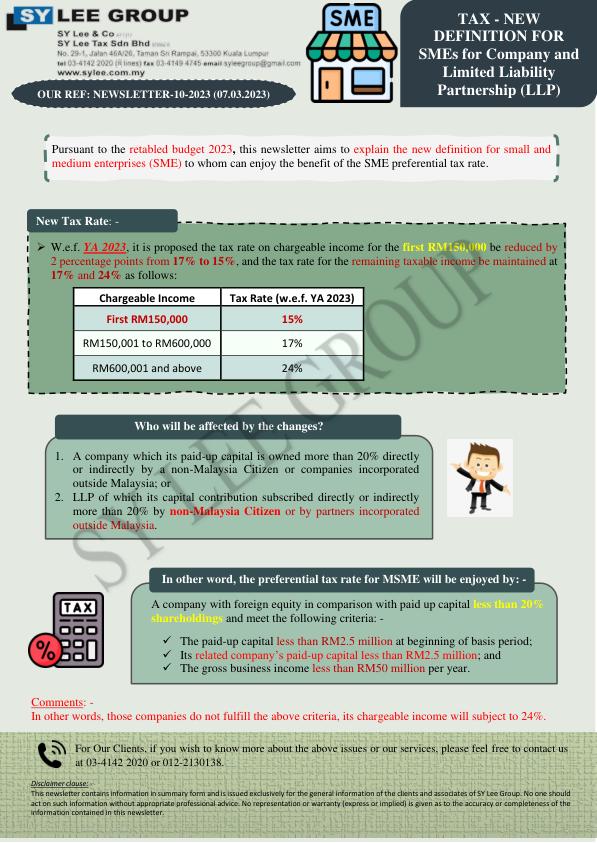

Newsletter-10-2023 - New Definition of SME for Tax Purpose

07.Mar.2023

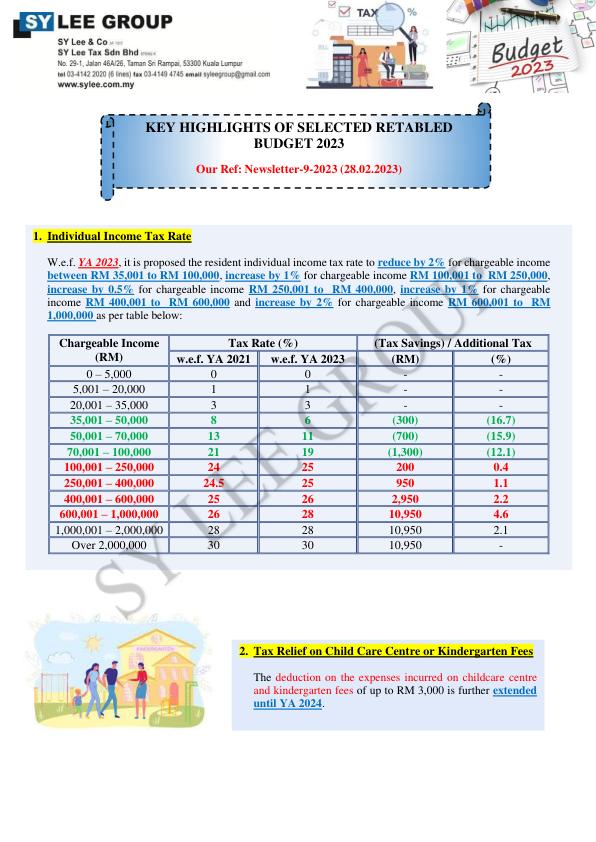

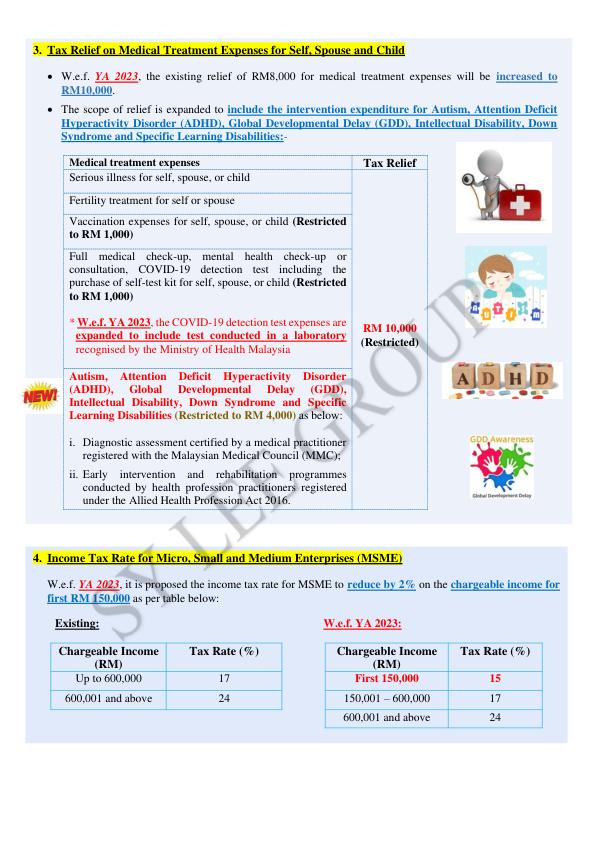

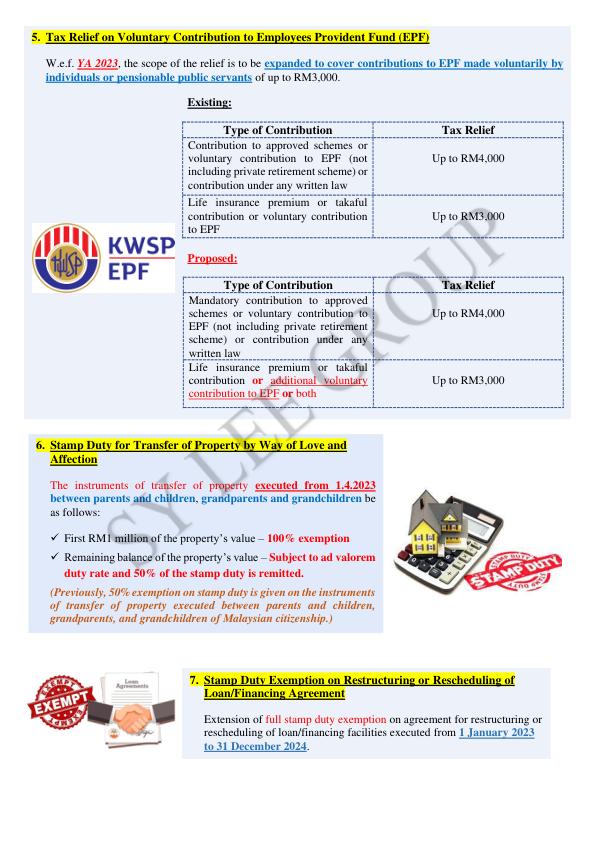

Newsletter-9-2023 - Key Highlights of Selected Retabled Budget 2023

28.Feb.2023

Newsletter-8-2023 - Facilities income vs Rental income

24.Feb.2023

Newsletter-7-2023 - Property Developer - Tax treatment for Sale of completed unit properties - Based on SPA Date

23.Feb.2023

Newsletter-4-2022- Deferment of Implementation of Tax Deduction Remittance Under Section 107D of the ITA 1967

17.Jan.2023

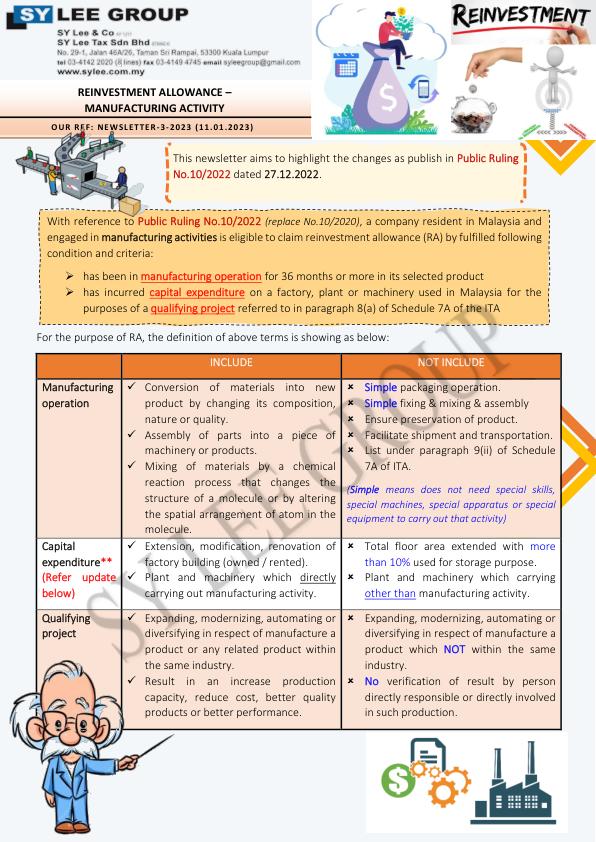

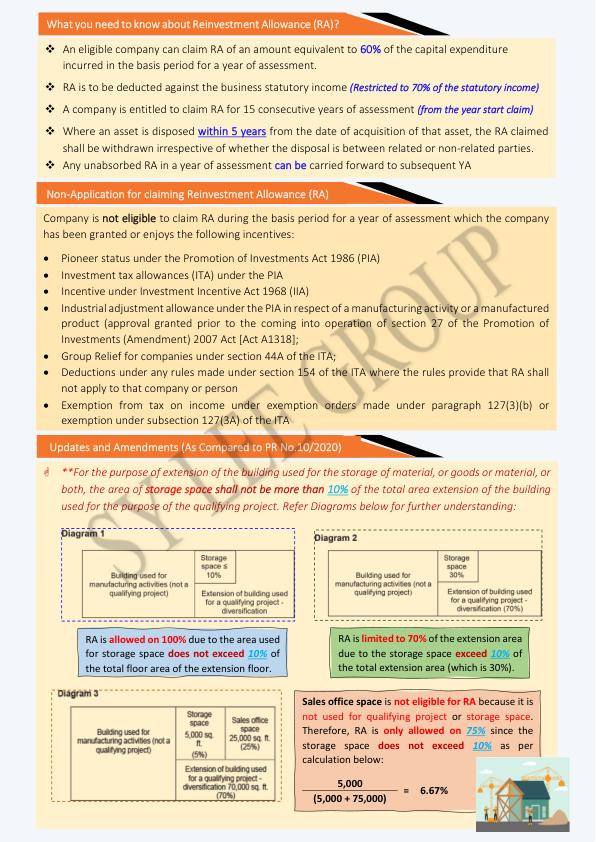

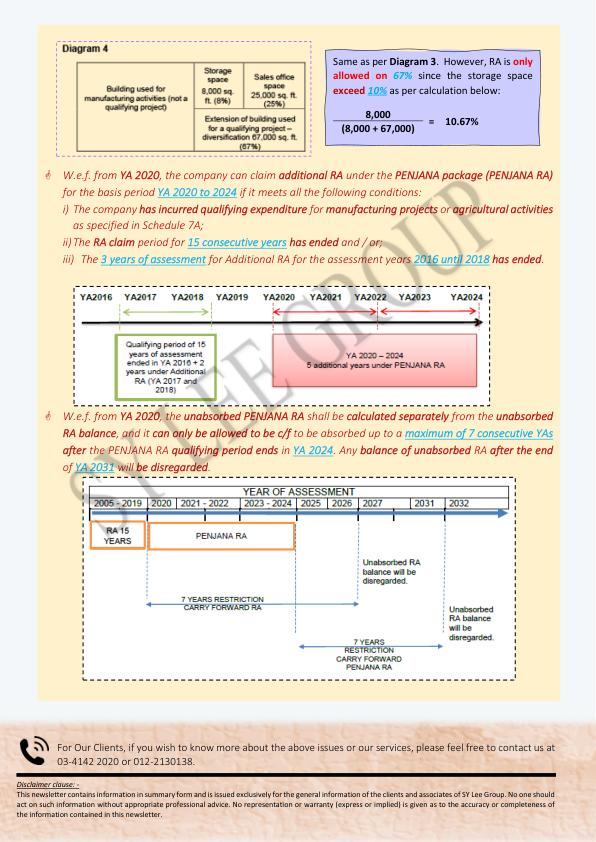

Newsletter-3-2023 - Reinvestment Allowance - Manufacturing Activity

11.Jan.2023

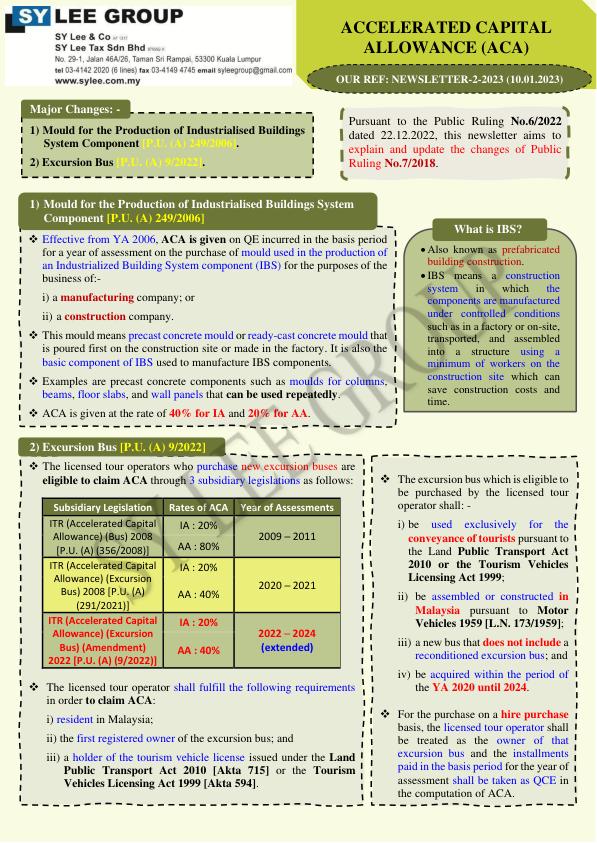

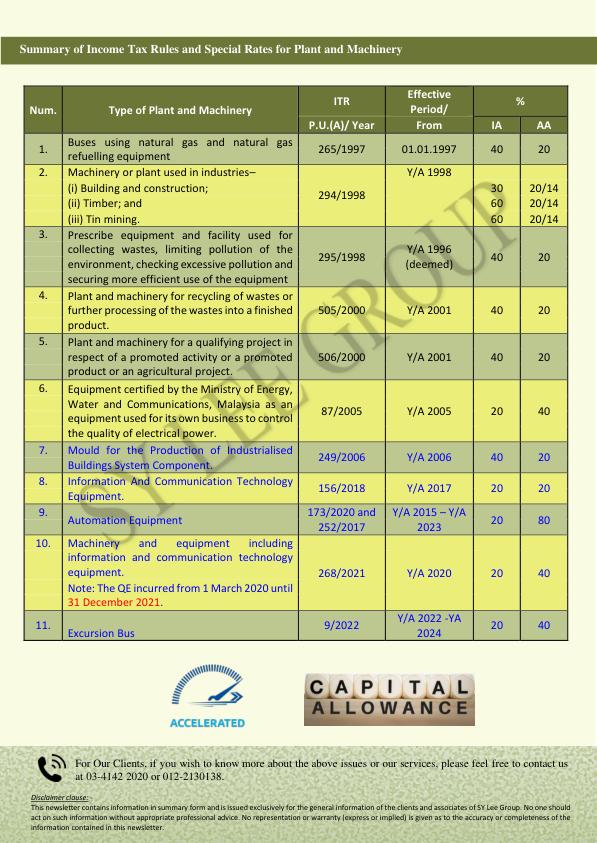

Newsletter-2-2023 - Accelerated Capital Allowance

10.Jan.2023

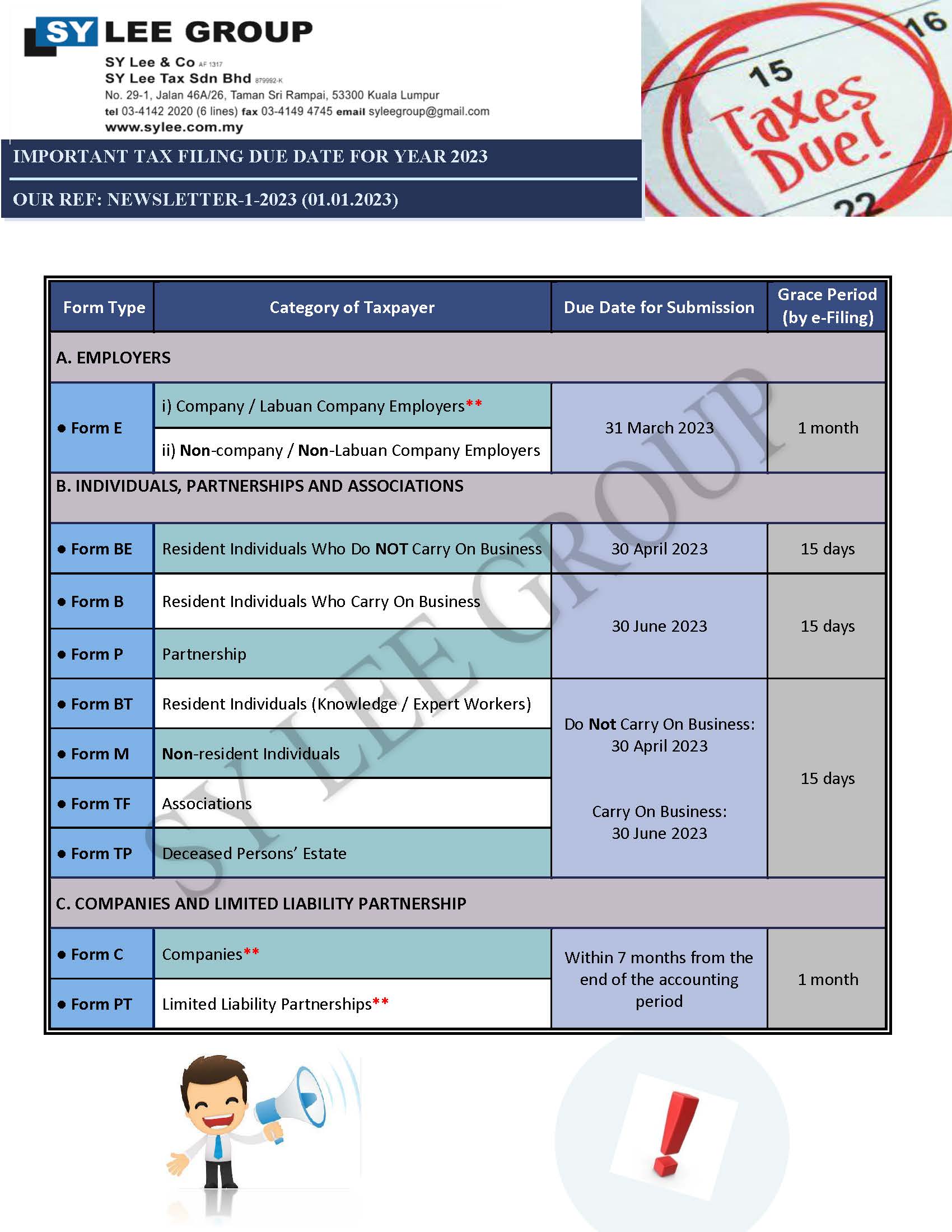

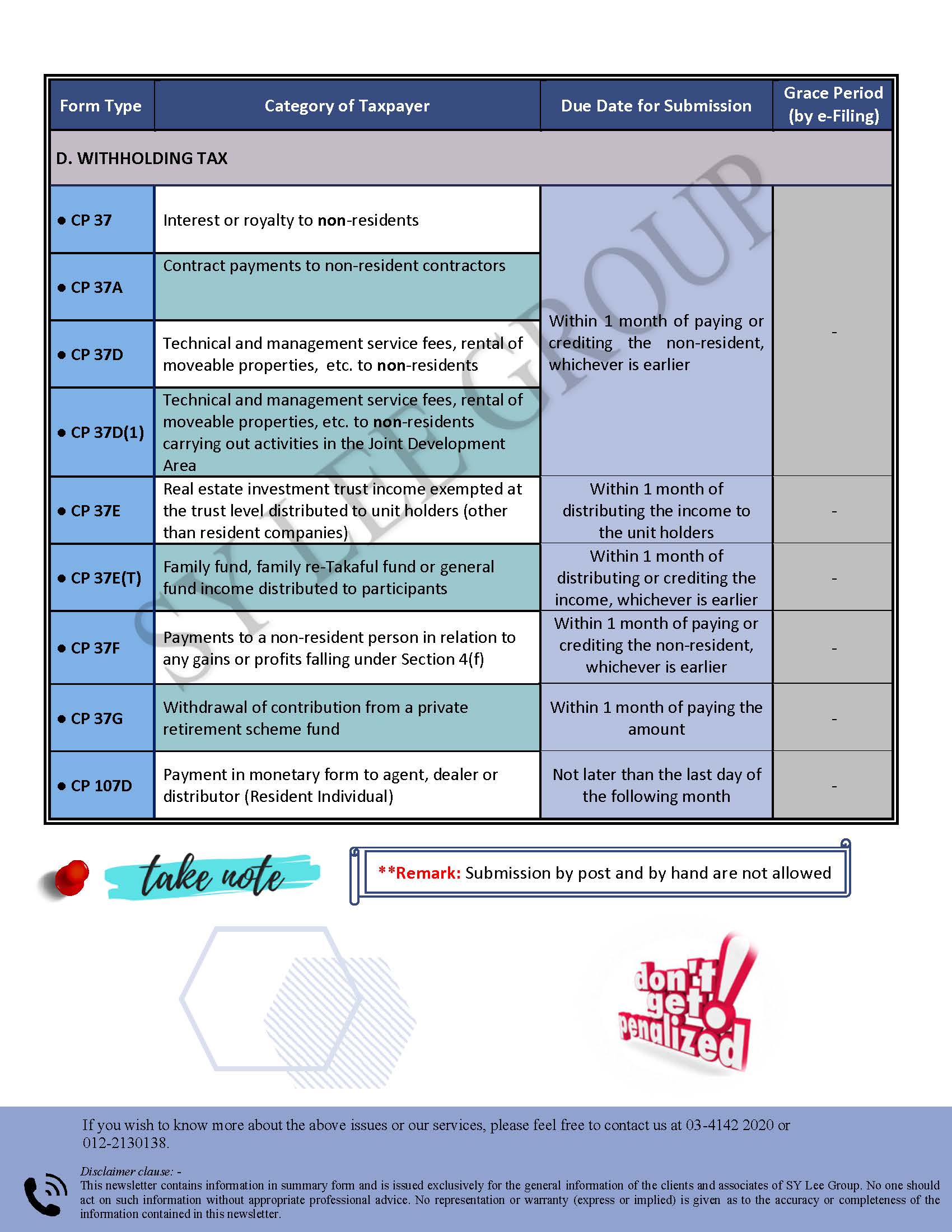

Newsletter-1-2023 - Important Tax Filing Due Date For Year 2023

01.Jan.2023

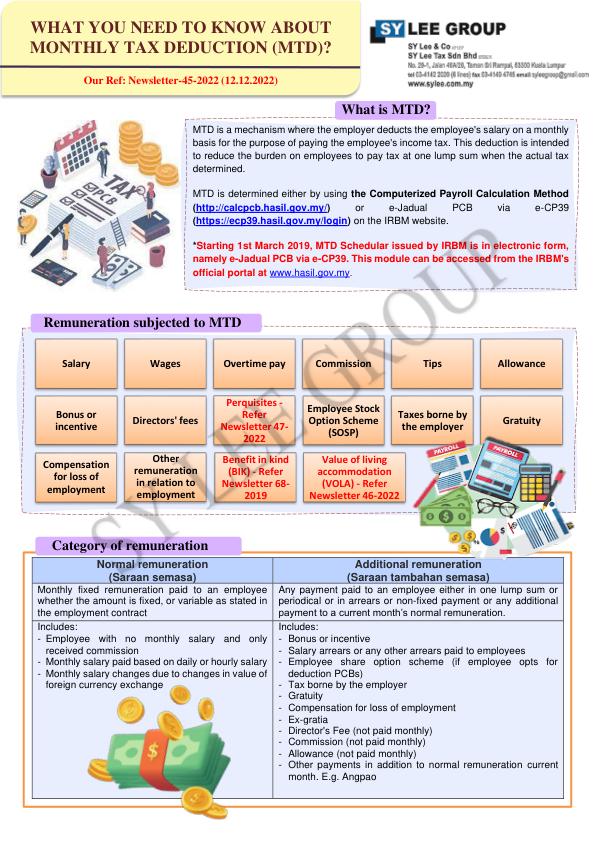

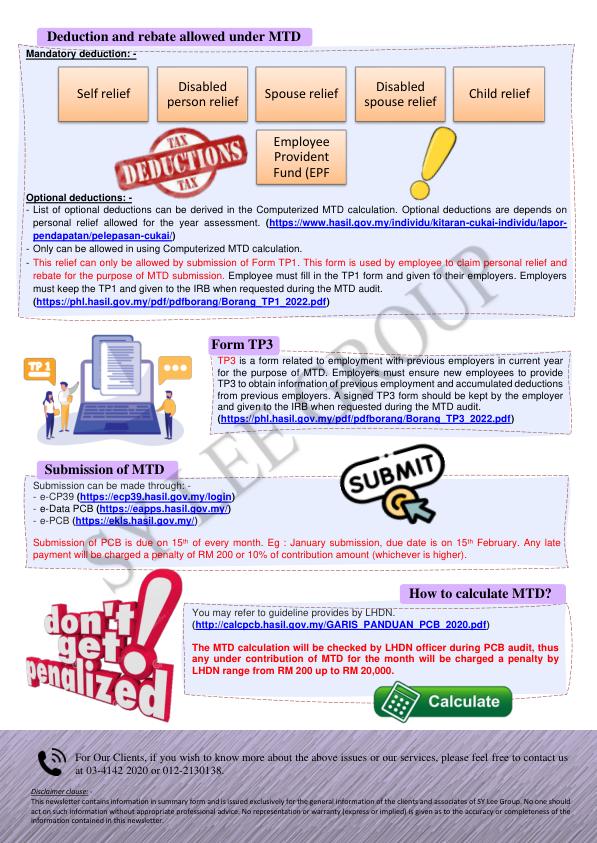

Newsletter-45-2022 - What You Need to Know About MTD

12.Dec.2022

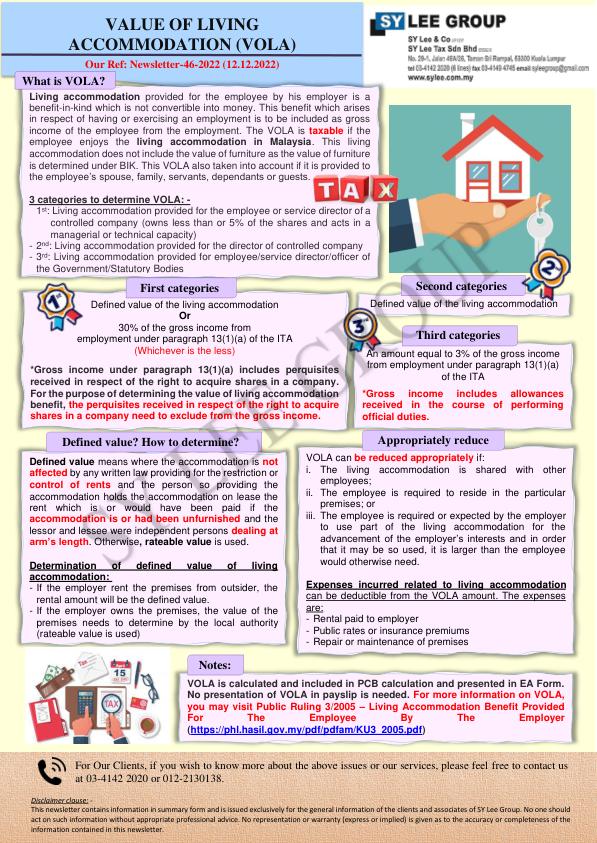

Newsletter-46-2022 - Value of Living Accommodation (VOLA)

12.Dec.2022

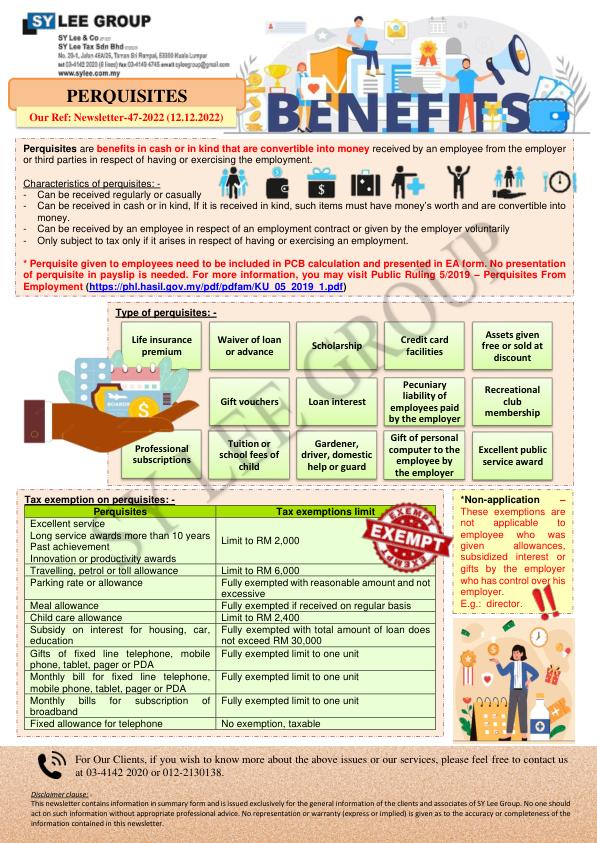

Newsletter-47-2022 - Perquisites

12.Dec.2022

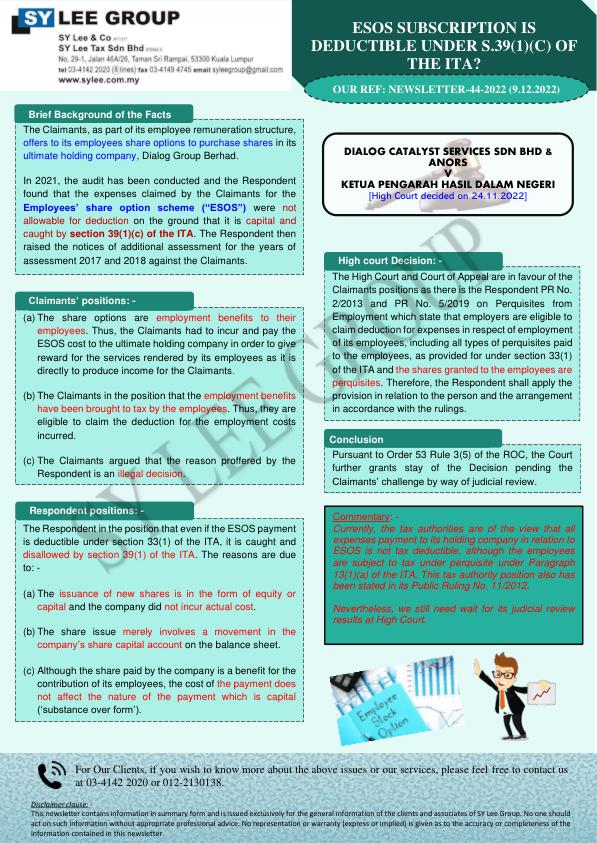

Newsletter-44-2022 - ESOS Subscription Is Deductible Under S_39_1__c_ of The ITA

09.Dec.2022

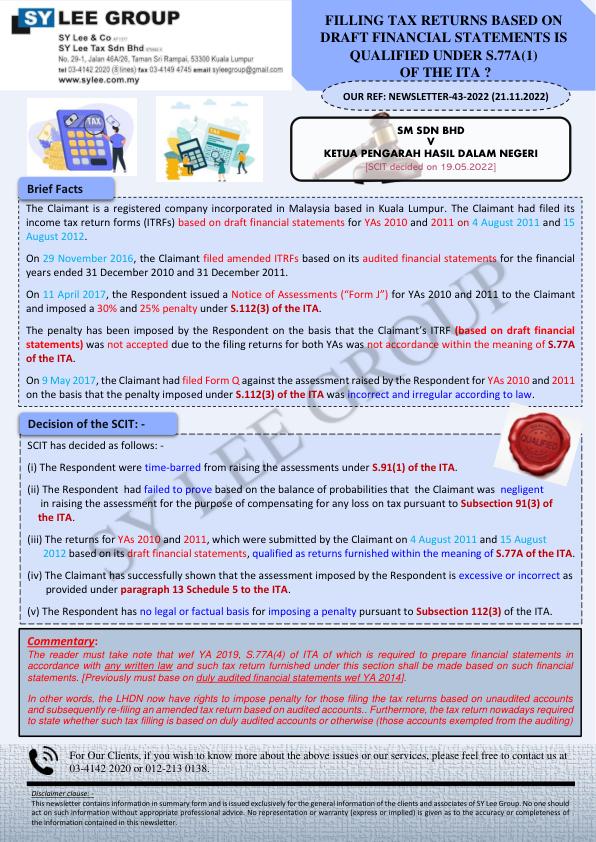

Newsletter-43-2022 - Filing Tax Returns Based On Draft Financial Statements is Qualified Under S_77A_1_ of The ITA

21.Nov.2022

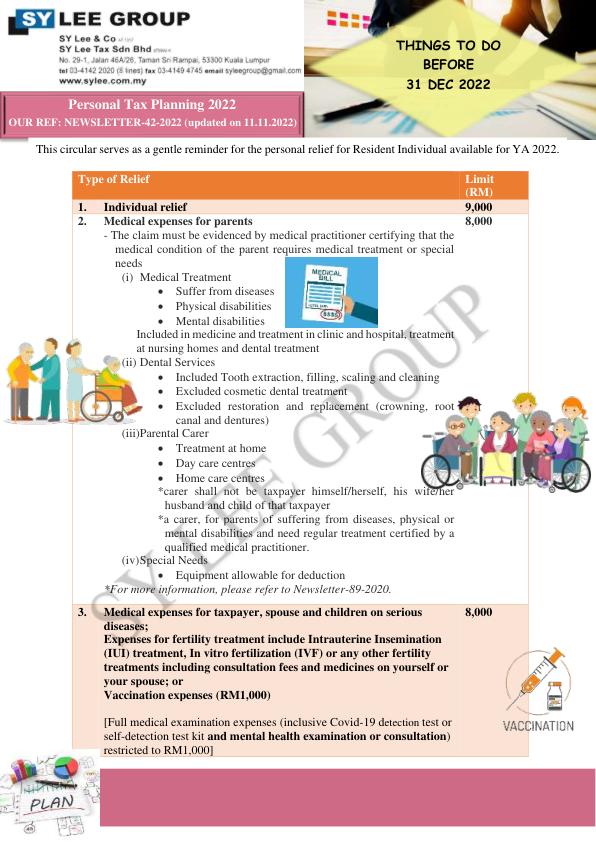

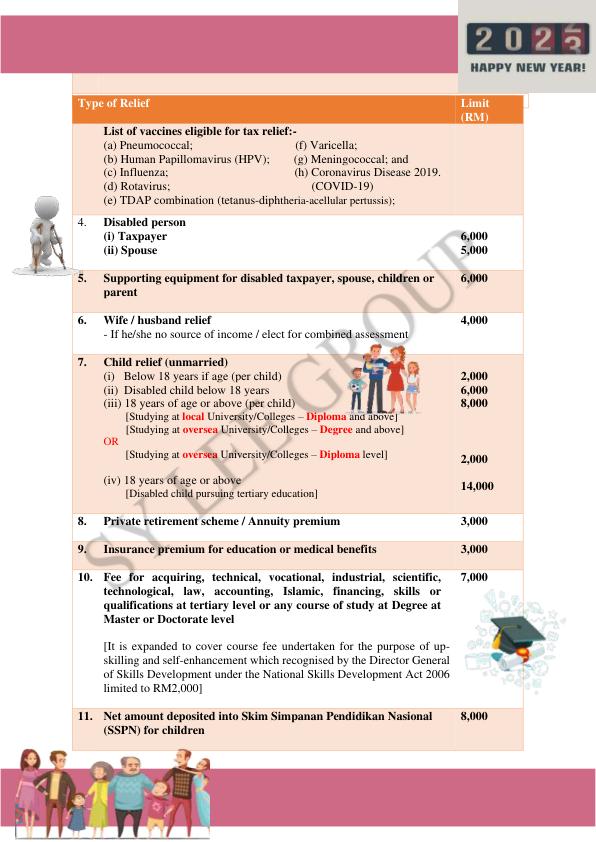

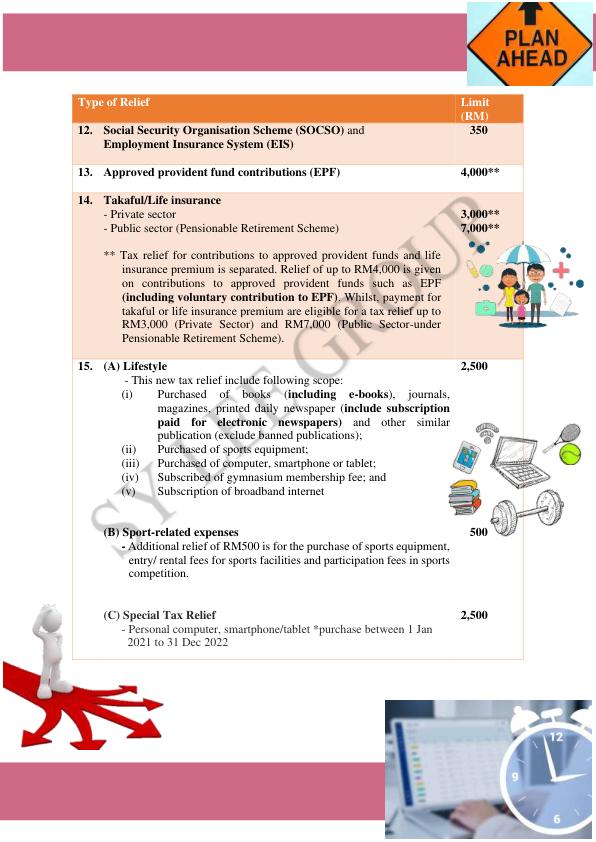

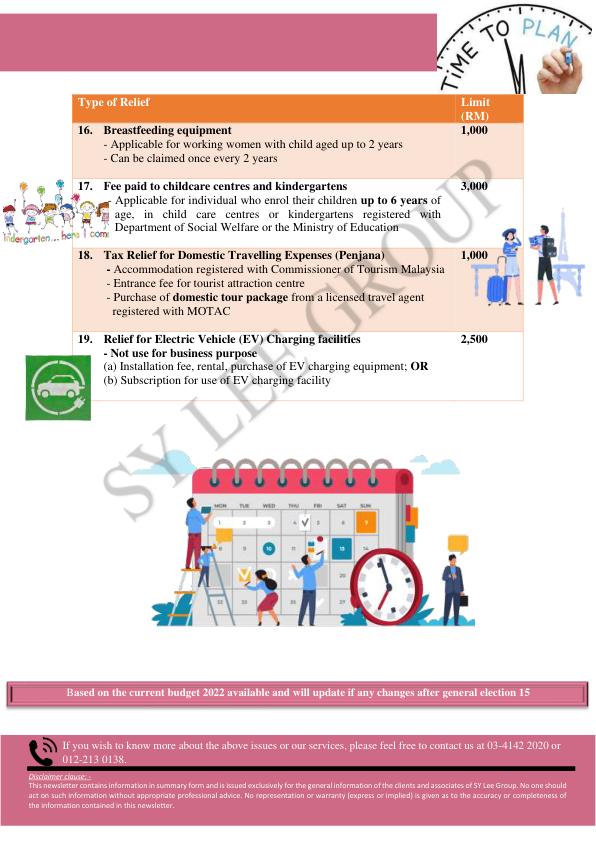

Newsletter-42-2022 - Personal Tax Planning 2022

11.Nov.2022

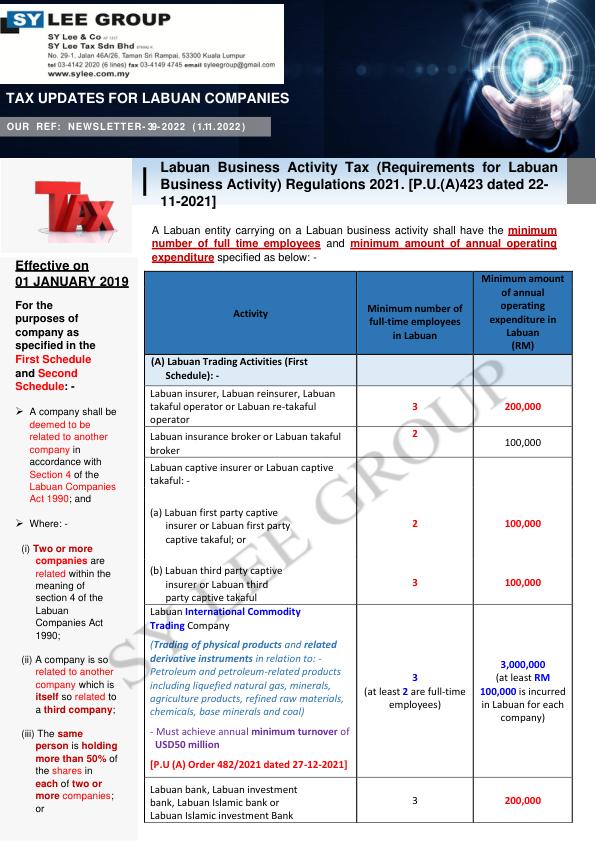

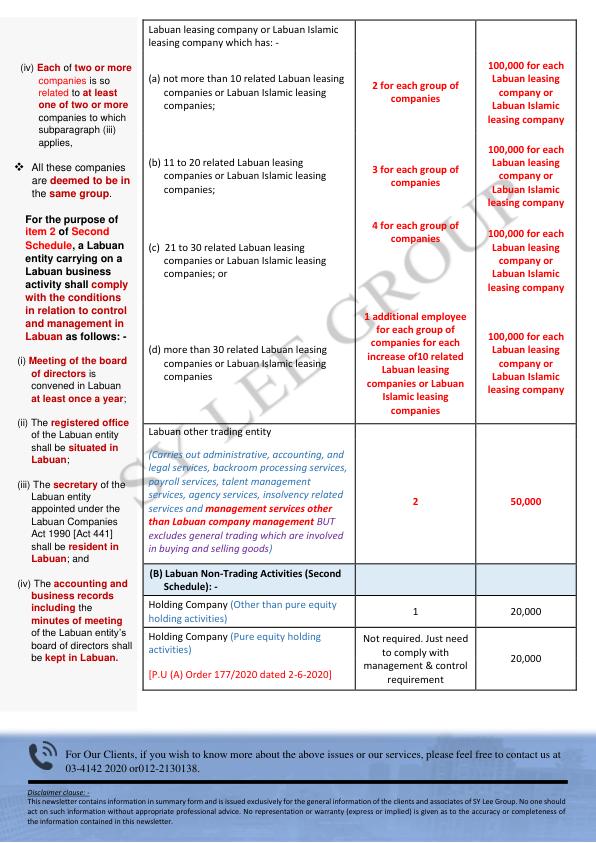

Newsletter-39-2022-Tax updates for Labuan Companies

01.Nov.2022

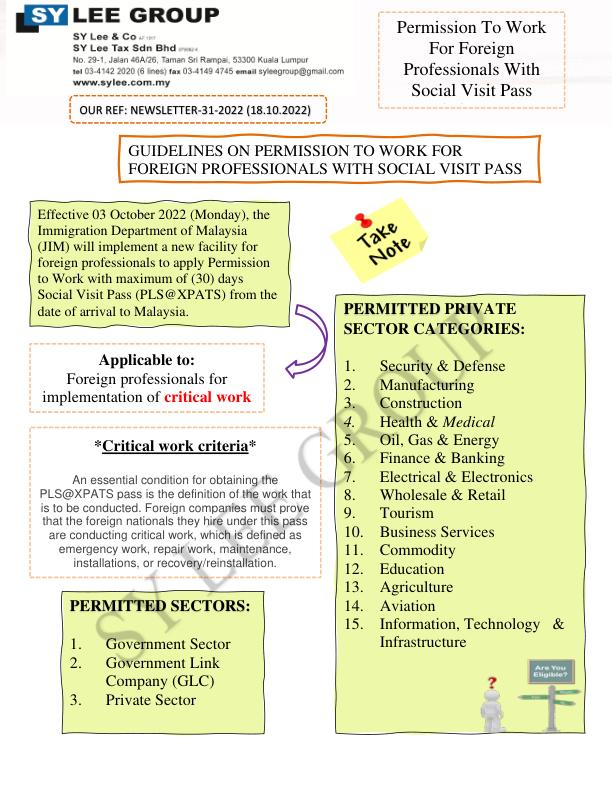

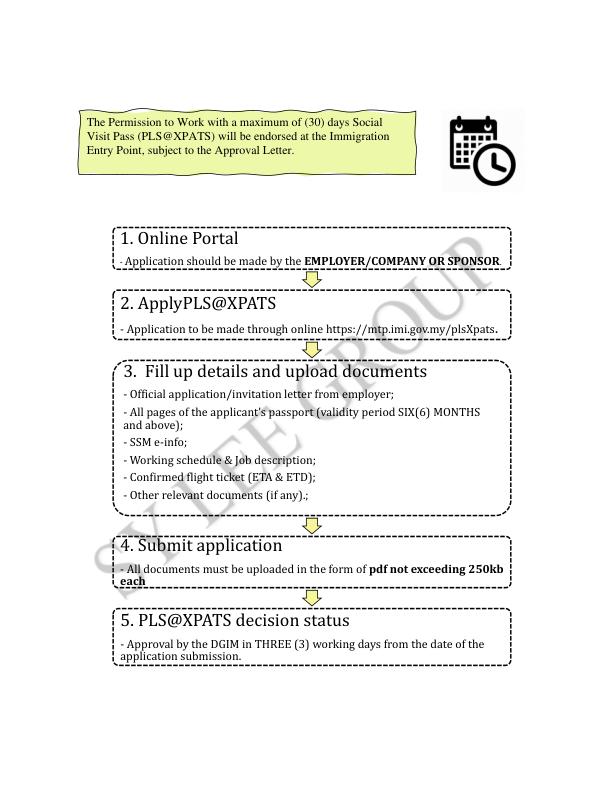

Newsletter-31-2022- Permission To Work For Foreign Professionals With Social Visit Pass

31.Oct.2022

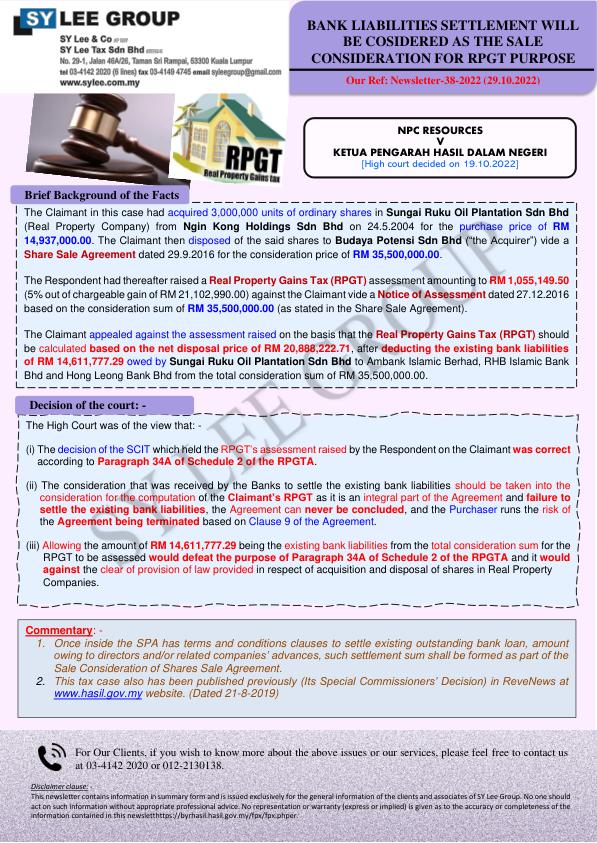

Newsletter-38-2022 - Bank Liabilities Settlement will be considered as The Sale Consideration for RPGT Purpose

29.Oct.2022

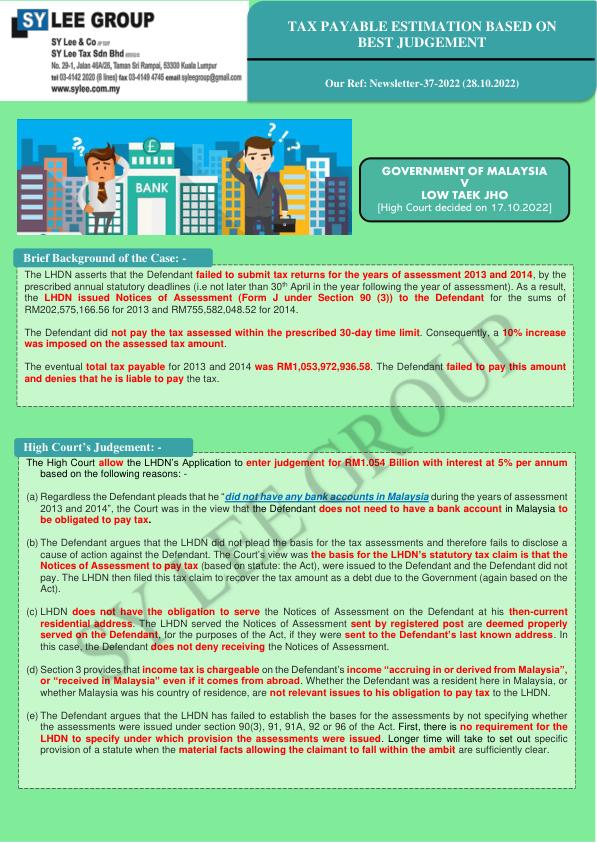

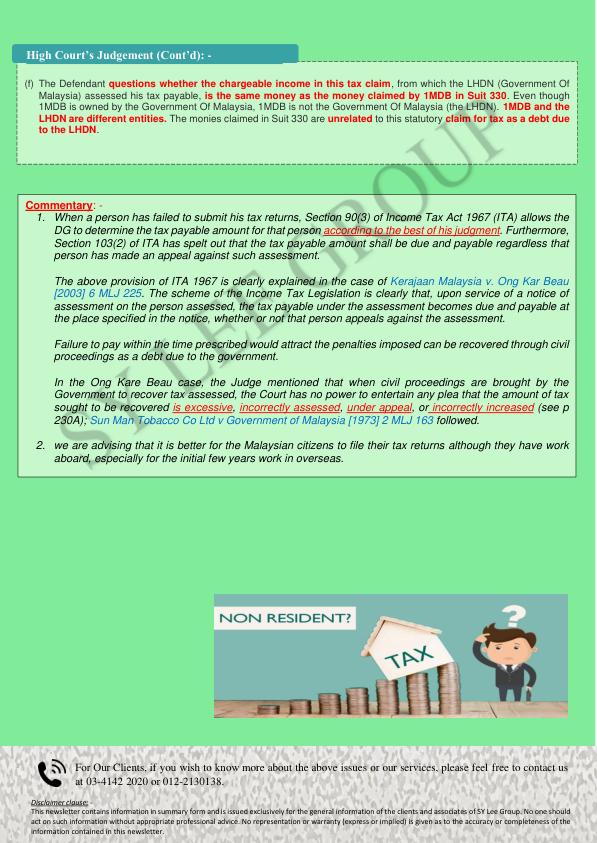

Newsletter-37-2022 - Tax Payable Estimation Based on Best Judgement

28.Oct.2022

Newsletter-35-2022 - Nominee Director May Liable for Company_s Tax payables

21.Oct.2022

Newsletter-34-2022- Income Tax v RPGT

20.Oct.2022

Newsletter-30-2022 - Service Reseller Payment is Service or Royalty ?

14.Oct.2022

Newsletter-29-2022 - Payment for Exemption to Build low Cost Housing is Tax Deductible

12.Oct.2022

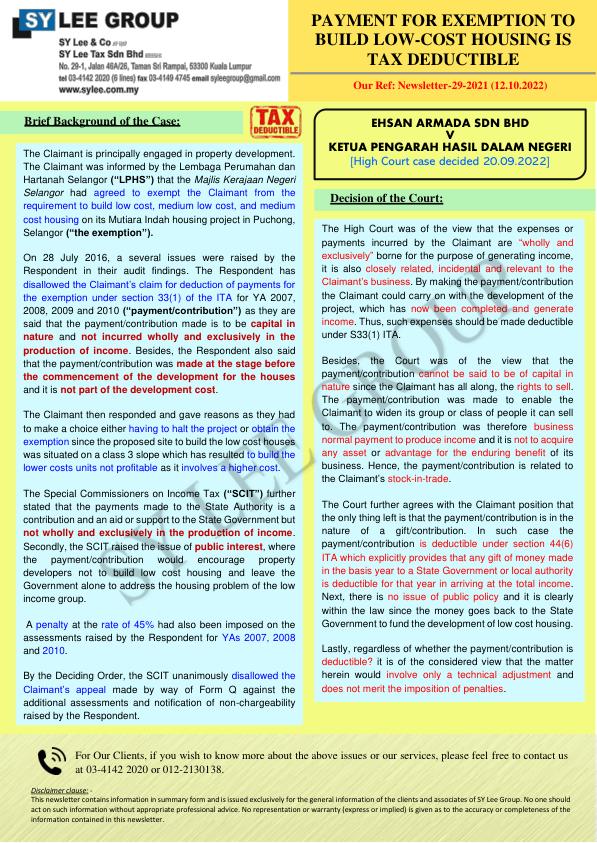

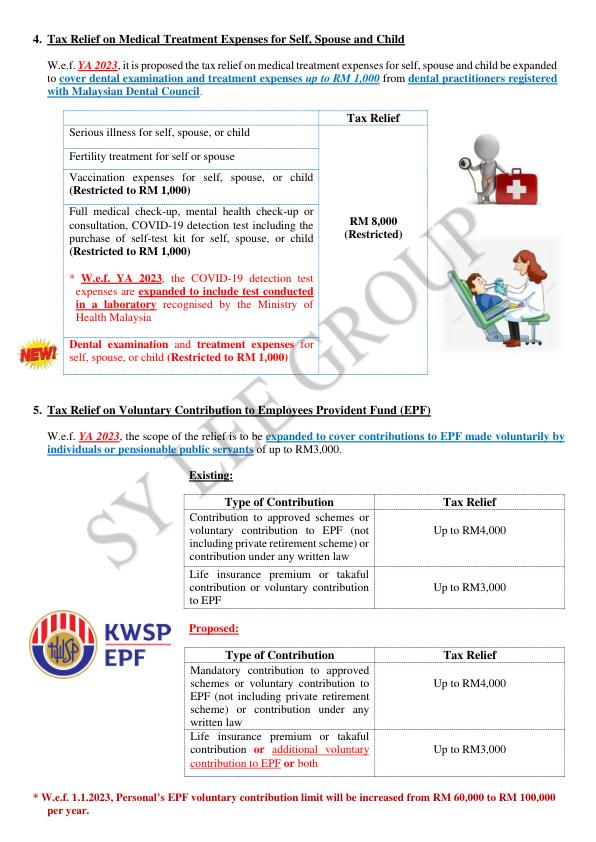

Newsletter-28-2022 - Key Highlights of Selected Tax Proposals of Budget 2023

08.Oct.2022

Newsletter-28-2022 - Key Highlights of Selected Tax Proposals of Budget 2023

08.Oct.2022

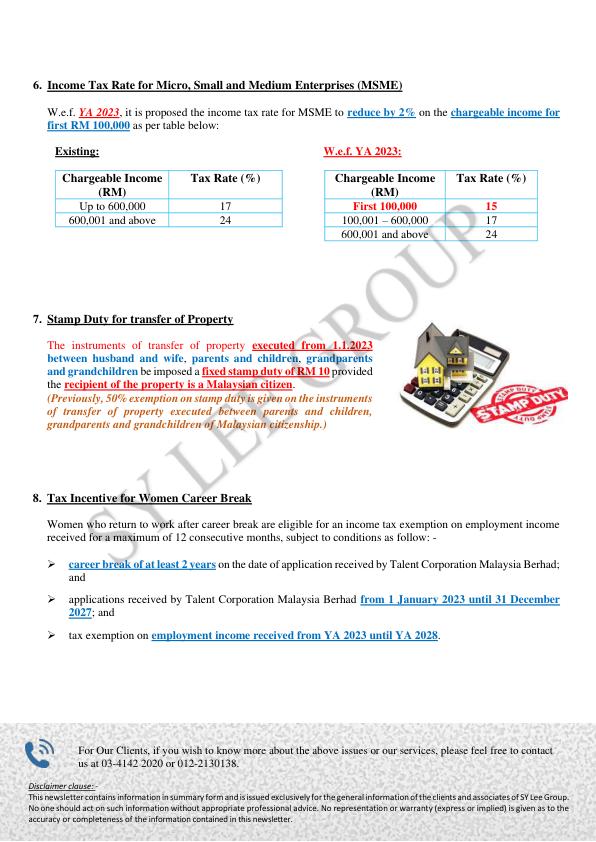

Newsletter-27-2022 - Exemption on Business Income of Malaysia Shipping

07.Oct.2022

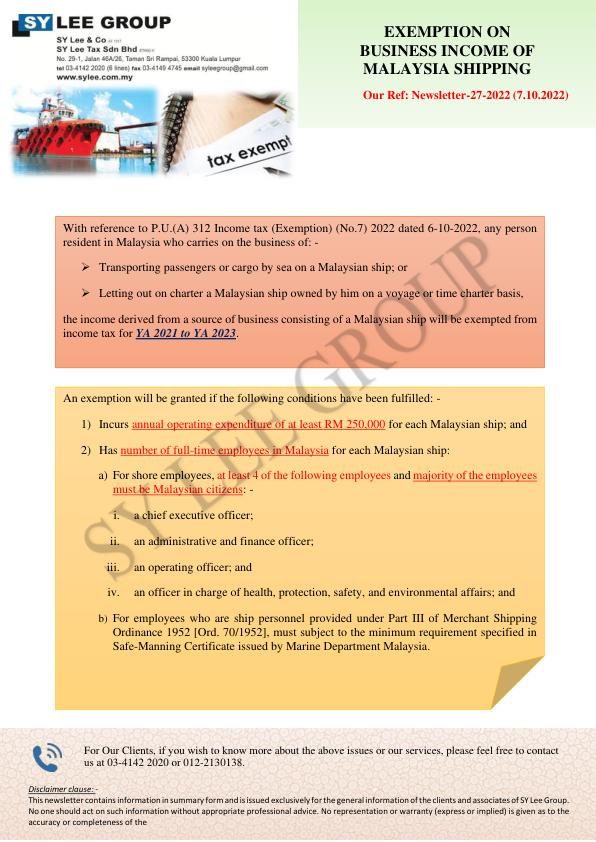

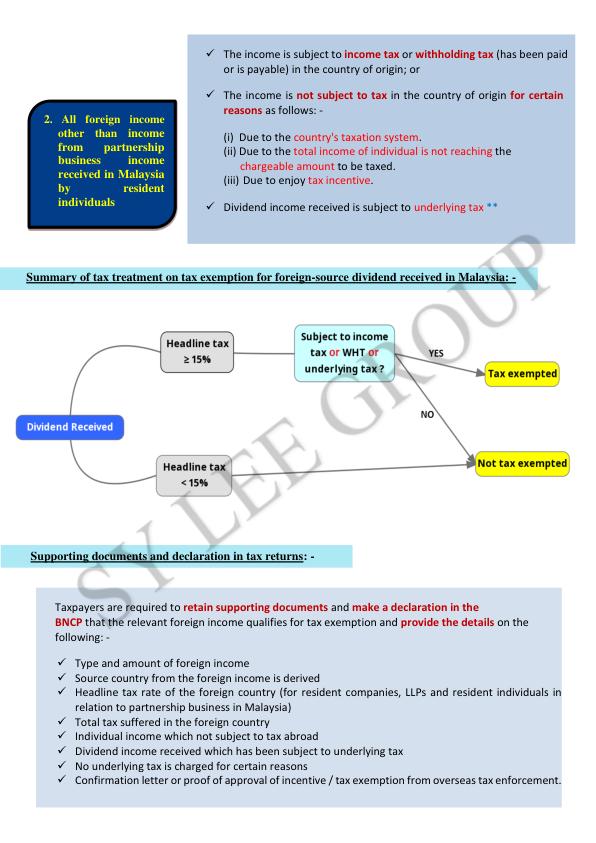

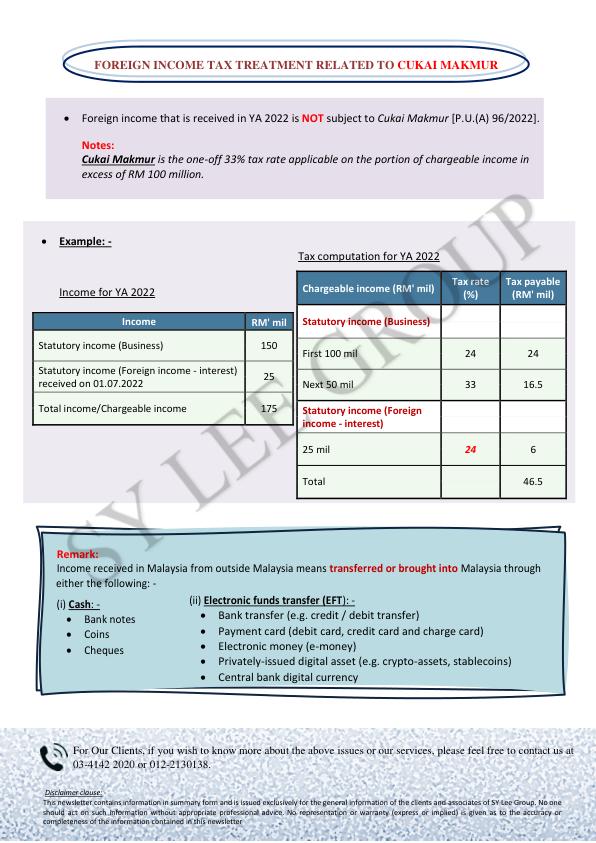

Newsletter-26-2022 - Guidelines on Tax Treatment of Foreign Income Received in Malaysia

05.Oct.2022

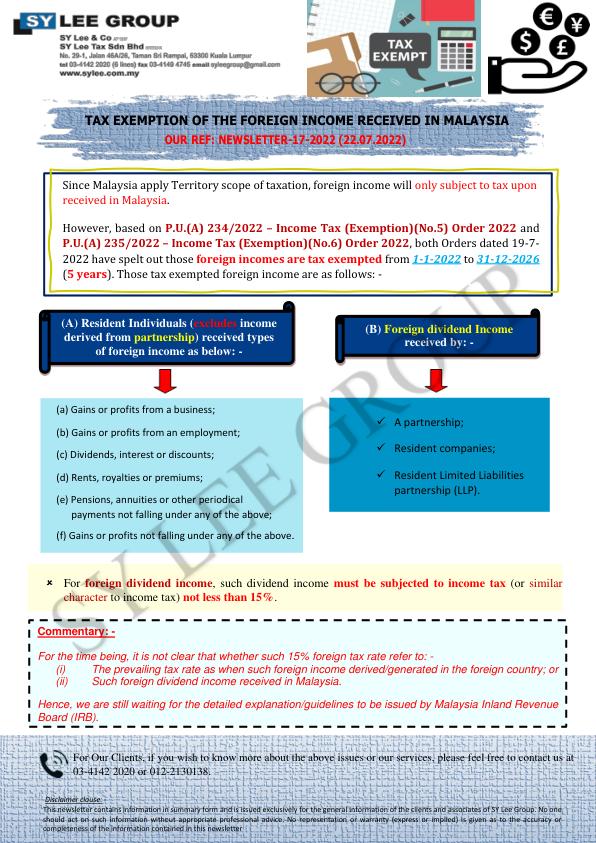

Newsletter-17-2022 - Tax Exemption of the Foreign Income Received in Malaysia

22.Jul.2022

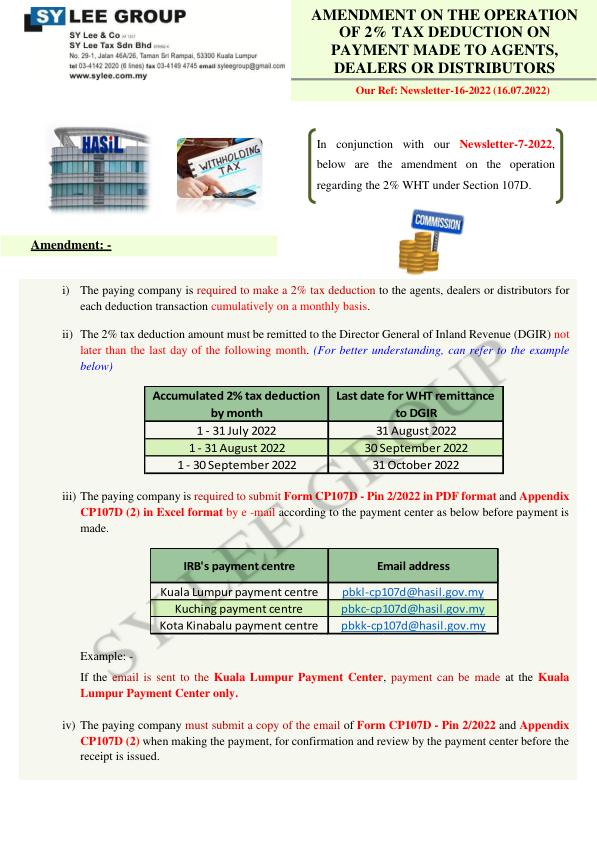

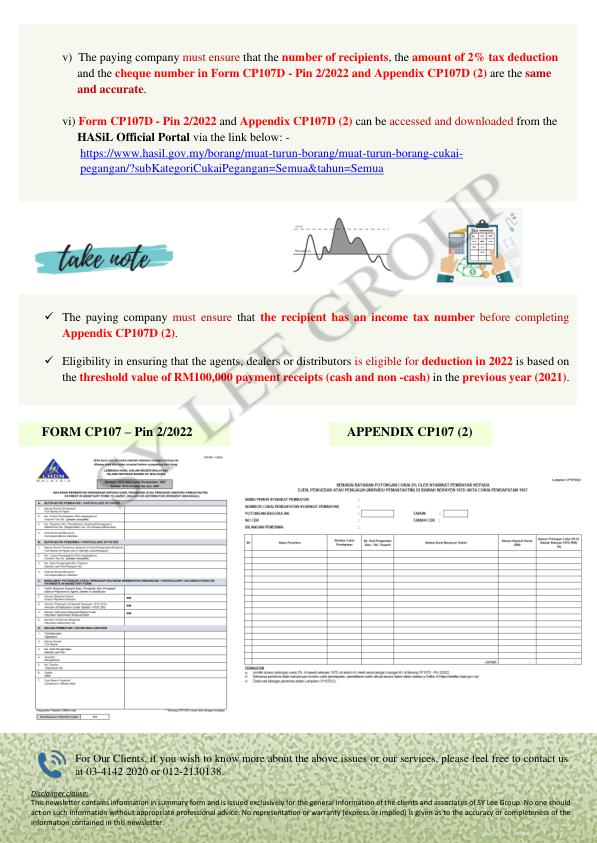

Newsletter-16-2022- Amendment on Operation of 2_ Tax Deduction From Payment Made to Agents_ Dealers and Distributors

16.Jul.2022

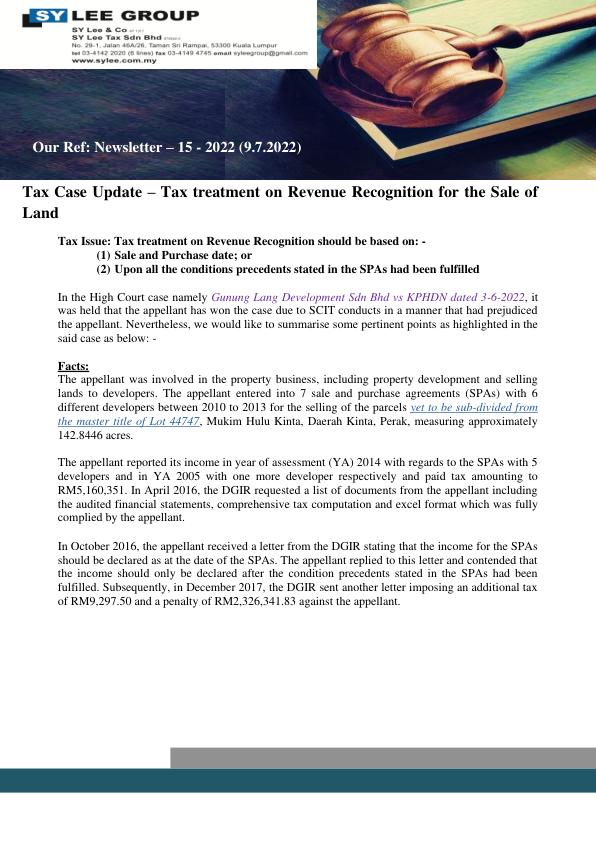

Newsletter-15-2022-Tax Cases Update - Land Trader Pag

09.Jul.2022

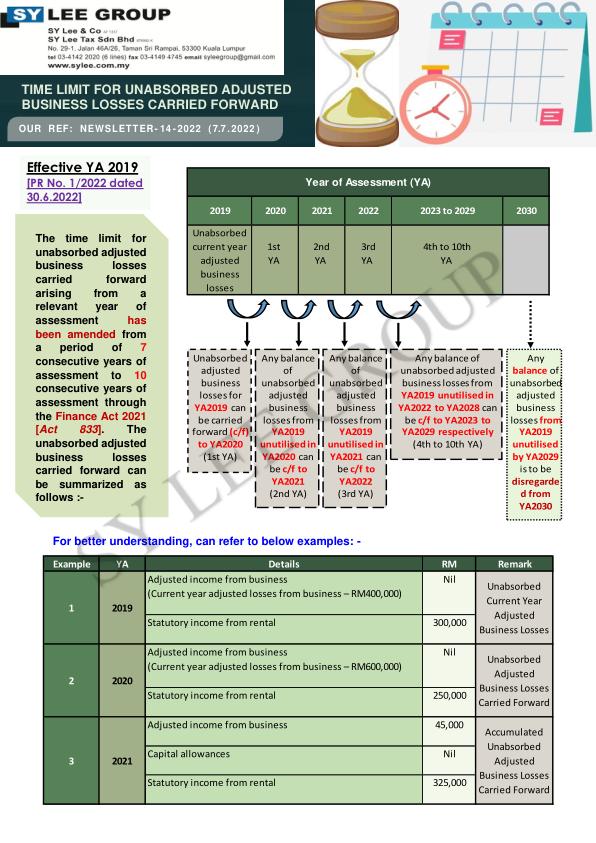

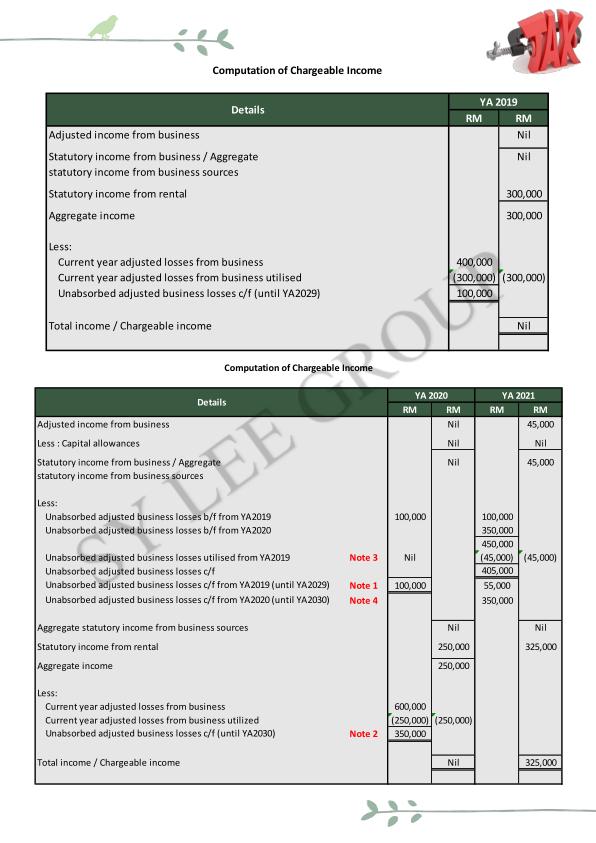

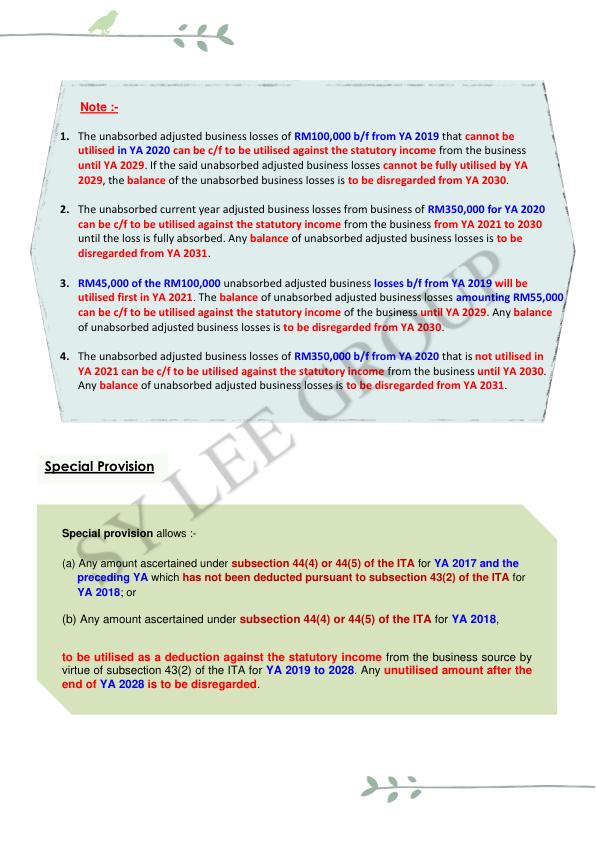

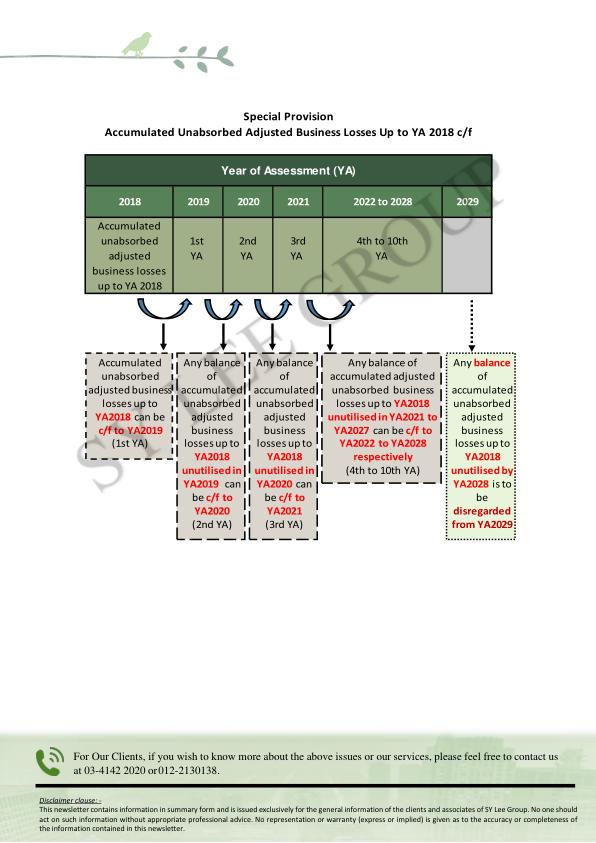

Newsletter-14-2022 - TIME LIMIT FOR UNABSORBED ADJUSTED (1)

07.Jul.2022

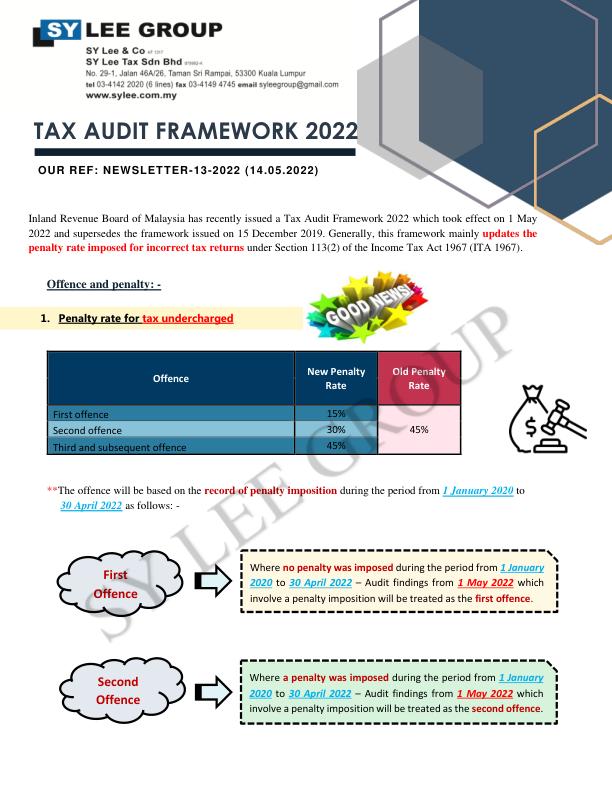

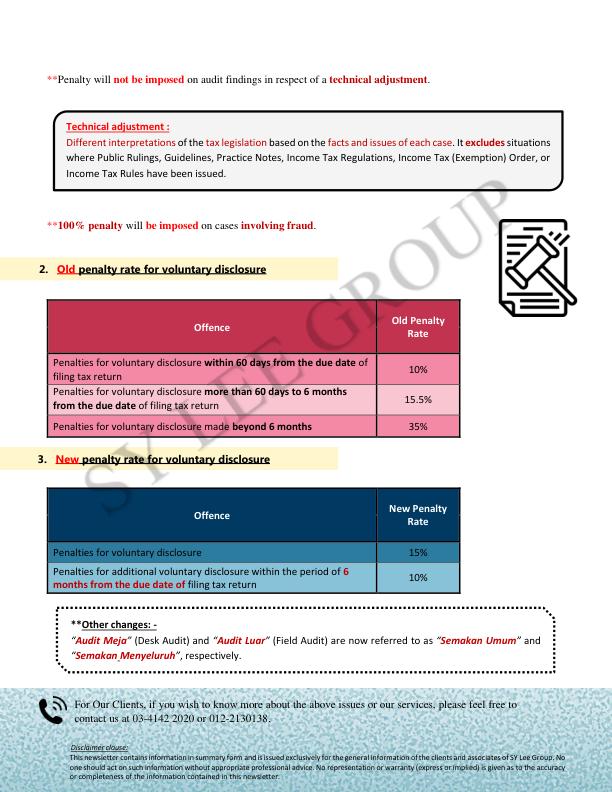

Newsletter-13-2022 - Tax Audit Framework 2022

14.May.2022

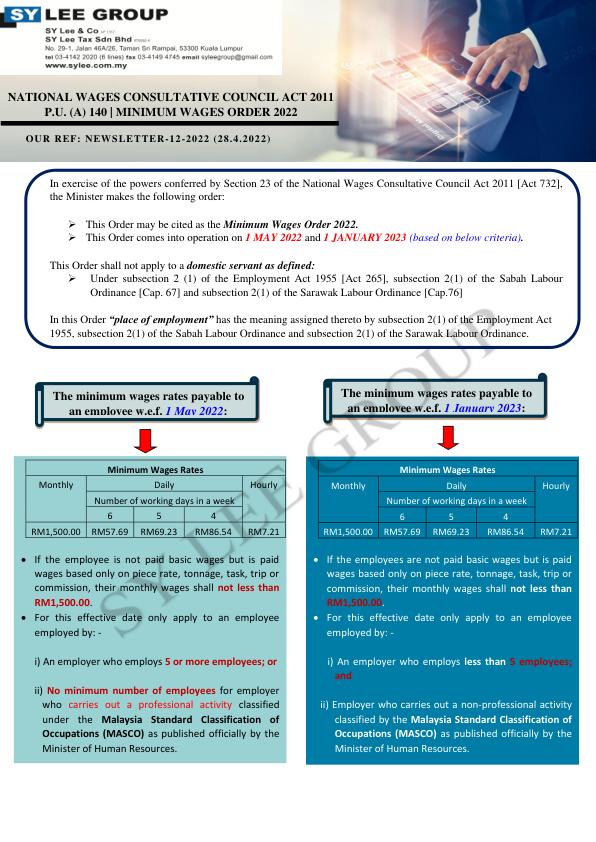

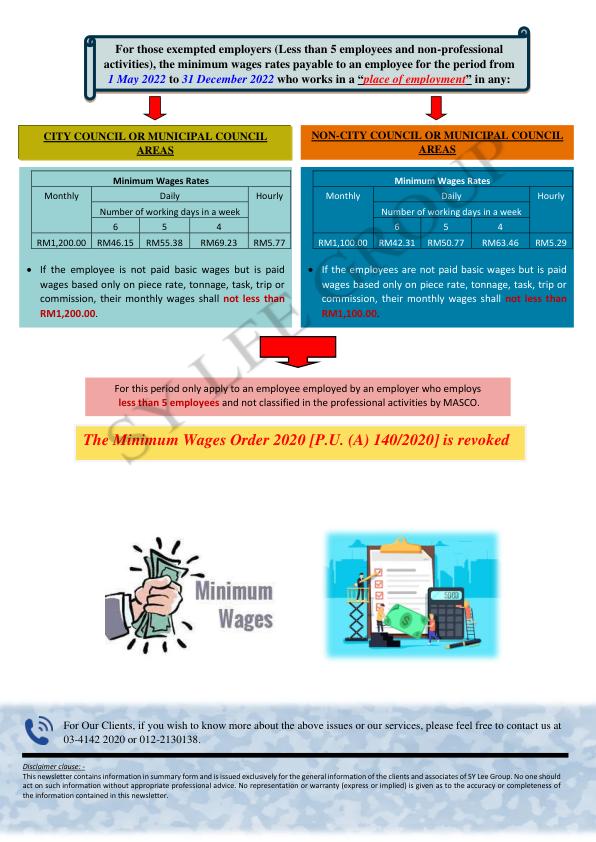

Newsletter-12-2022- Minimum Wages Order 2022 _(\)

29.Apr.2022

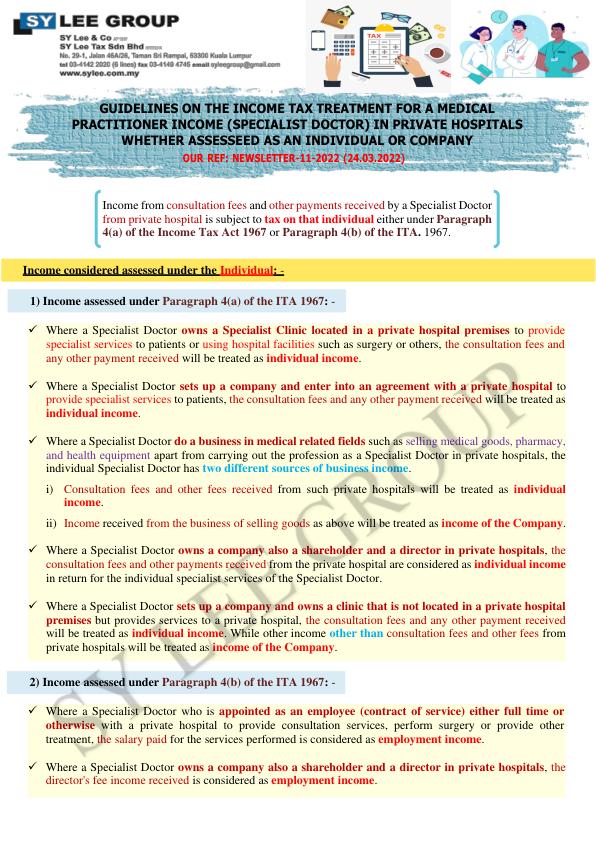

Newsletter-11-2022 - Guidelines on The Income Tax Treatment for Medical Specialist

24.Mar.2022

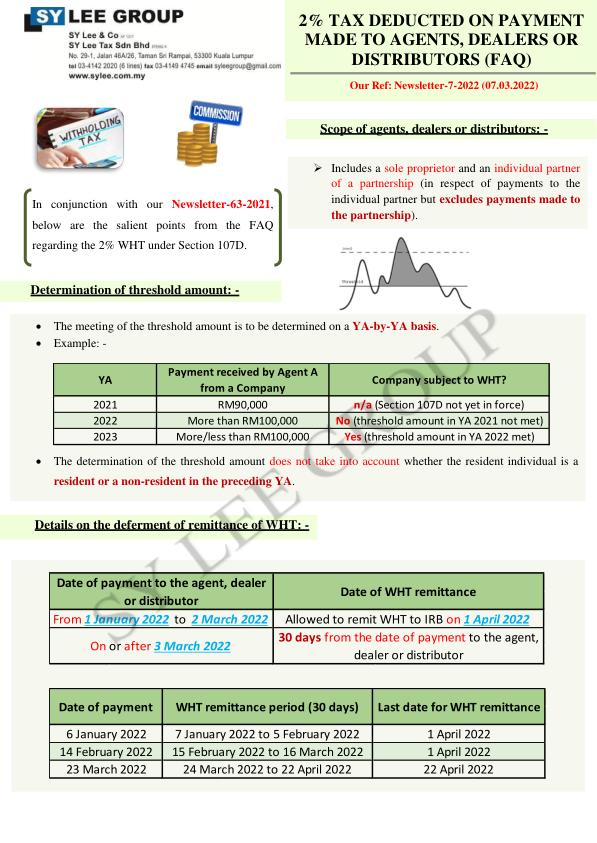

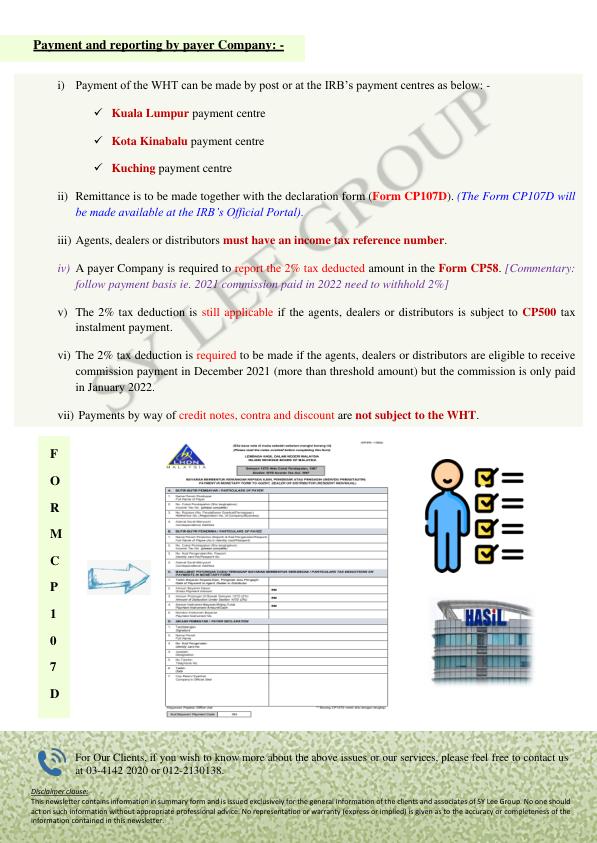

Newsletter-7-2022- 2% Tax Deducted From Payment Made to Agents, Dealers and Distributors (FAQ)

07.Mar.2022

Newsletter-3-2022- Payment for Release of Bumi Quota Units for Property Developer - Tax Deductible

17.Jan.2022

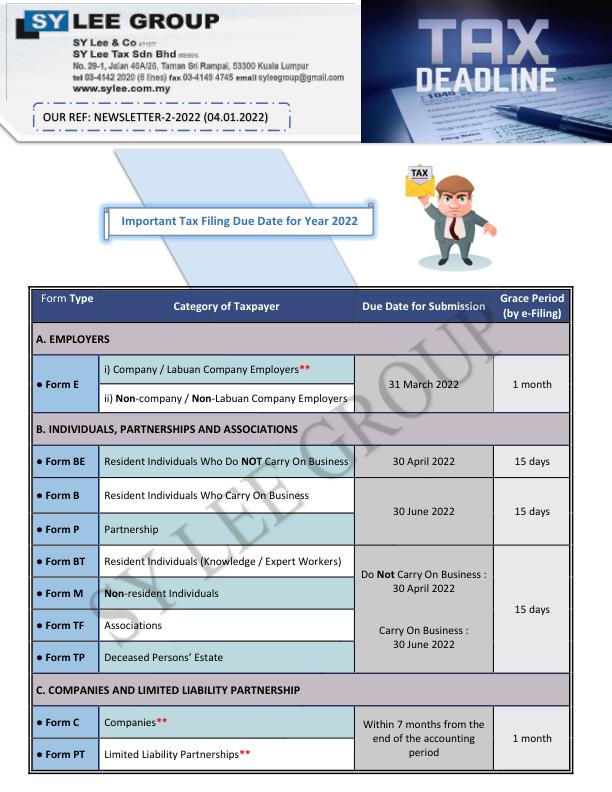

Newsletter-2-2022-Important tax filing due date for year 2022

04.Jan.2022

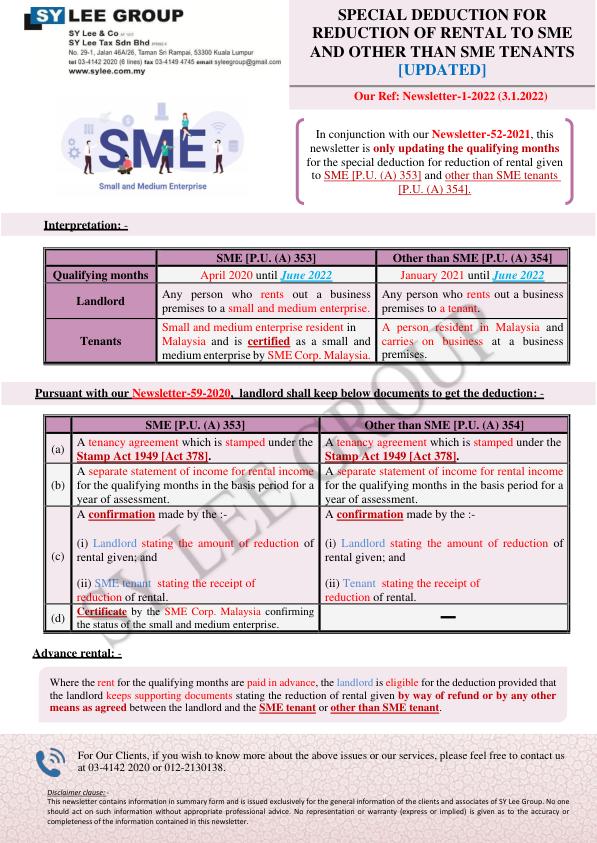

Newsletter-1-2022- Special Deduction for Reduction of Rental to SME and Other Than SME Tenants (UPDATED)

03.Jan.2022

Newsletter-40-2019-Income Tax (Deductions for the Employment of Disabled Persons)(Amendment) Rules 2019

02.Aug.2019

Newsletter-39-2019-Income Tax (Exemption) [No.8] Order 2019

02.Aug.2019

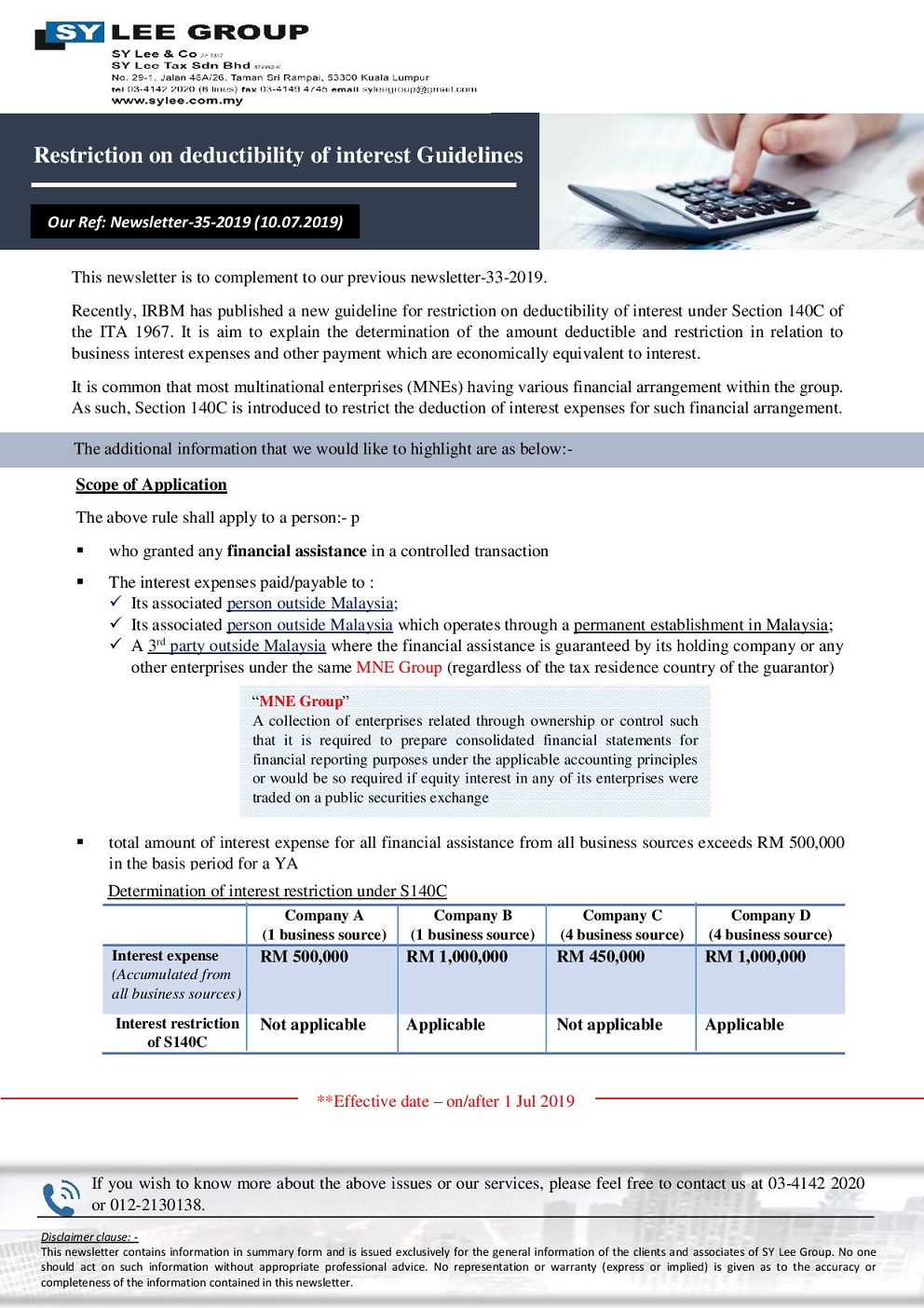

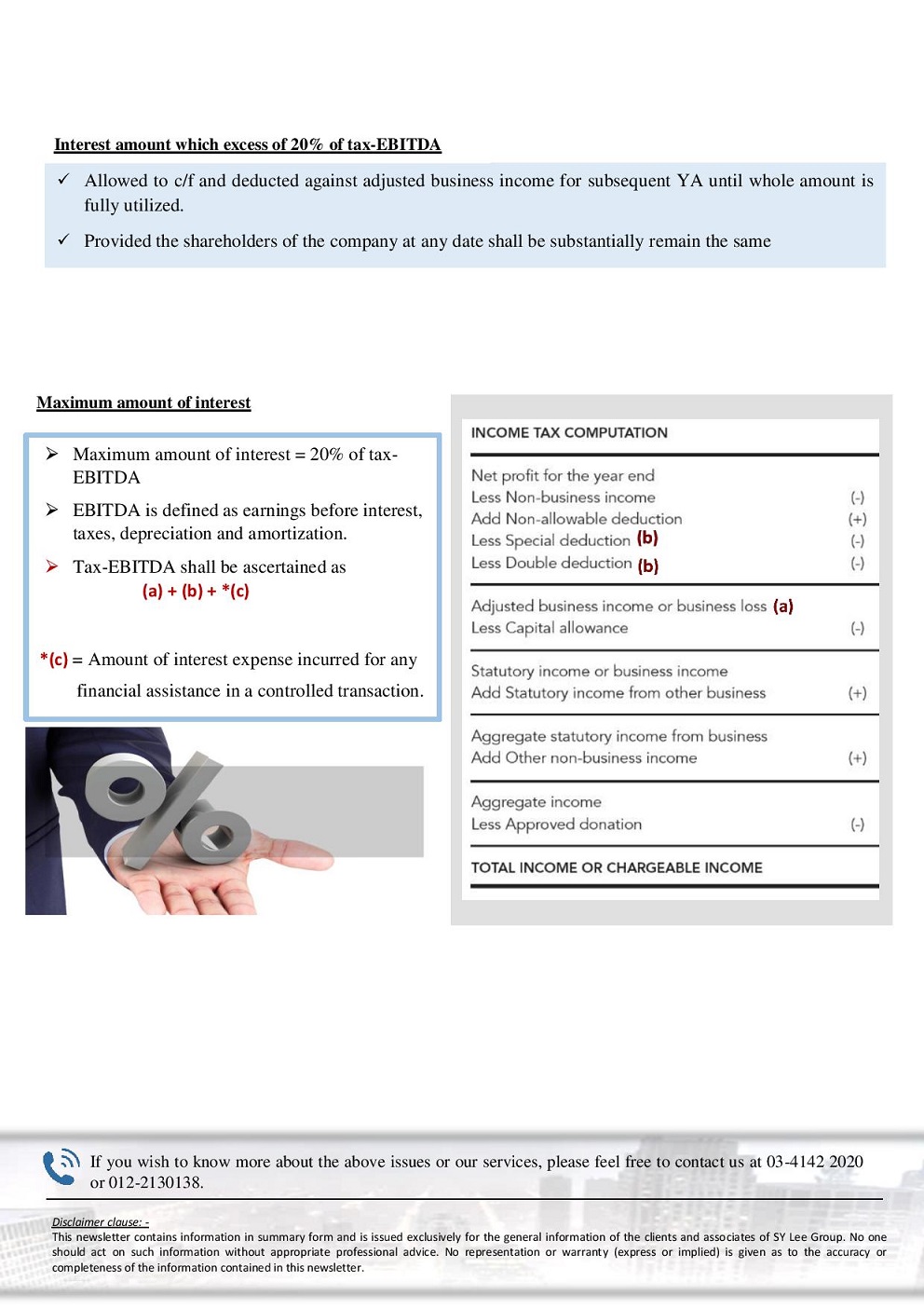

Newsletter-35-2019-Restriction on deductibility of interest guidelines

12.Jul.2019

Newsletter-33-2019-Restriction on deductibility of controlled party's interest expense (Amendment)

08.Jul.2019

Newsletter-30-2019-New information required for Company Income Tax Return Form(e-C) for YA 2019

28.Jun.2019

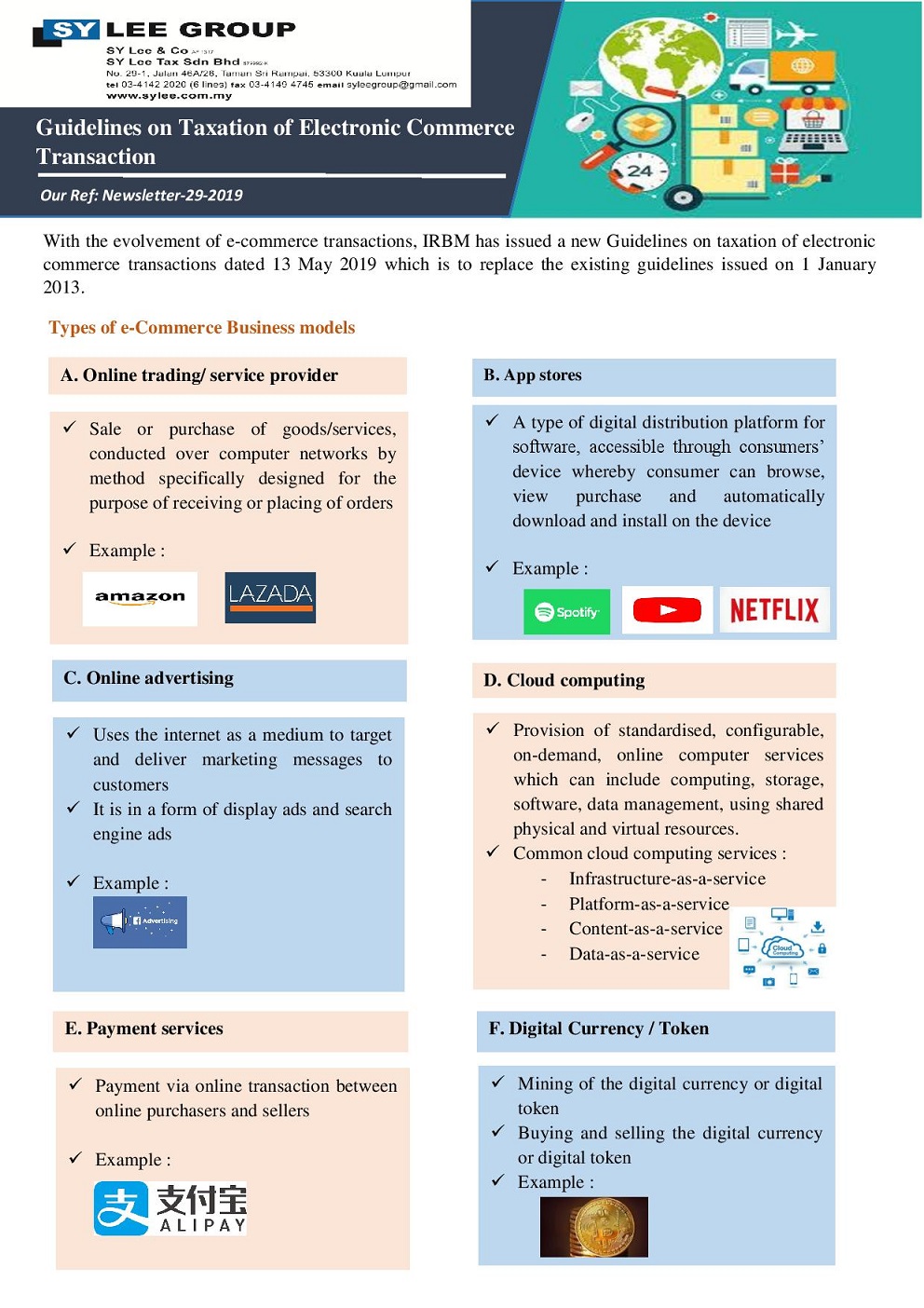

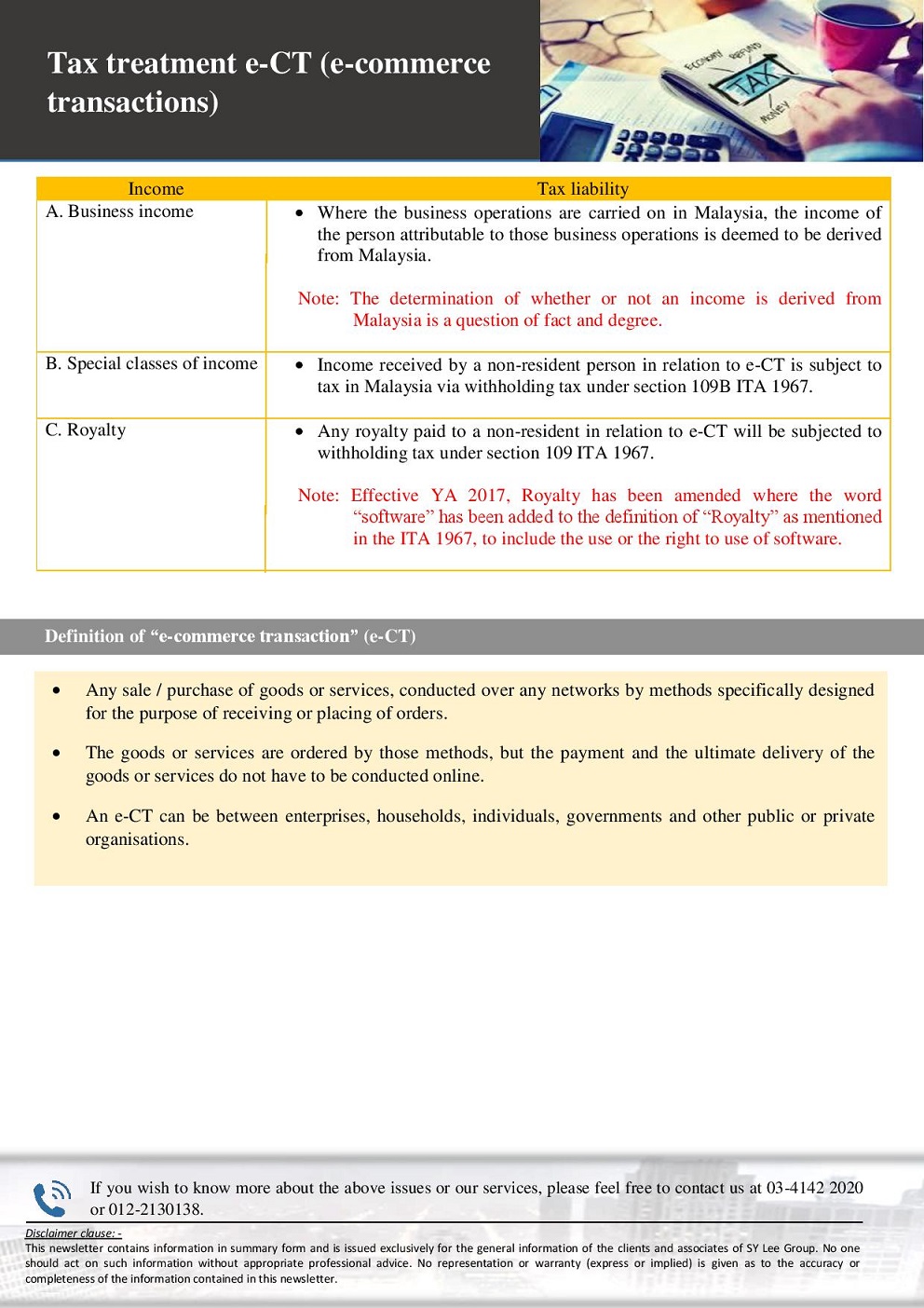

Newsletter-29-2019-Guidelines on Taxation of Electronic Commerce Transactions

21.Jun.2019

Newsletter-28-2019-Income Tax (Exemption) [No.3]

19.Jun.2019

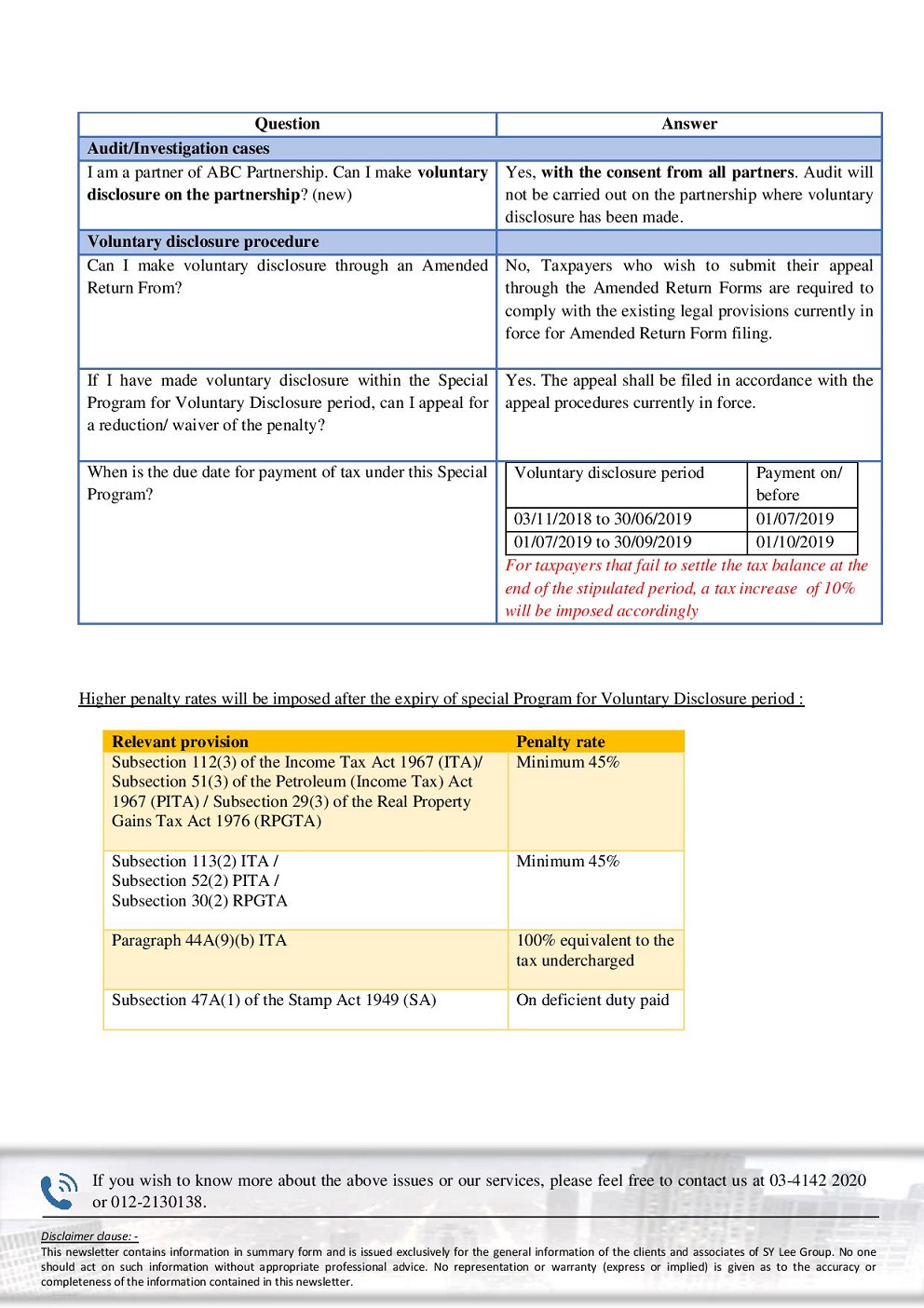

Newsletter-27-2019-FAQ-Voluntary Disclosure Program

19.Jun.2019

Newsletter-26-2019-Income Tax (Exemption) [No.4]

19.Jun.2019

Newsletter-25-2019-Guidelines for Approval of Director General of Inland Revenue under Subsection 44(6)

11.Jun.2019

Newsletter-24-2019-Criteria of the Application for Judicial Review on Tax appeal

30.May.2019

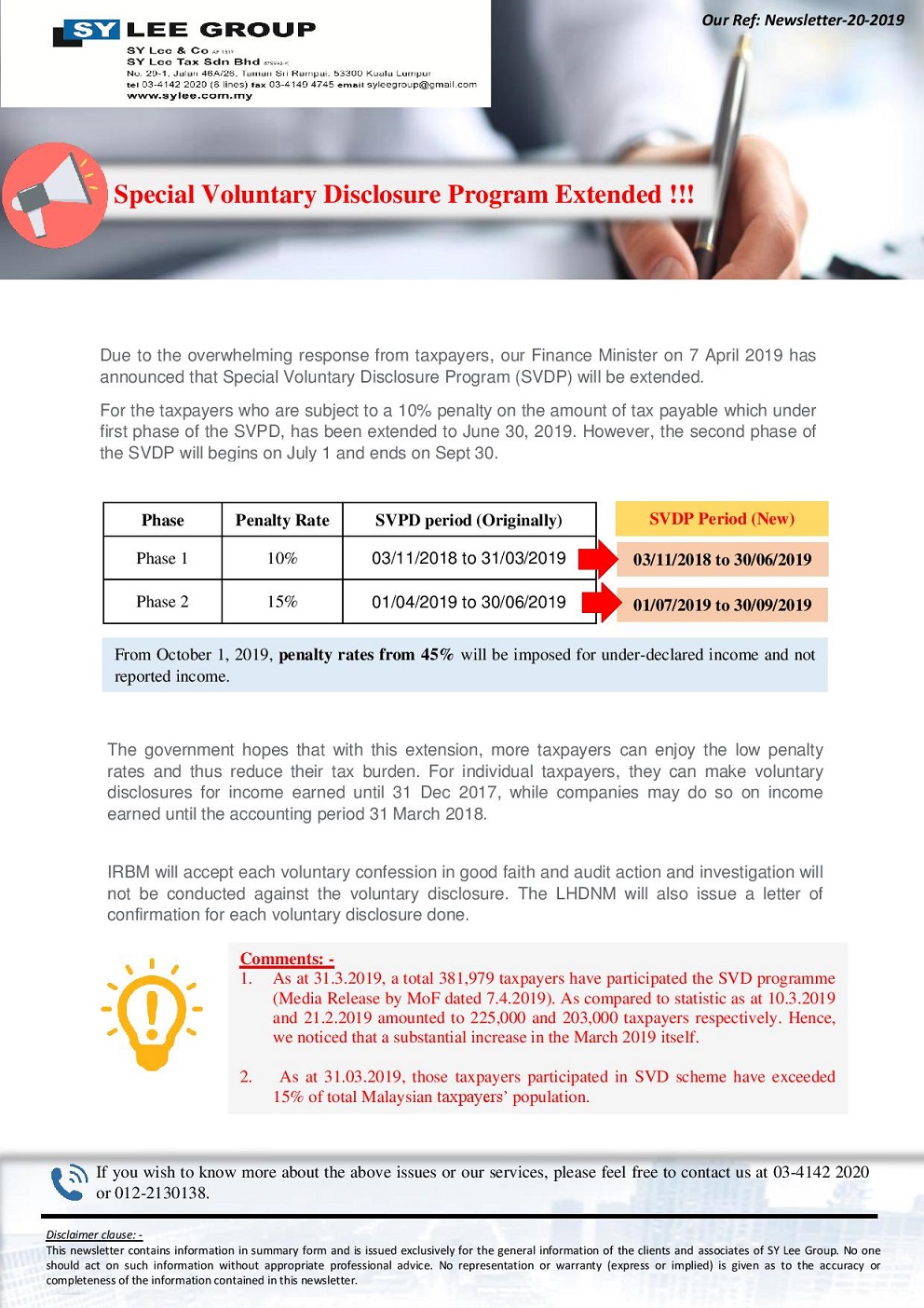

Newsletter-20-2019-Special Voluntary Program Extended

11.Apr.2019

Newsletter-18-2019-Director's liability on Company's outstanding taxes

25.Mar.2019

Newsletter-15-2019-50% tax exemption on individual rental income

04.Mar.2019

Newsletter-14-2019-RPGT Exemption for residential property below RM200k & Allowable Tax Deduction amount on payment to Labuan Company by Resident

27.Feb.2019

Newsletter-13-2019-Professional Indemnity Insurance

22.Feb.2019

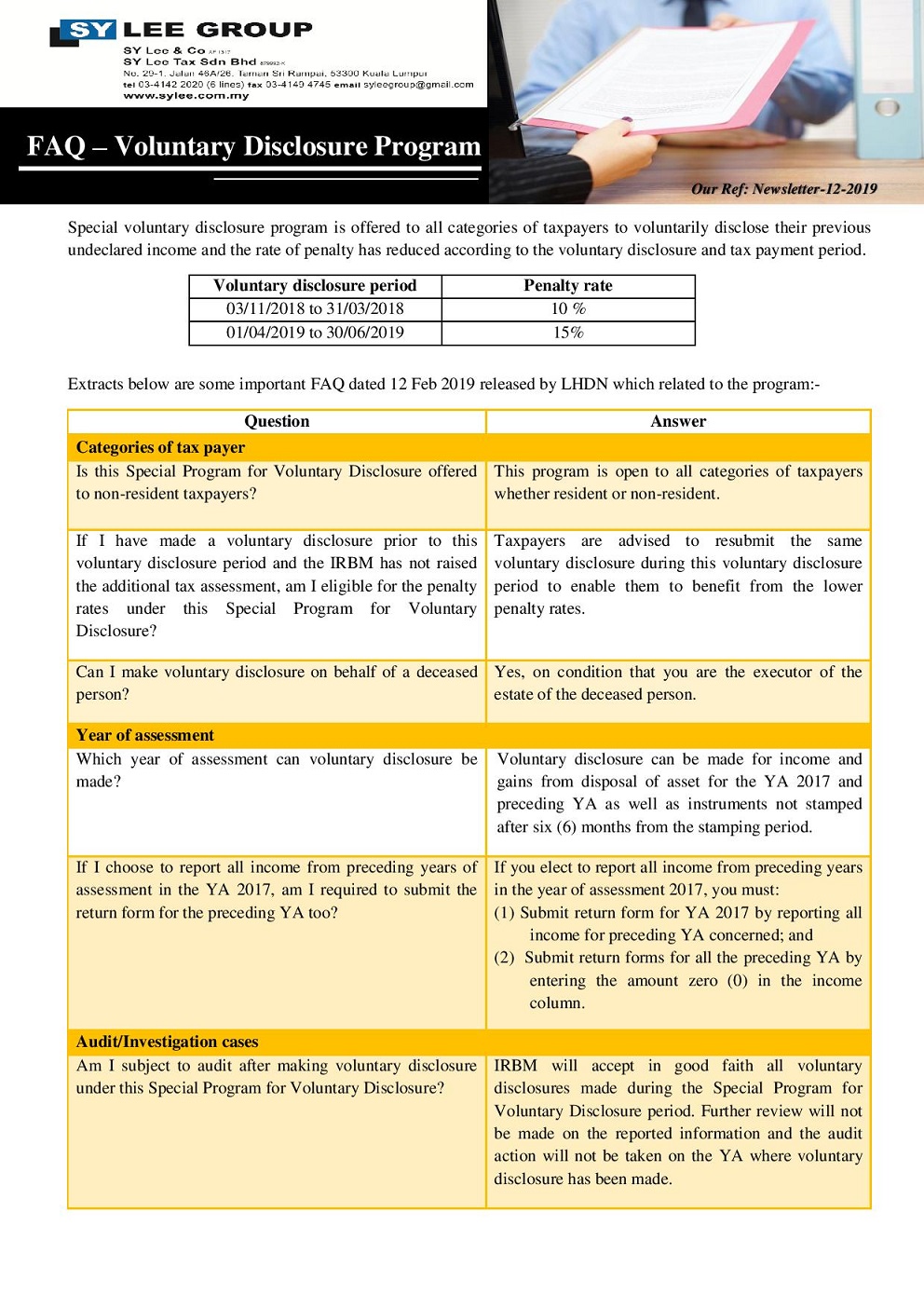

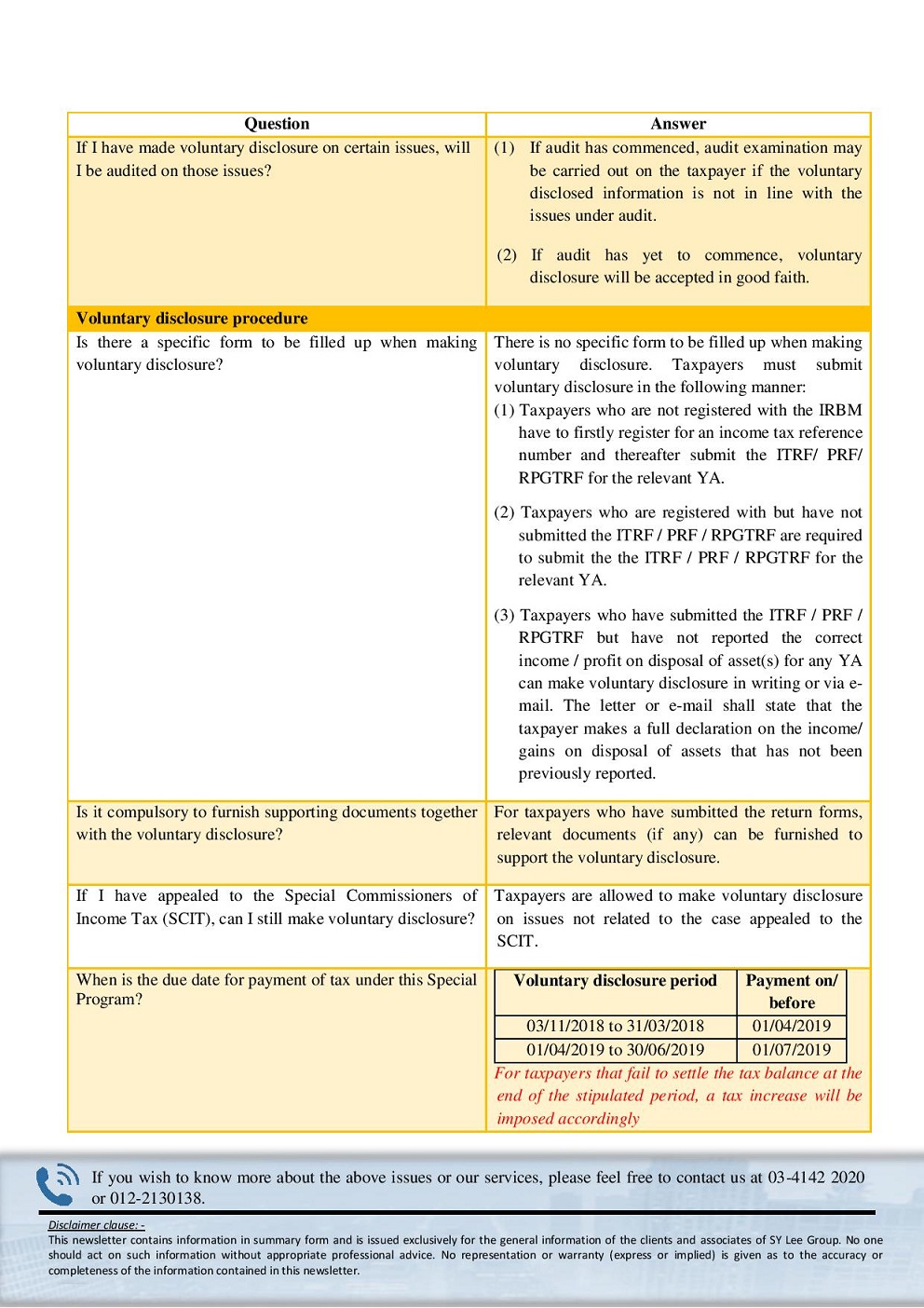

Newsletter-12-2019-FAQ Voluntary Disclosure Program

18.Feb.2019

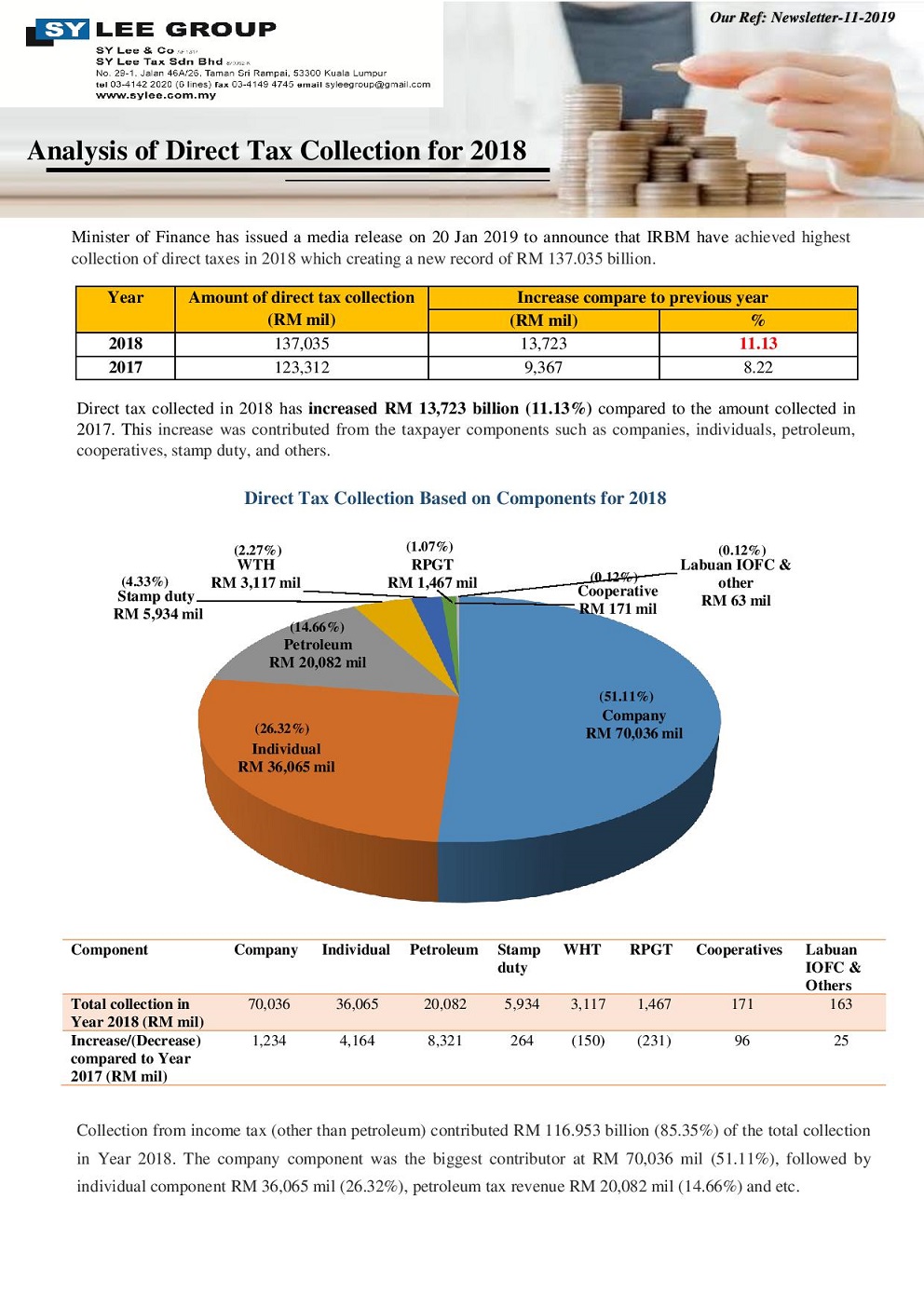

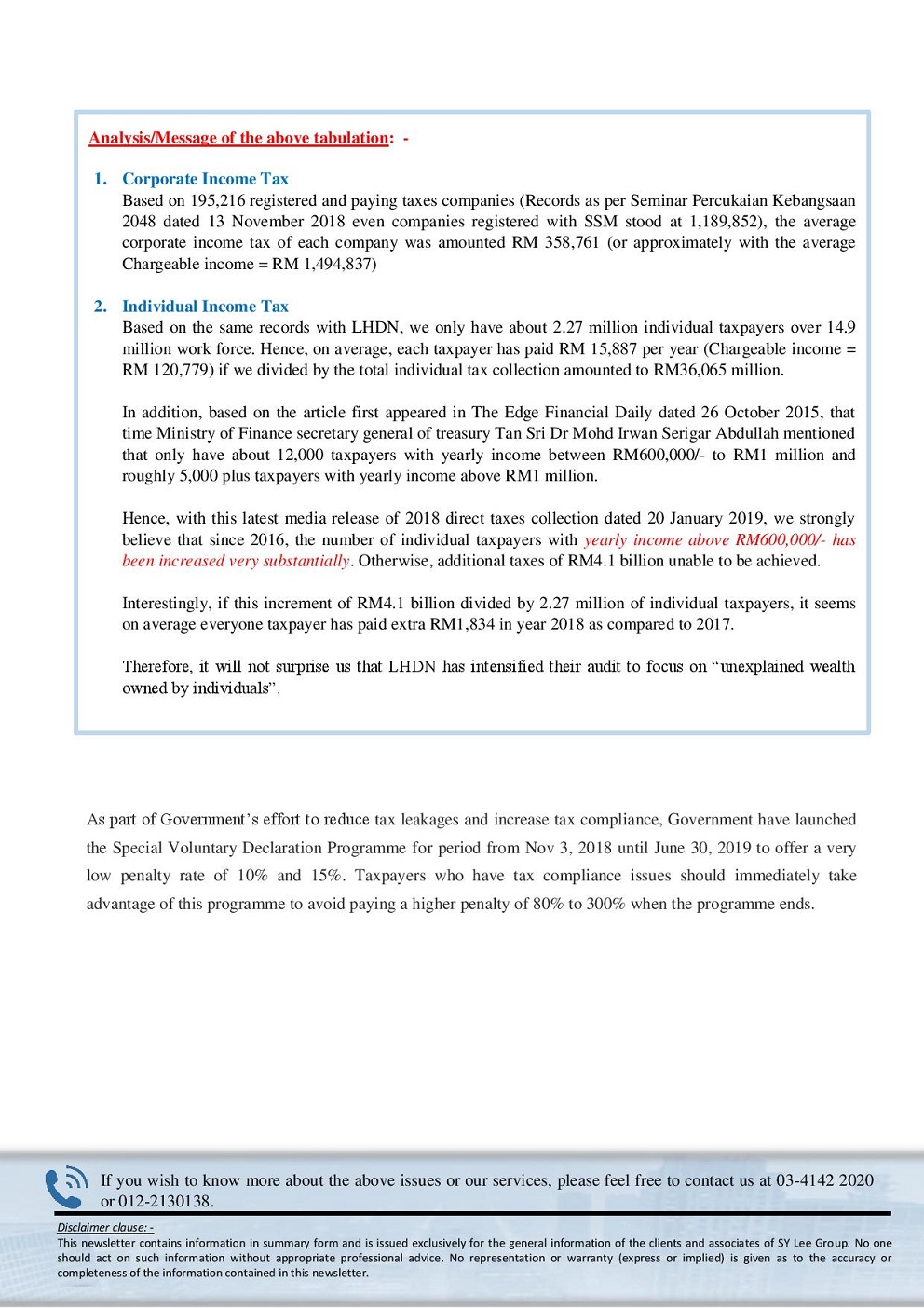

Newsletter-11-2019-Analysis of Direct Tax collection for 2018

24.Jan.2019

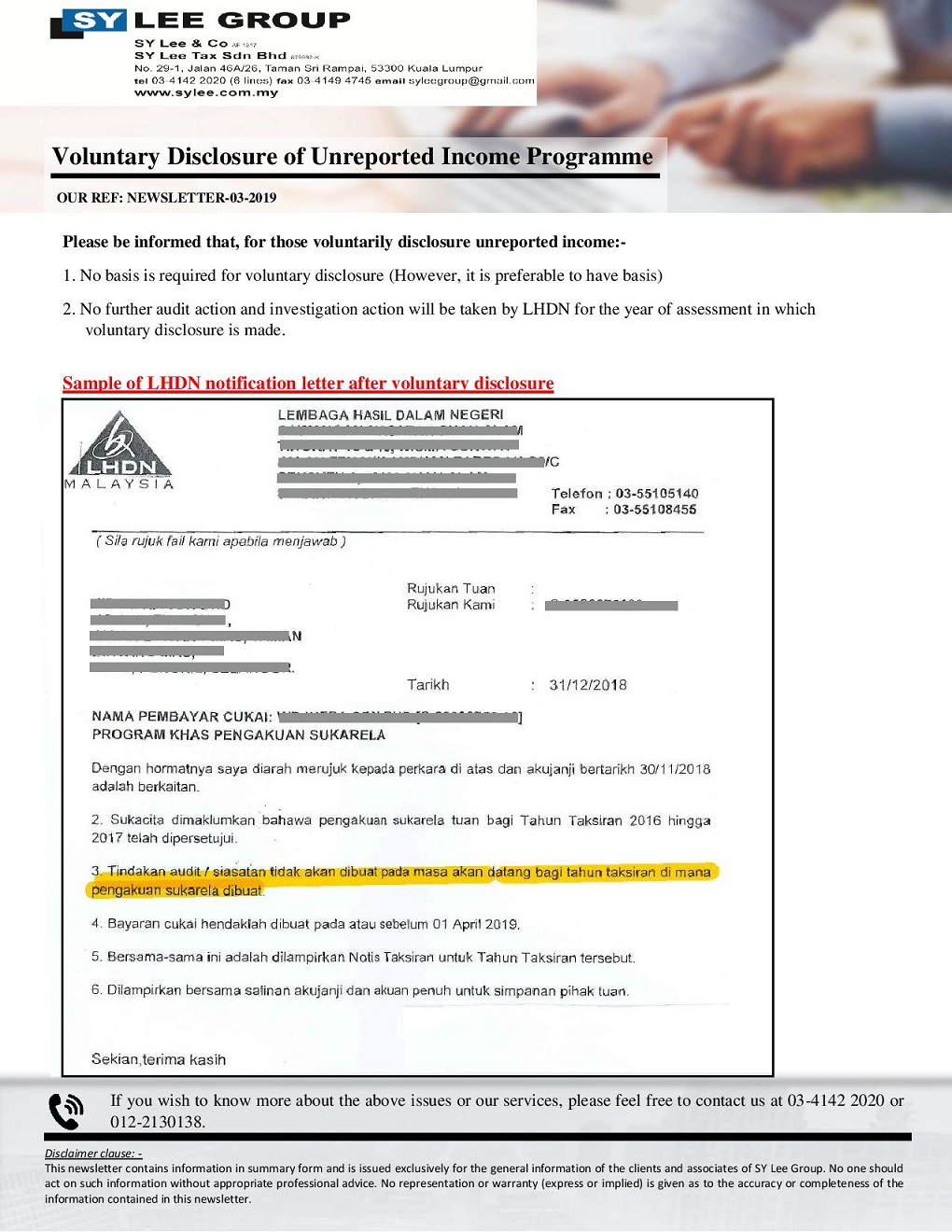

Newsletter-3-2019-Voluntary Disclosure of Unreported Income Programme

04.Jan.2019

Newsletter-65-2018-Withholding Tax on Special Classes of Income

11.Dec.2018

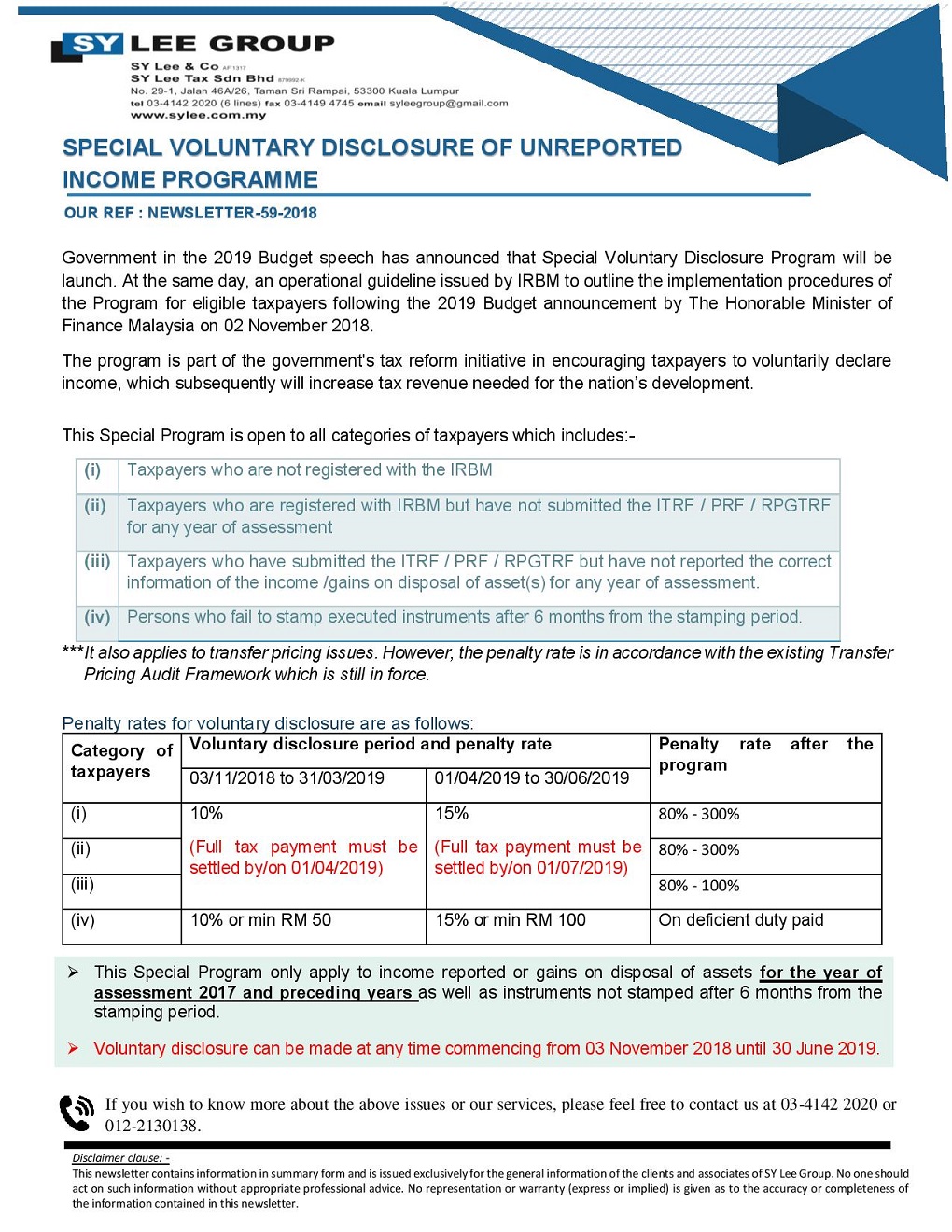

Newsletter-59-2018-Special Voluntary Disclosure of Unreported Income Programme

05.Nov.2018

Newsletter-56-2018-Guideline on Income Tax Exemption for Religious Institution or Organization Under Income Tax (Exemption) Order 2017

09.Oct.2018

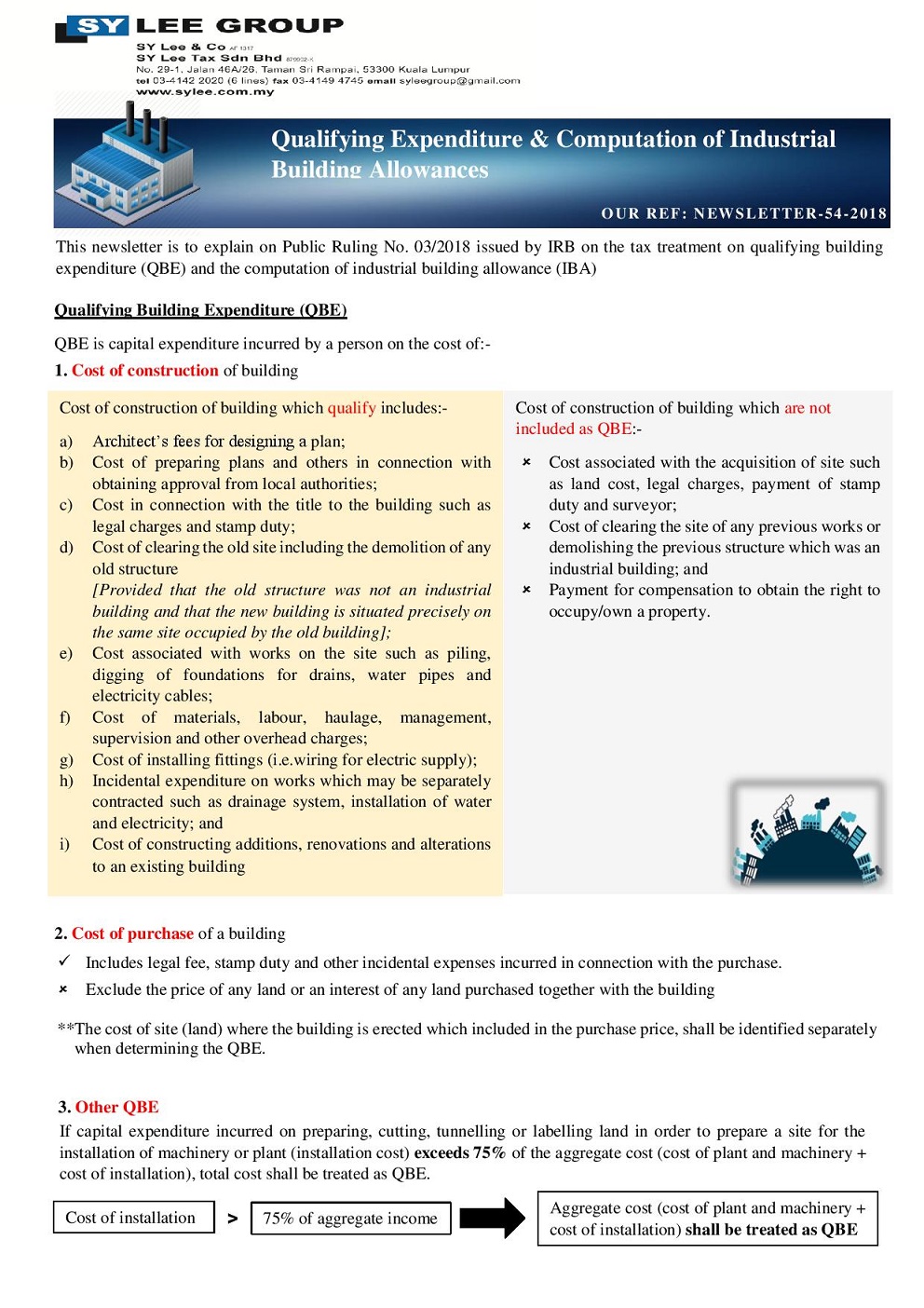

Newsletter-54-2018 - Qualifying expenditure & Computation of Industrial Building Allowance

19.Sep.2018

Newsletter-44-2018 - Deduction on secretarial and tax filing fee

03.Sep.2018

Newsletter-42-2018 - Revised Real Property Gains Tax (RPGT) Guidelines

24.Aug.2018

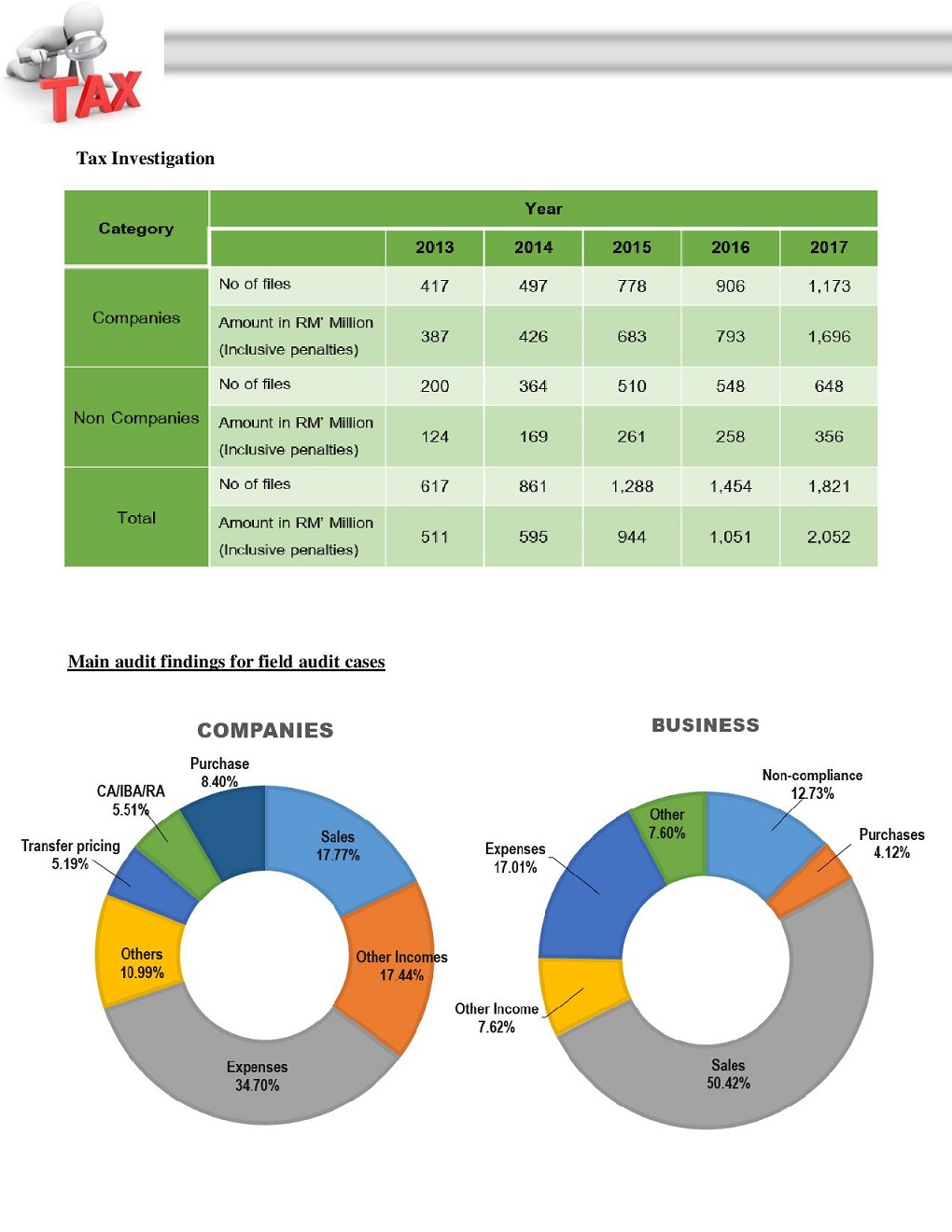

Newsletter-35-2018 - Tax Audit & Investigation Statistics

17.Jun.2018

Newsletter-34-2018 - Income Tax (ACA) (ICT Equipment) Rules 2018

17.Jun.2018

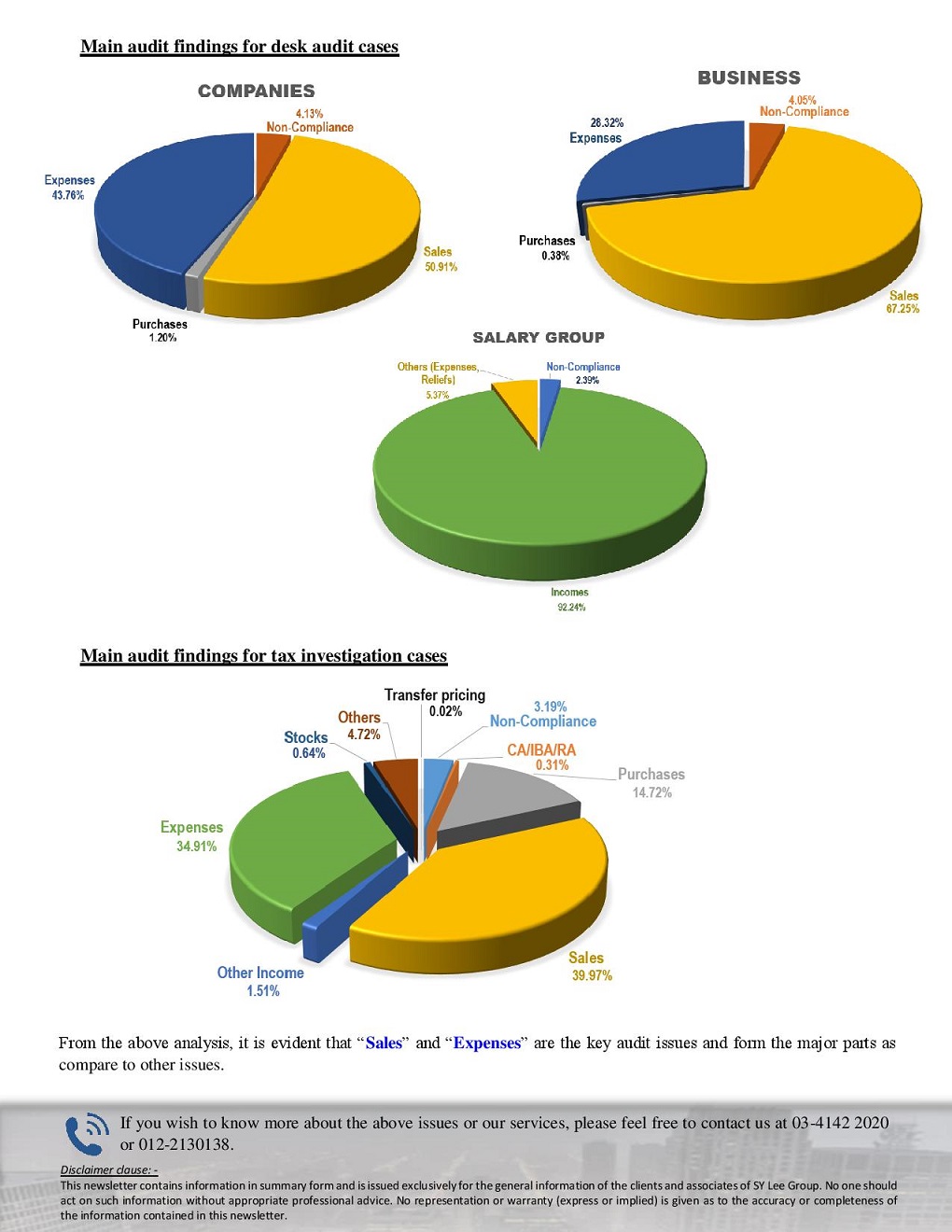

Newsletter-32-2018 - Donation to Tabung Harapan Malaysia Donations - Tax Exempted

04.Jun.2018

Newsletter-20-2018- Tax treatment on cryptocurrency

02.May.2018

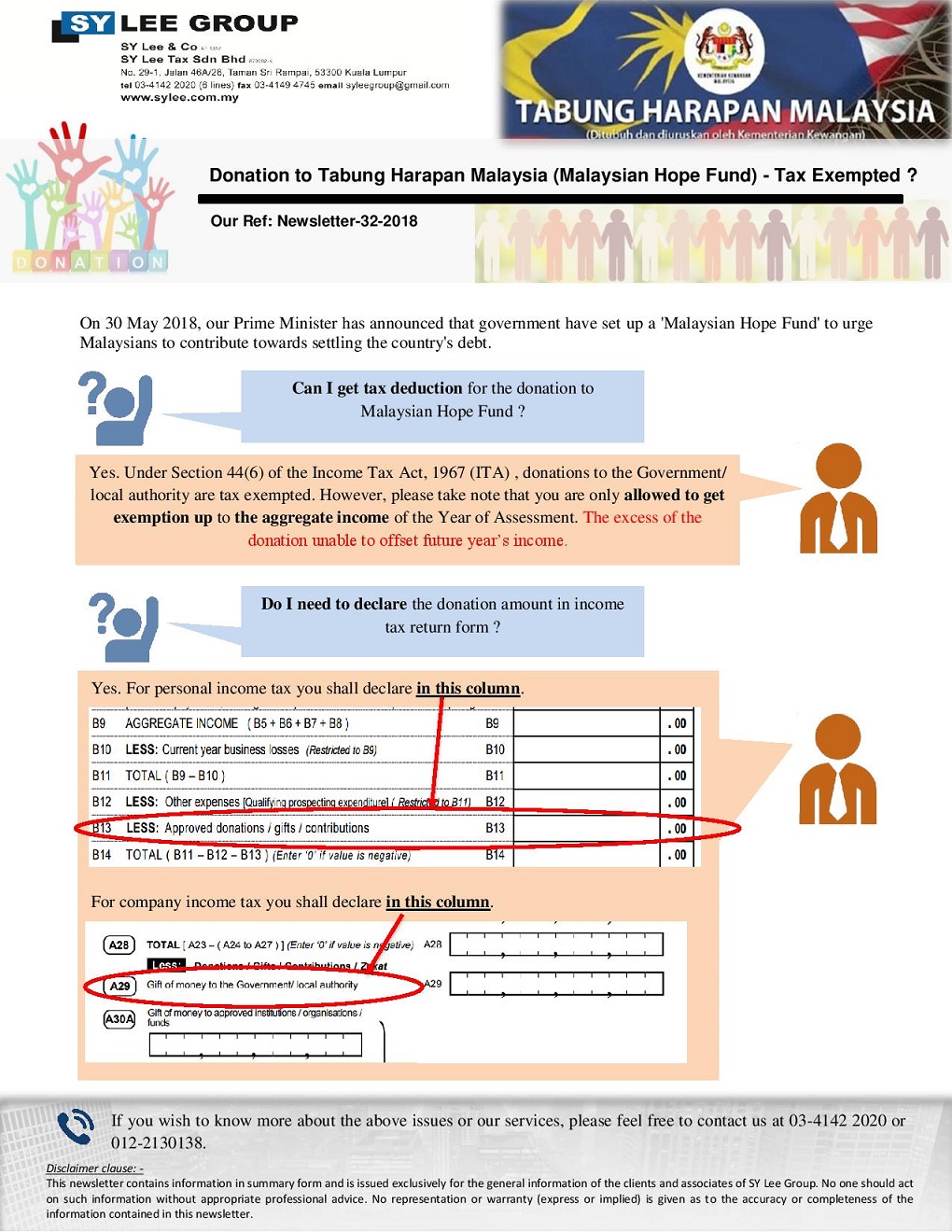

Newsletter-17-2018- Witholding tax on payment to non-resident in relation to digital advertising

31.Mar.2018

Newsletter-15-2018- Tax case development-Part II

15.Mar.2018

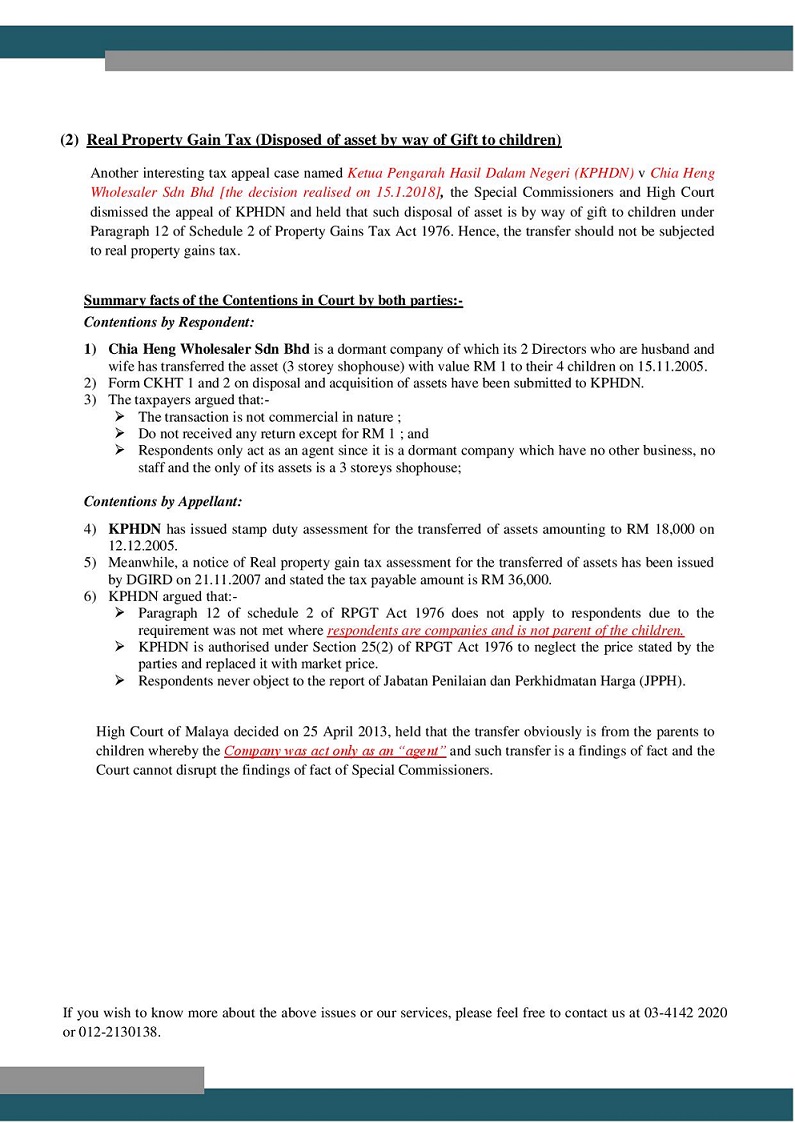

Newsletter-13-2018 - Disposal of plant and machinery - Part II Controlled sales

05.Mar.2018

Newsletter-12-2018 - Recent Tax Development

01.Mar.2018

Newsletter-11-2018 - Income Tax (Exemption) Order 2018

21.Feb.2018

Newsletter-34-2017 -Professional Indemnity Insurance (PII)

26.Dec.2017

Newsletter-32-2017 -Disposal of Plant or Machinery Part I - Other than controlled sales

18.Dec.2017

Newsletter-31-2017 -Clarification on the effective date of Income Tax (Exemption) (No 9) Order 2017

15.Dec.2017

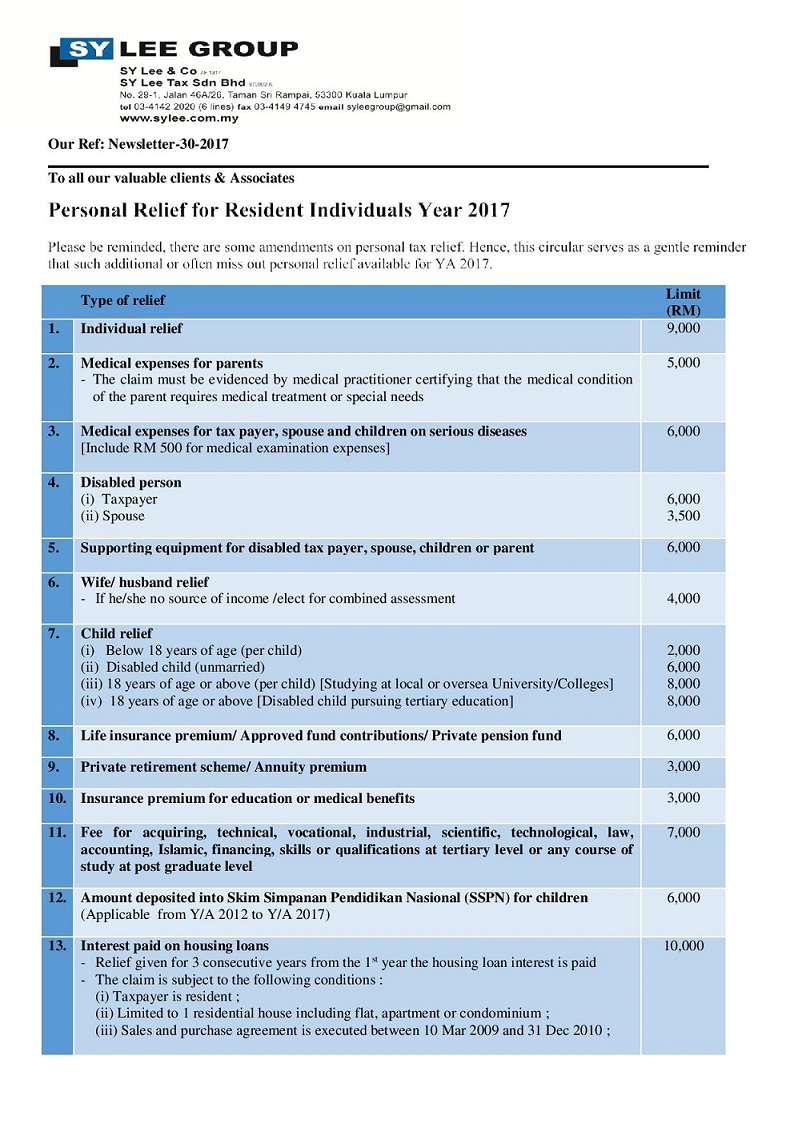

Newsletter-30-2017 -Personal Relief for Resident Individuals 2017

29.Nov.2017

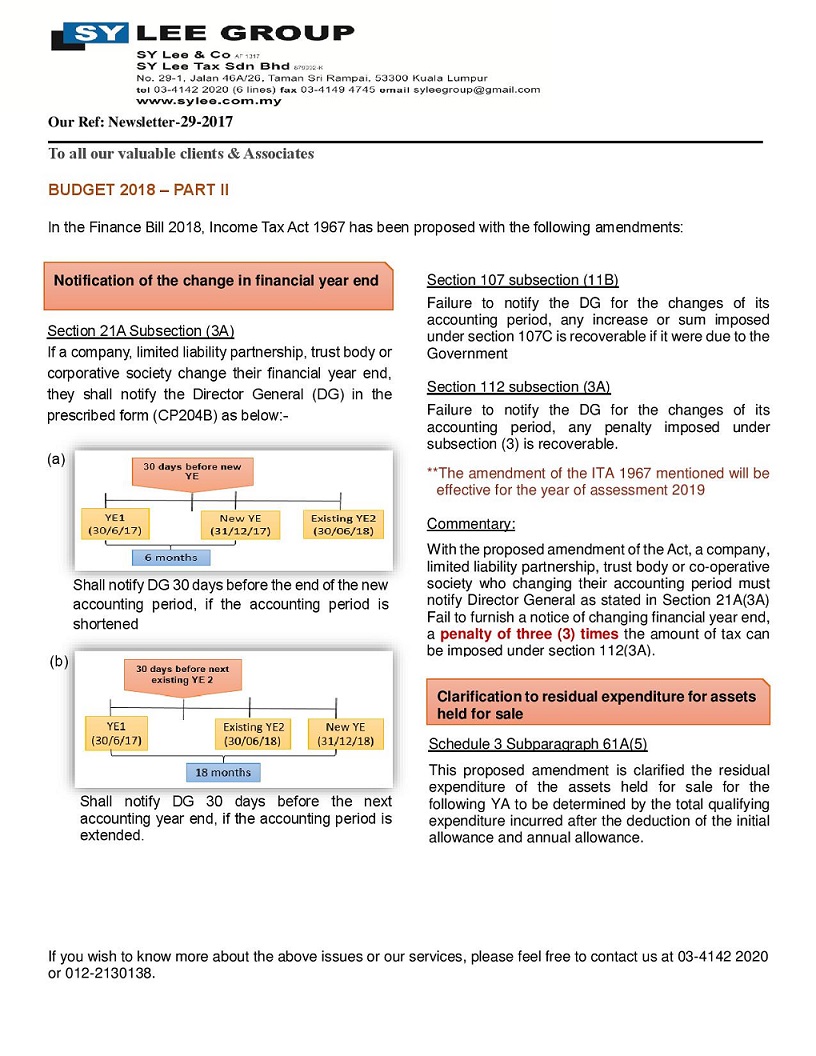

Newsletter-29-2017 -Budget 2018 Part II

01.Nov.2017

Newsletter-28-2017 -Income tax (Exemption) (No 9) Order 2017

26.Oct.2017

Newsletter-27-2017 -WHT on income of a Non-Resident Public Entertainer

17.Oct.2017

Newsletter-25-2017 -Company and Individual Declared Bankruptcy

15.Sep.2017

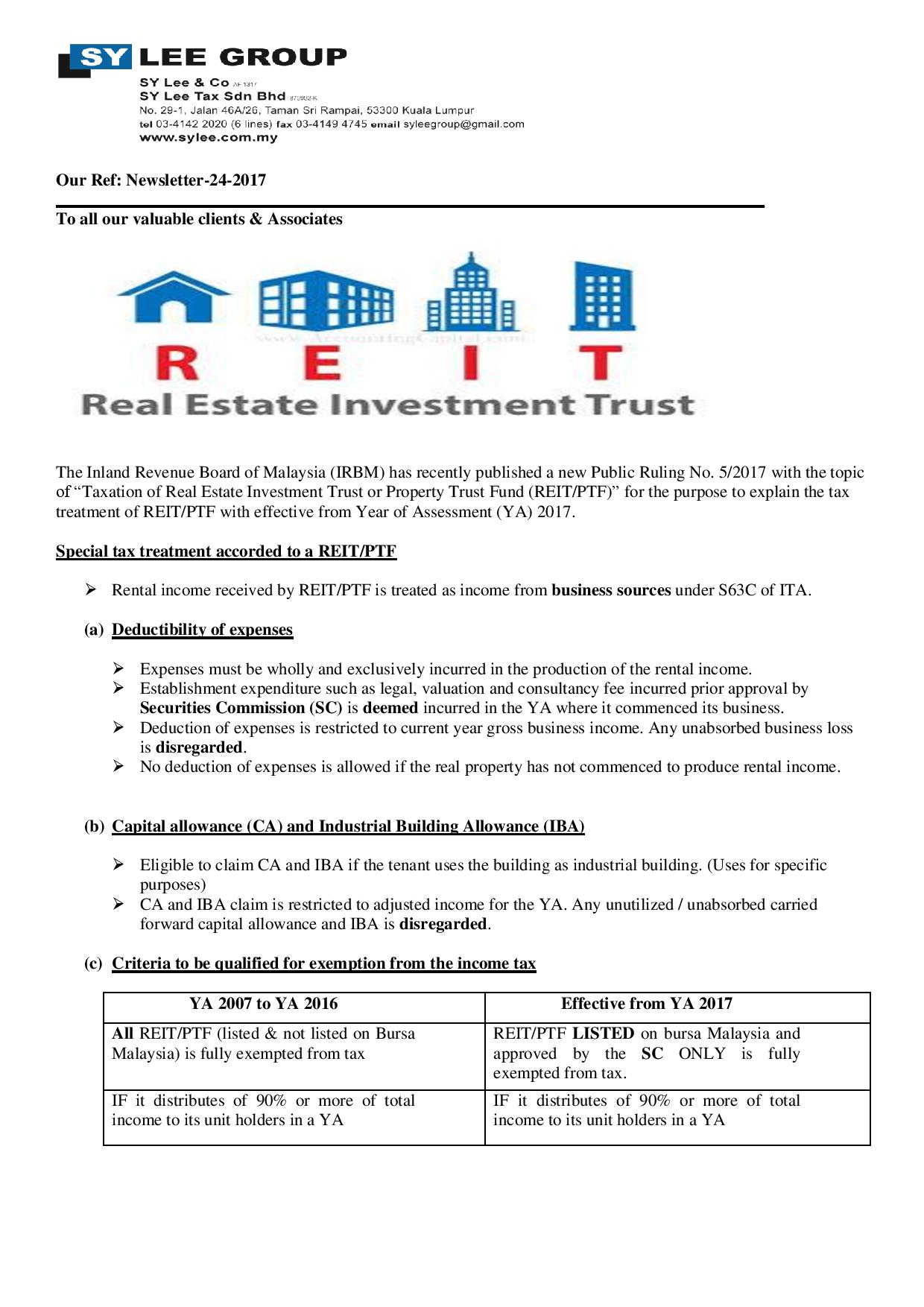

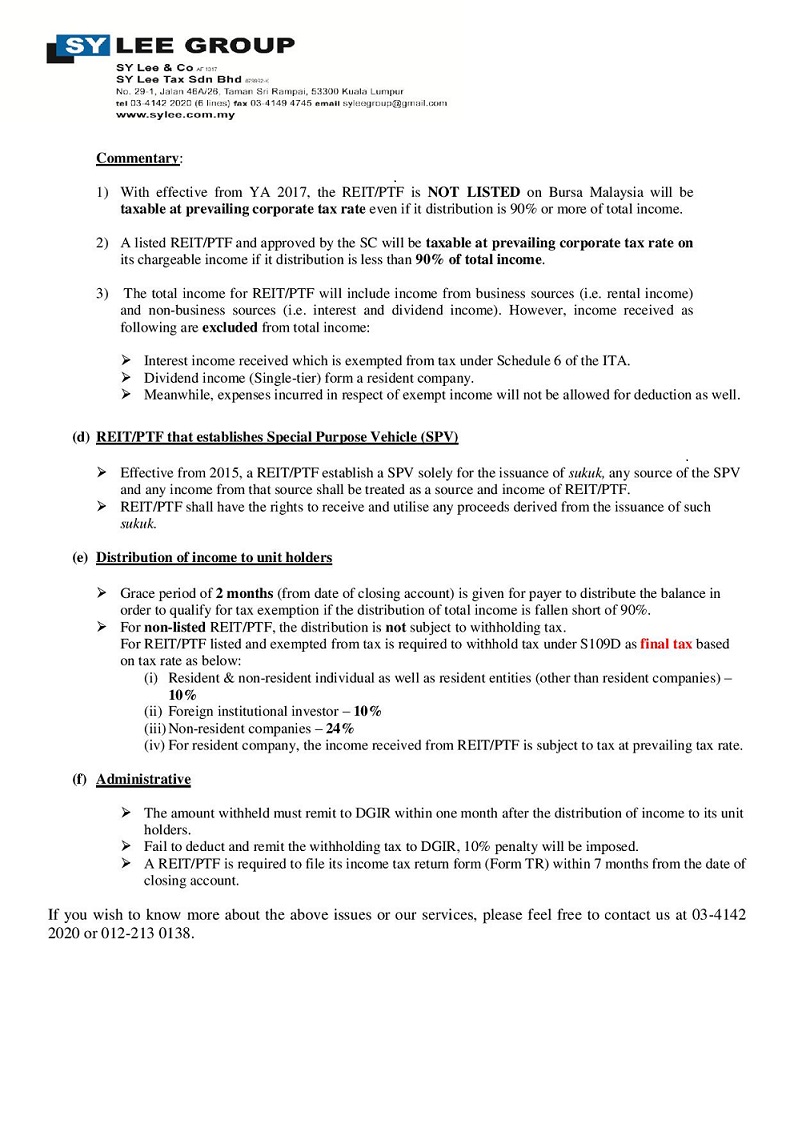

Newsletter-24-2017 -Taxation of Real Estate Investment Trust or Property Trust Fund

15.Sep.2017

Newsletter-23-2017 -Capital Good Adjustment (CGA) And its corresponding Income Tax treatment

15.Sep.2017

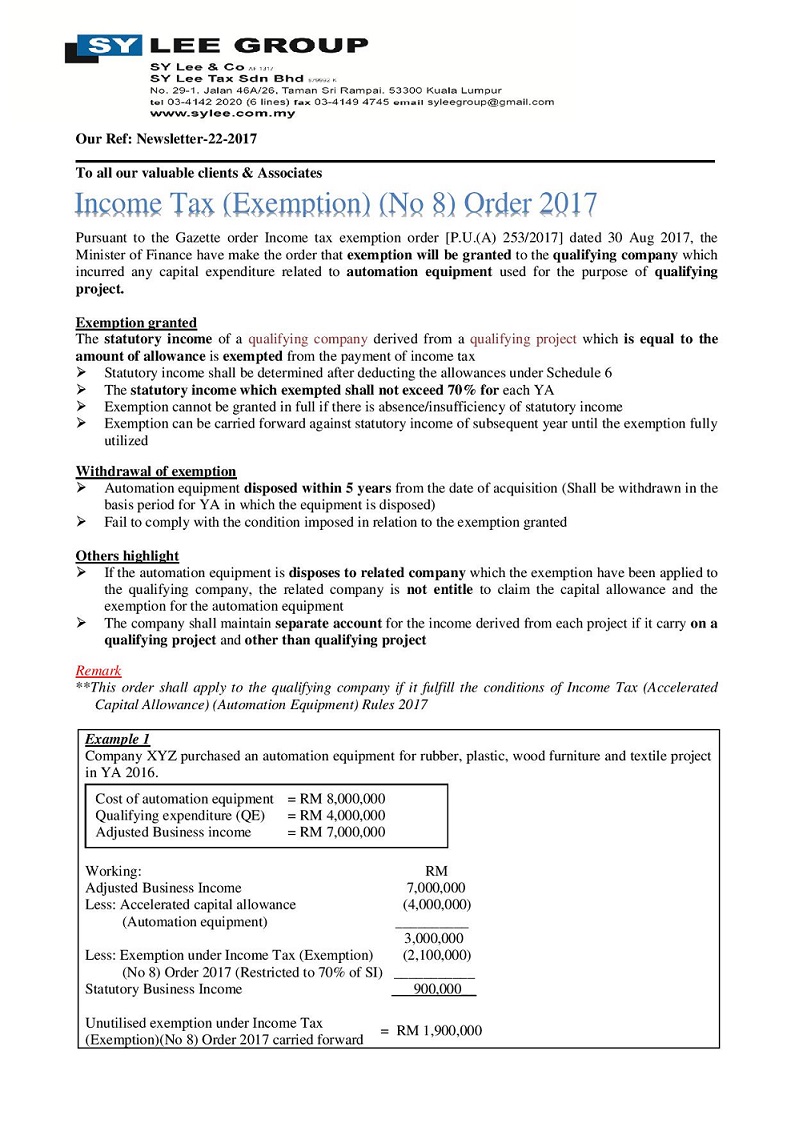

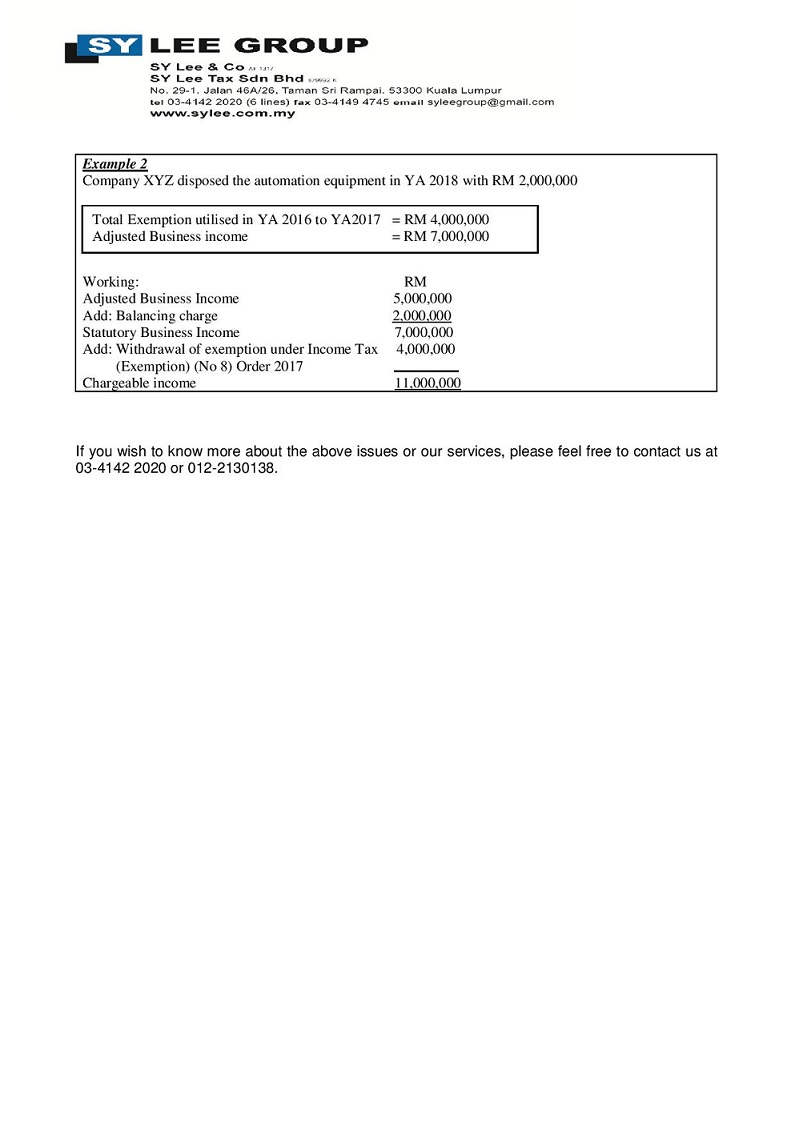

Newsletter-22-2017-Income Tax Exemption Order 2017

13.Sep.2017

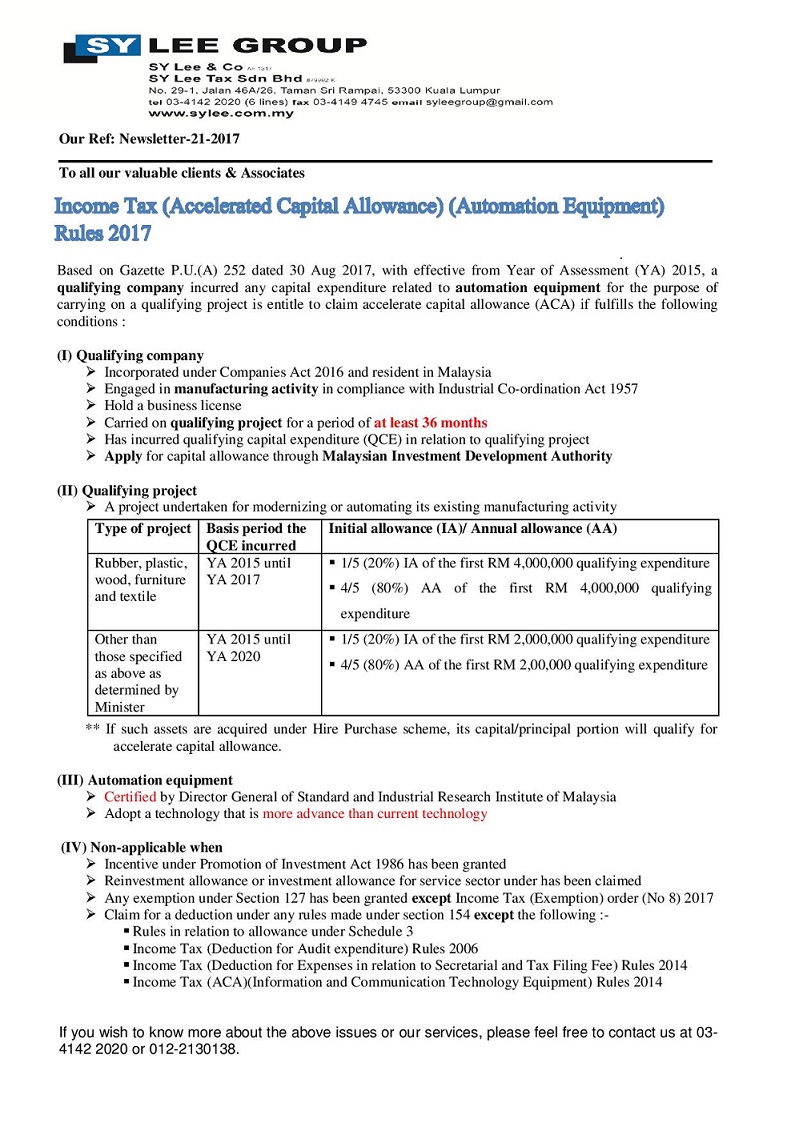

Newsletter-21-2017-ACA Automation Equipment Rule 2017

12.Sep.2017

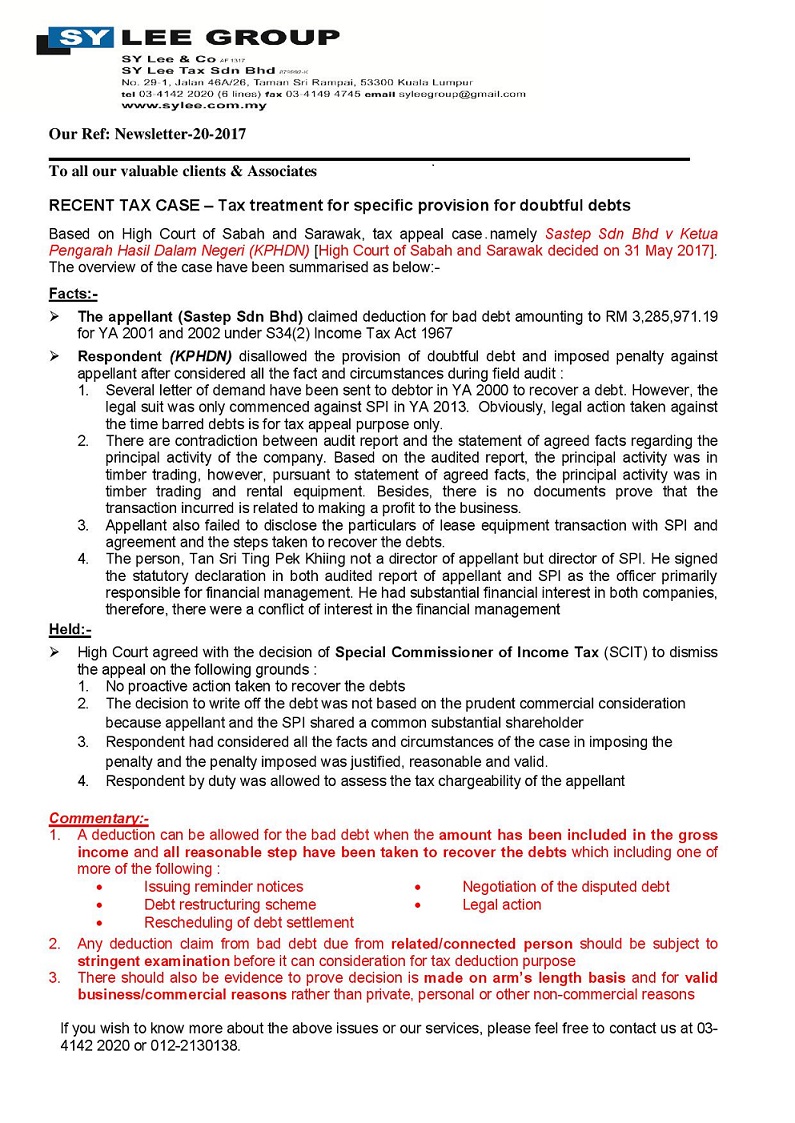

Newsletter-20-2017-Case-Specific Provision for Doubtful Debts

28.Aug.2017

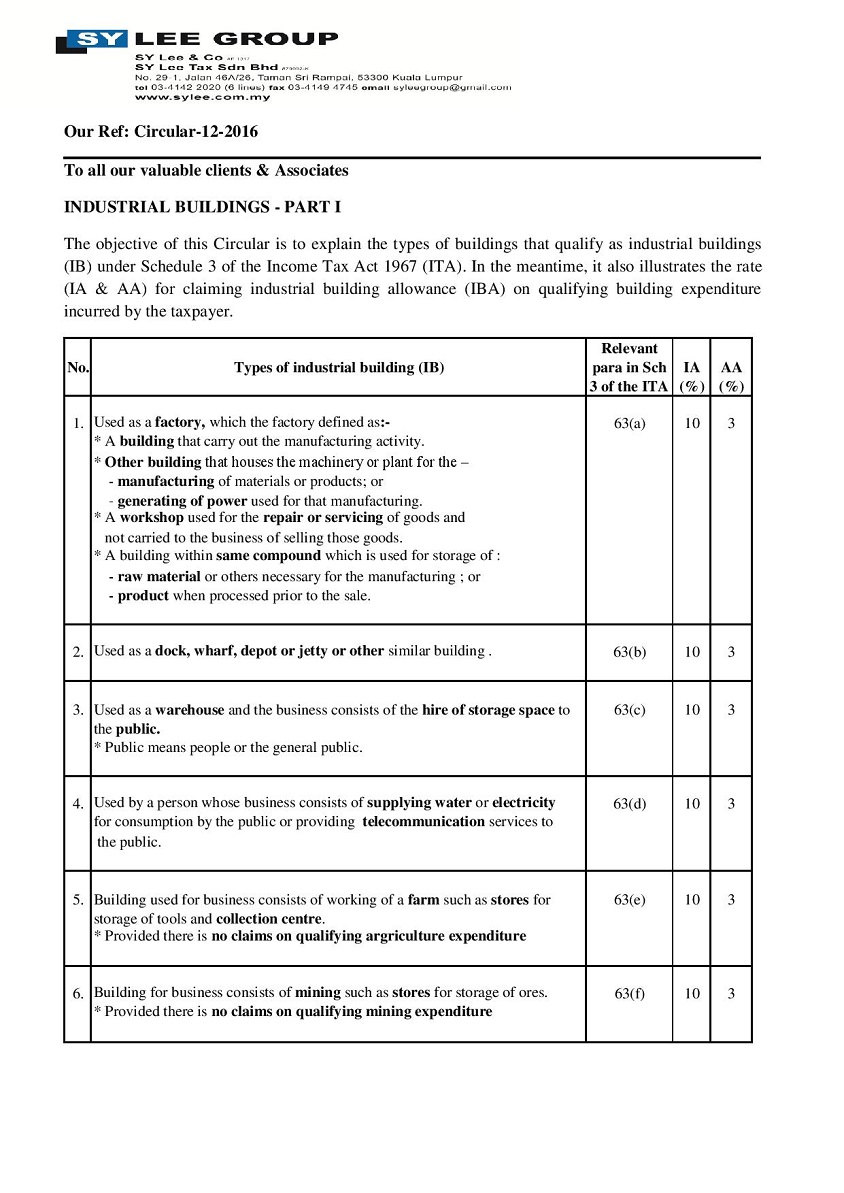

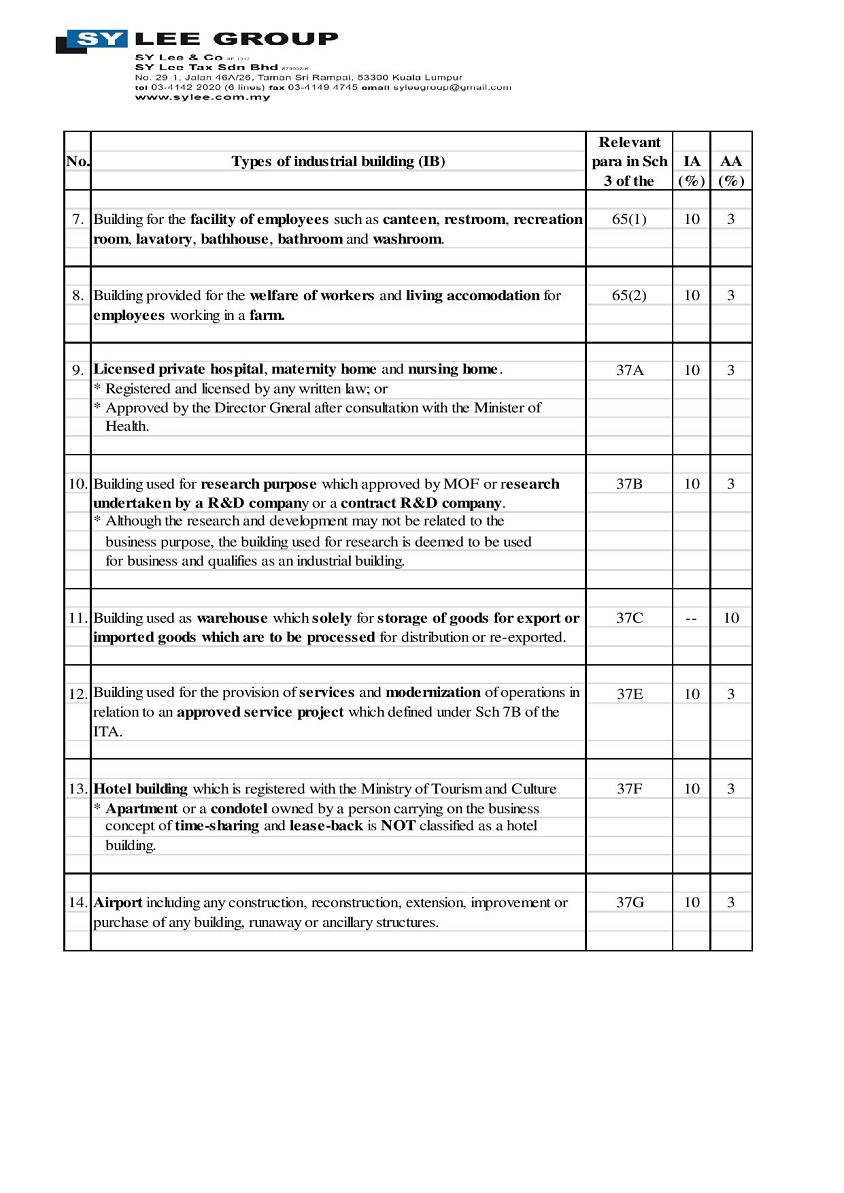

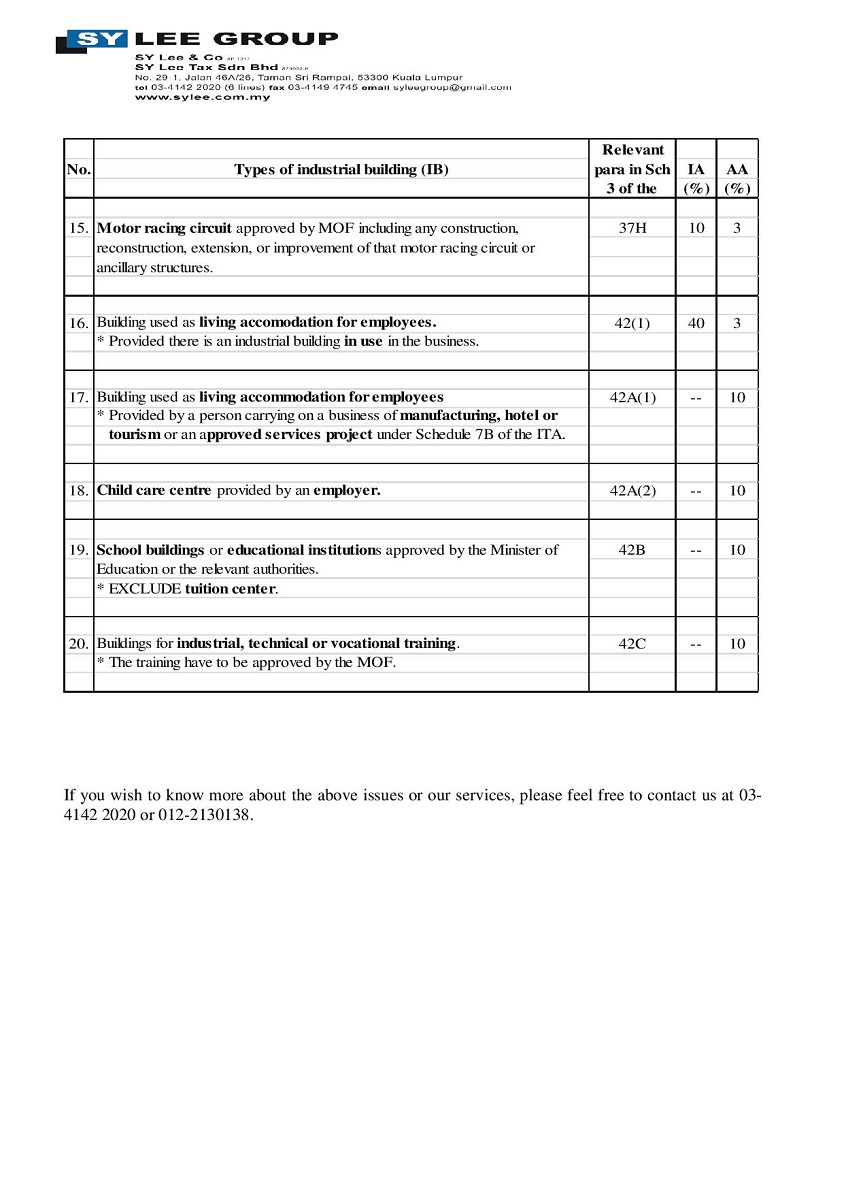

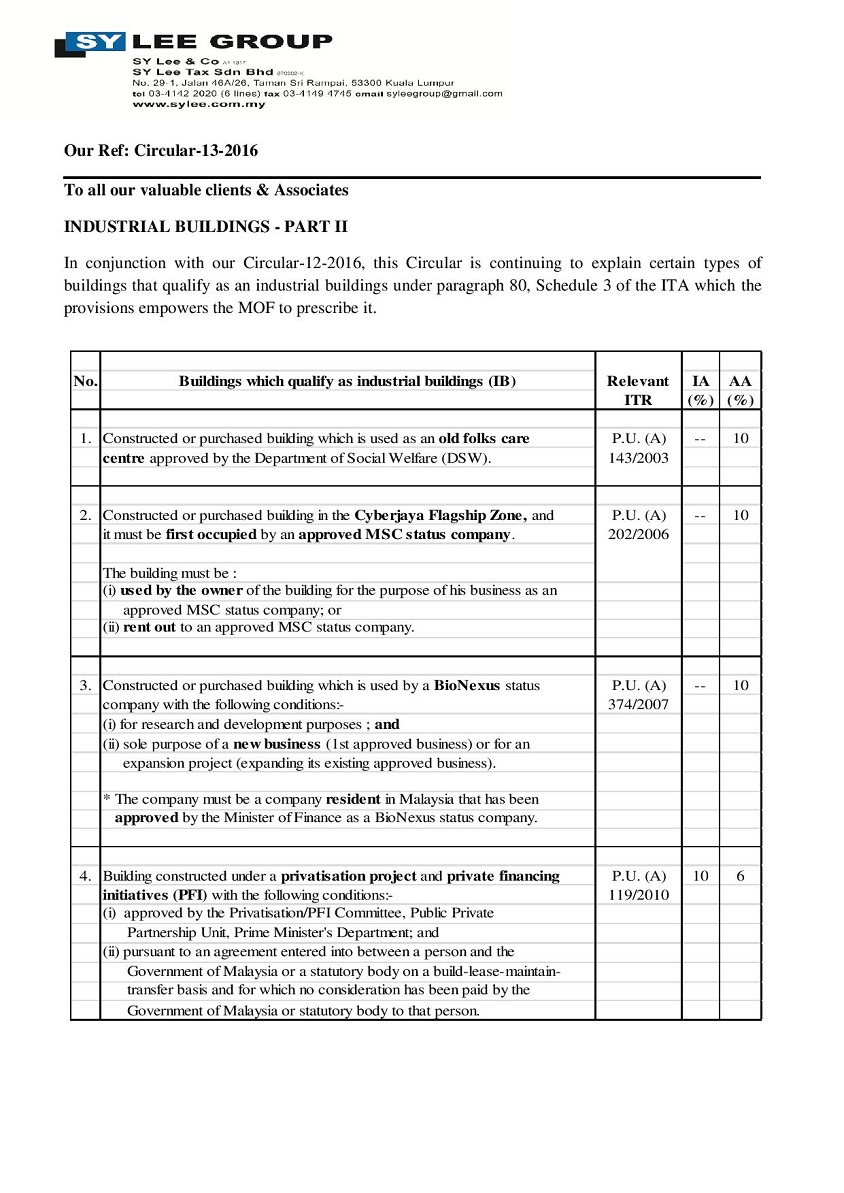

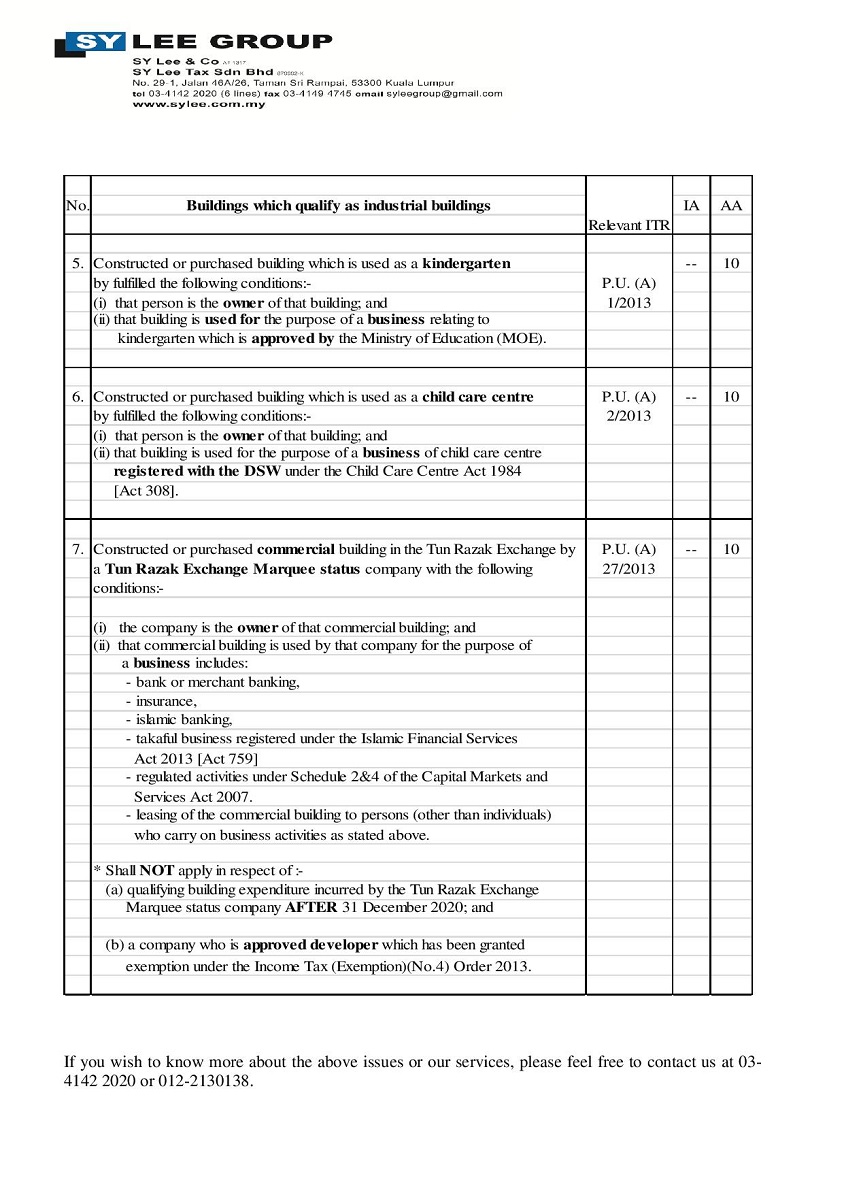

TAX UPDATE - INDUSTRIAL BUILDINGS

13.Dec.2016

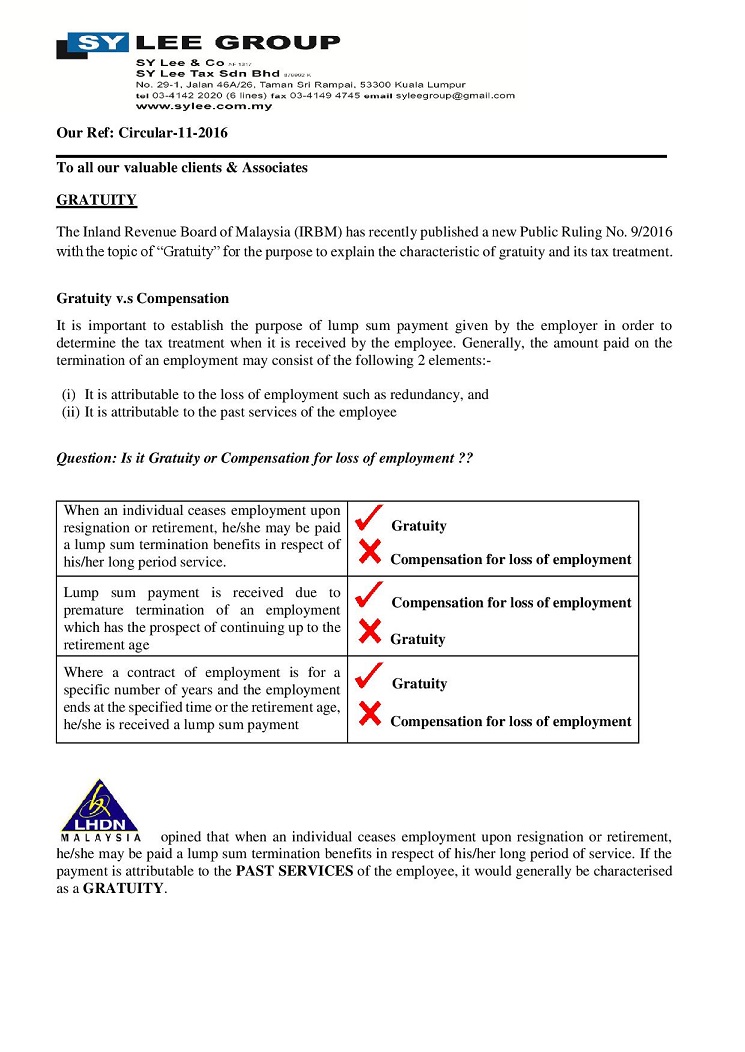

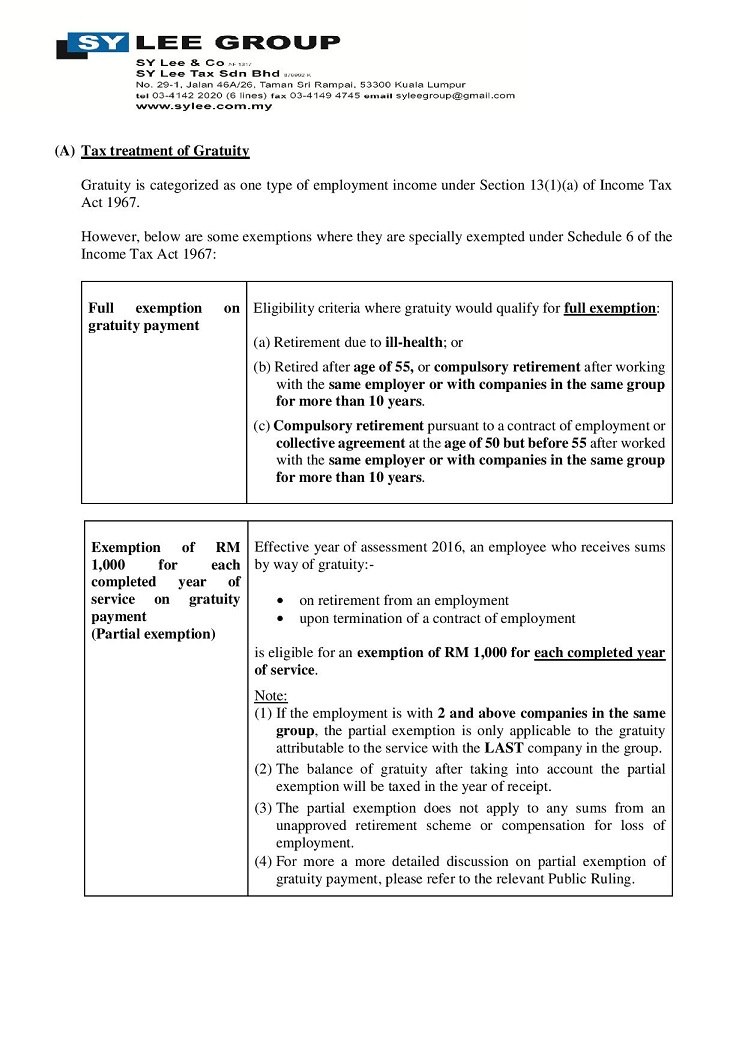

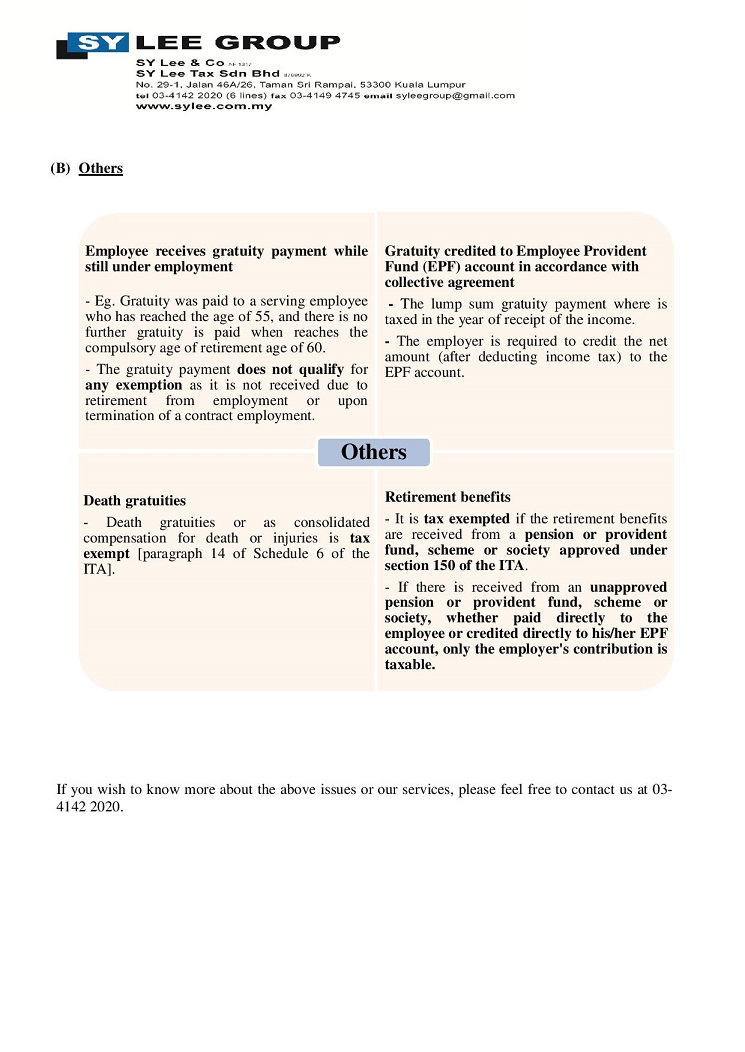

TAX UPDATE - GRATUITY

02.Dec.2016

\

\

(amendment)%20rules%202019-page-001.jpg)

%20%5Bno.8%5D%20order%202019%20-page-001.jpg)

%20for%20ya%202019-page-001.jpg)

%20%5Bno.3%5D-page-001.jpg)

%20%5Bno.4%5D-page-001.jpg)

-page-001.jpg)

-page-002.jpg)

%20order%202017-page-001.jpg)

%20guidelines-page-001.jpg)

%20(ict%20equipment)%20rules%202018-page-001.jpg)

%20order%202018%20-%20shipping%20activities-page-001.jpg)

-page-001.jpg)

(no%209)%20order%202017-page-001.jpg)

(no%209)%20order%202017-page-001.jpg)

(no%209)%20order%202017-page-002.jpg)

%20and%20its%20corresponding%20income%20tax%20treatment-page-001.jpg)

%20and%20its%20corresponding%20income%20tax%20treatment-page-002.jpg)

%20and%20its%20corresponding%20income%20tax%20treatment-page-003.jpg)