GST

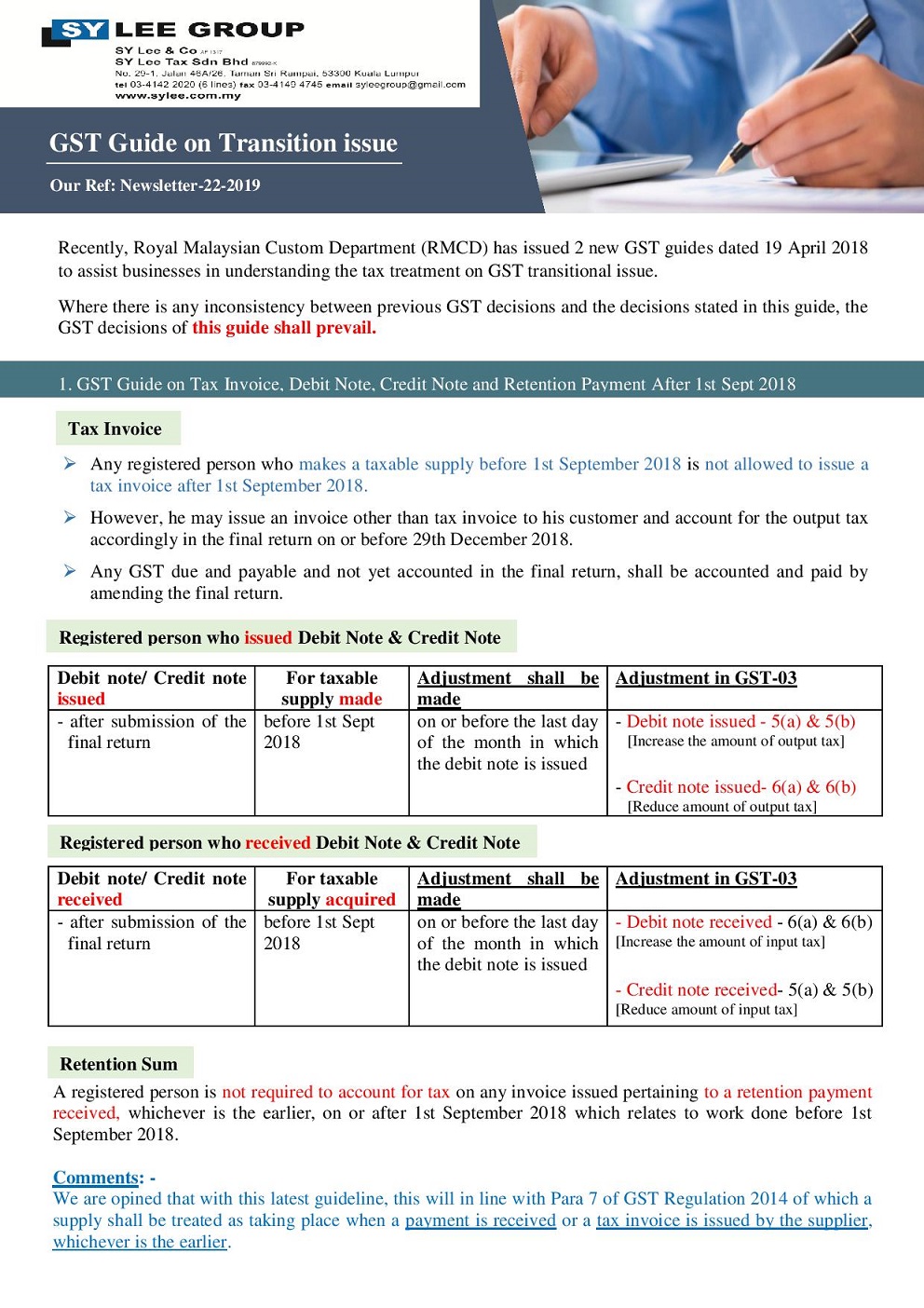

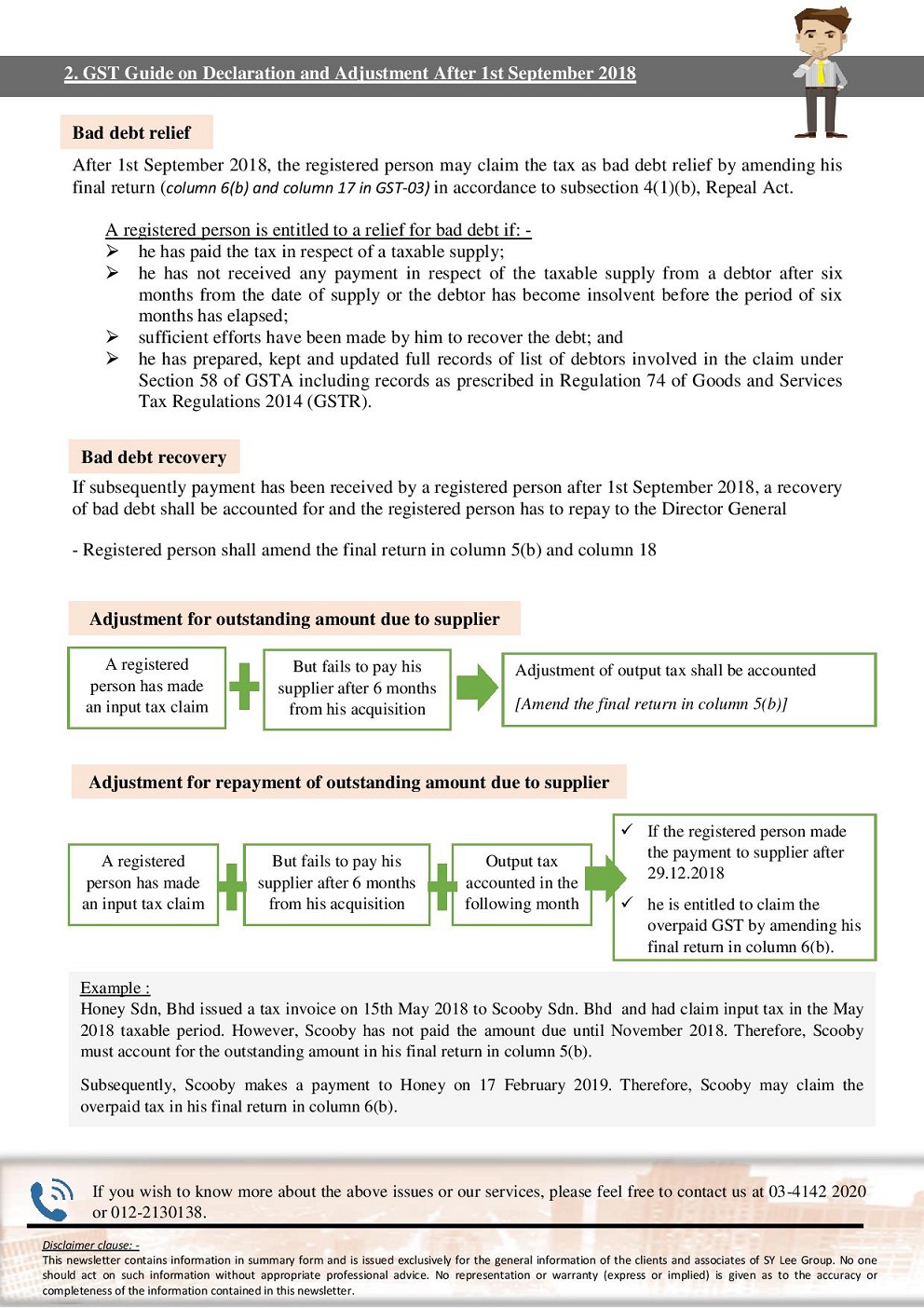

Newsletter-22-2019-GST Guide on Transition Issue

30.Apr.2019

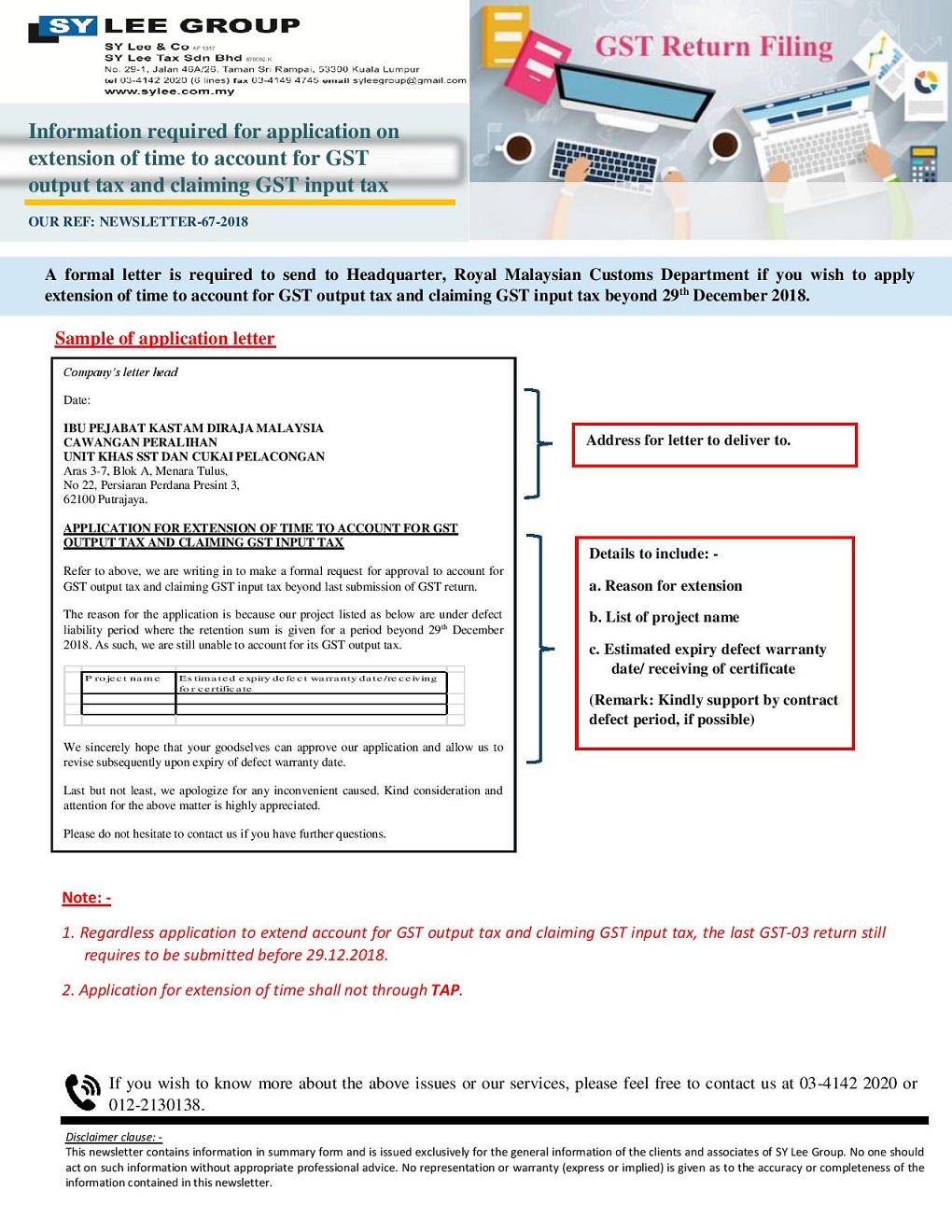

Newsletter-67-2018-Information required for extension to account for GST output tax

28.Dec.2018

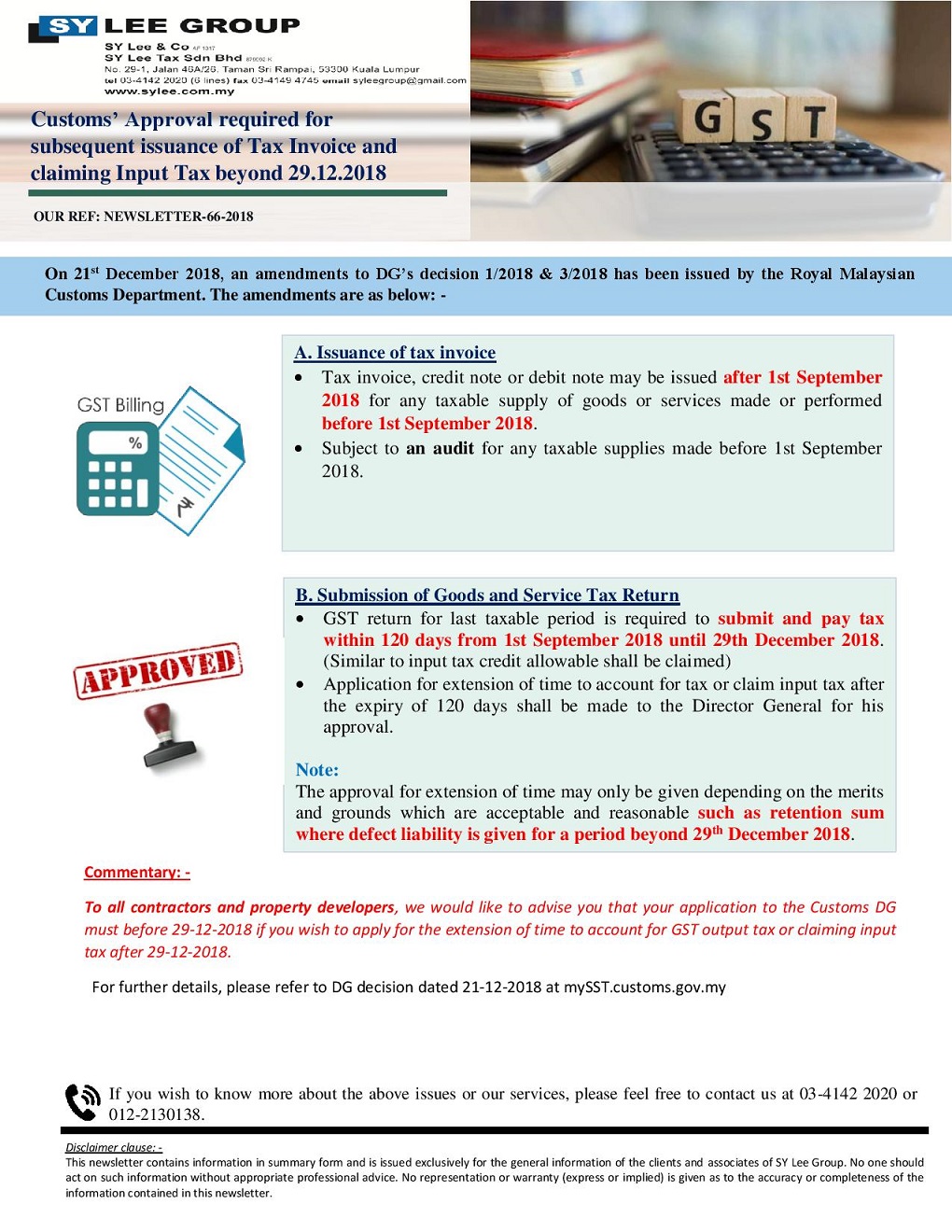

Newsletter-66-2018-Customs' Approval required for Issuance Tax Invoice beyond 29-12-2018

26.Dec.2018

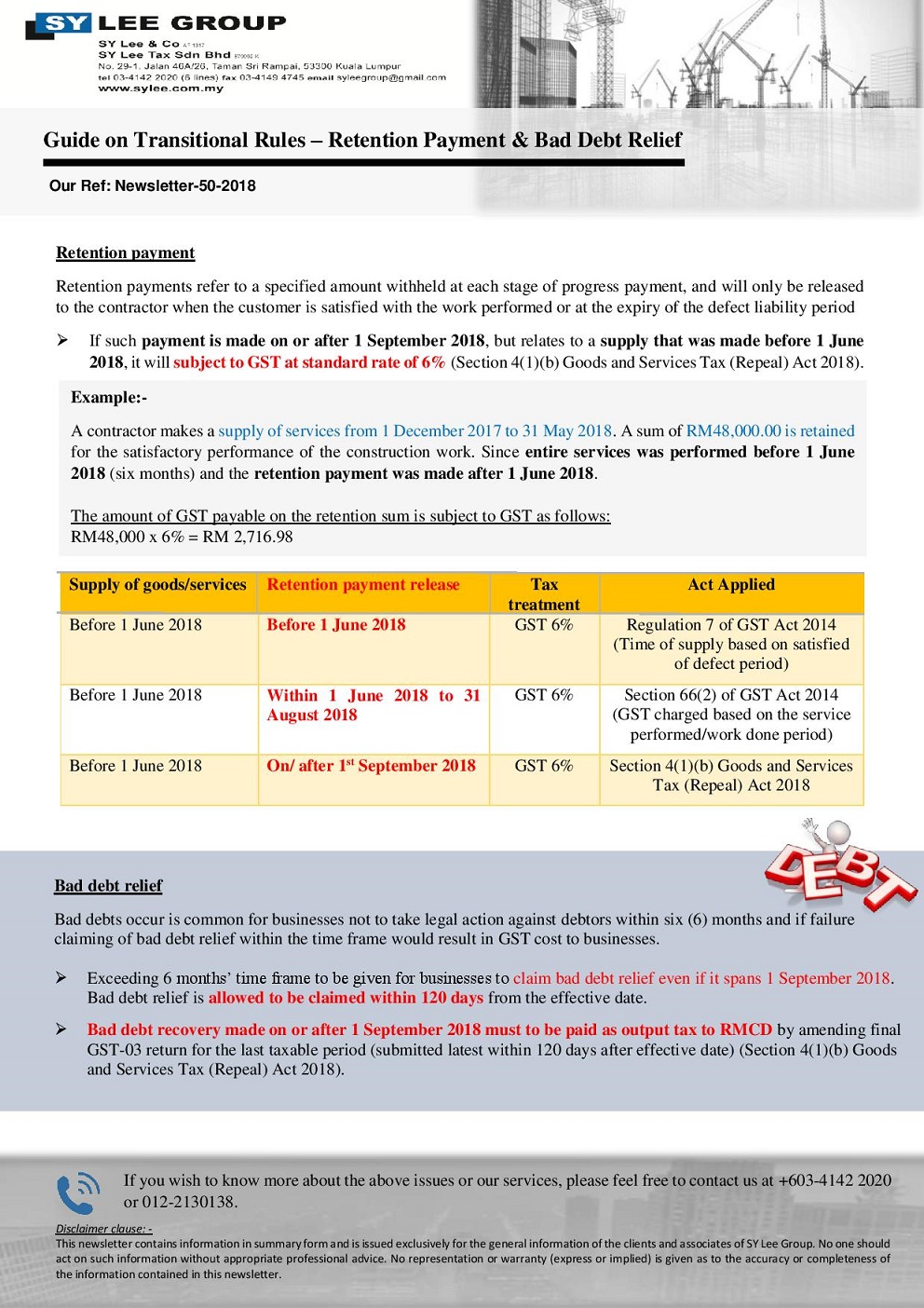

Newsletter-50-2018-Guide on Transitional Rules – Retention Payment & Bad Debt Relief

04.Sep.2018

Newsletter-38-2018 - GST (Repeal) Bill 2018

08.Aug.2018

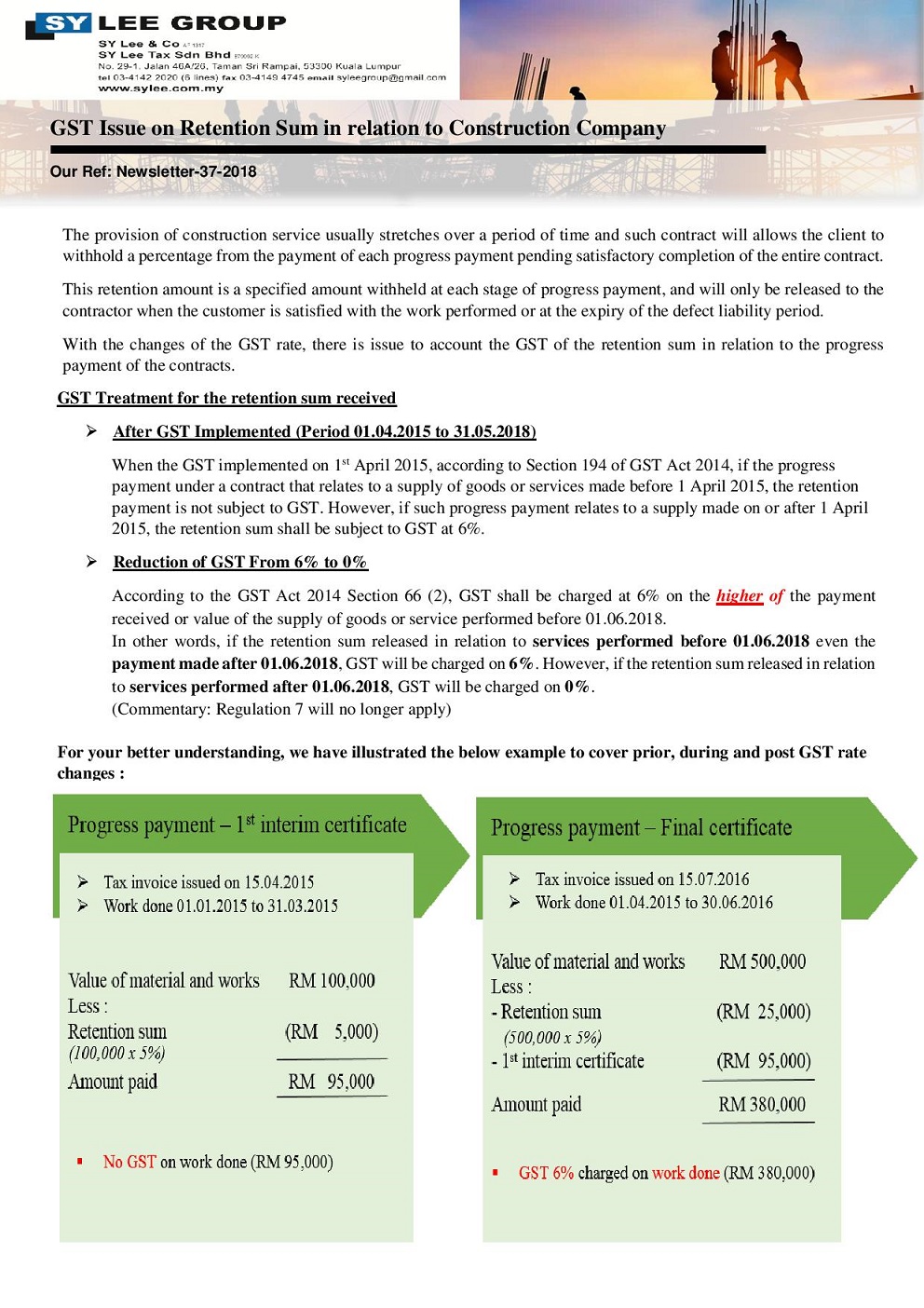

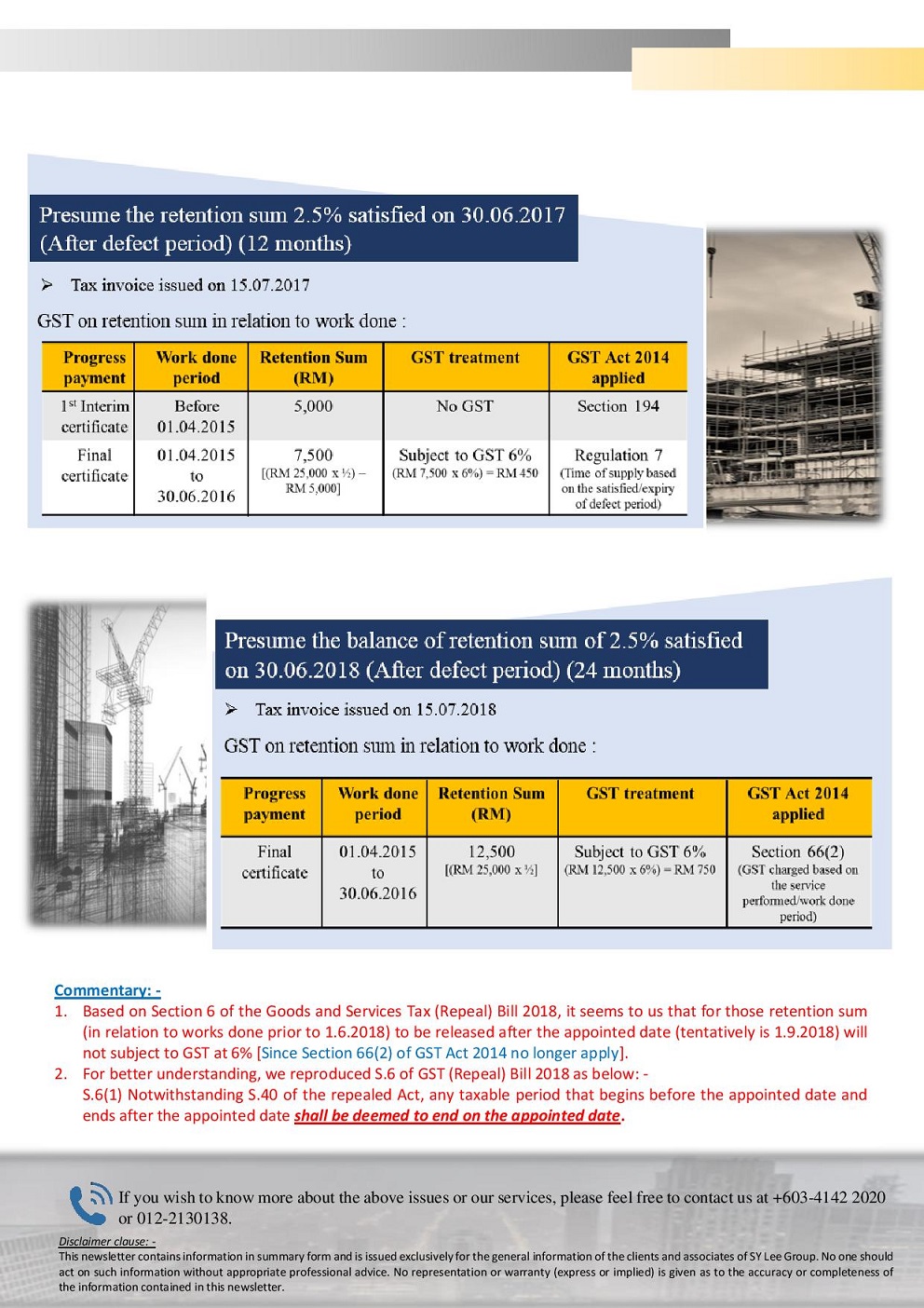

Newsletter-37-2018 - GST issue on retention sum of construction company

31.Jul.2018

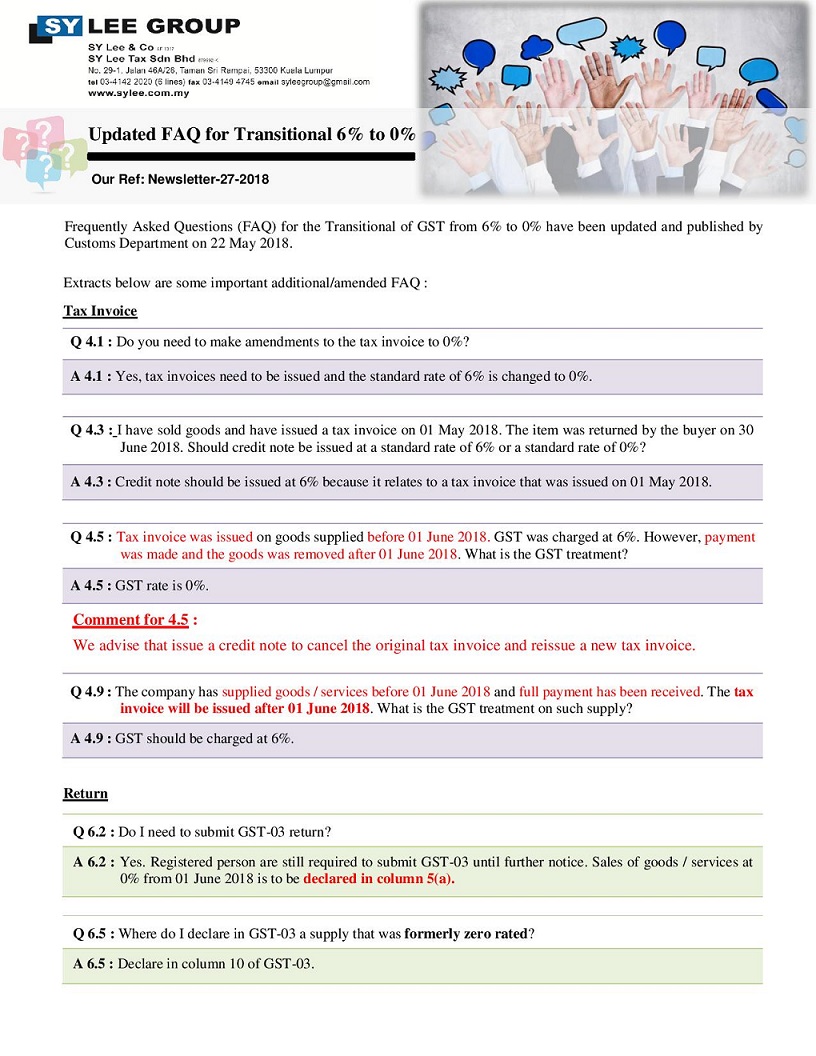

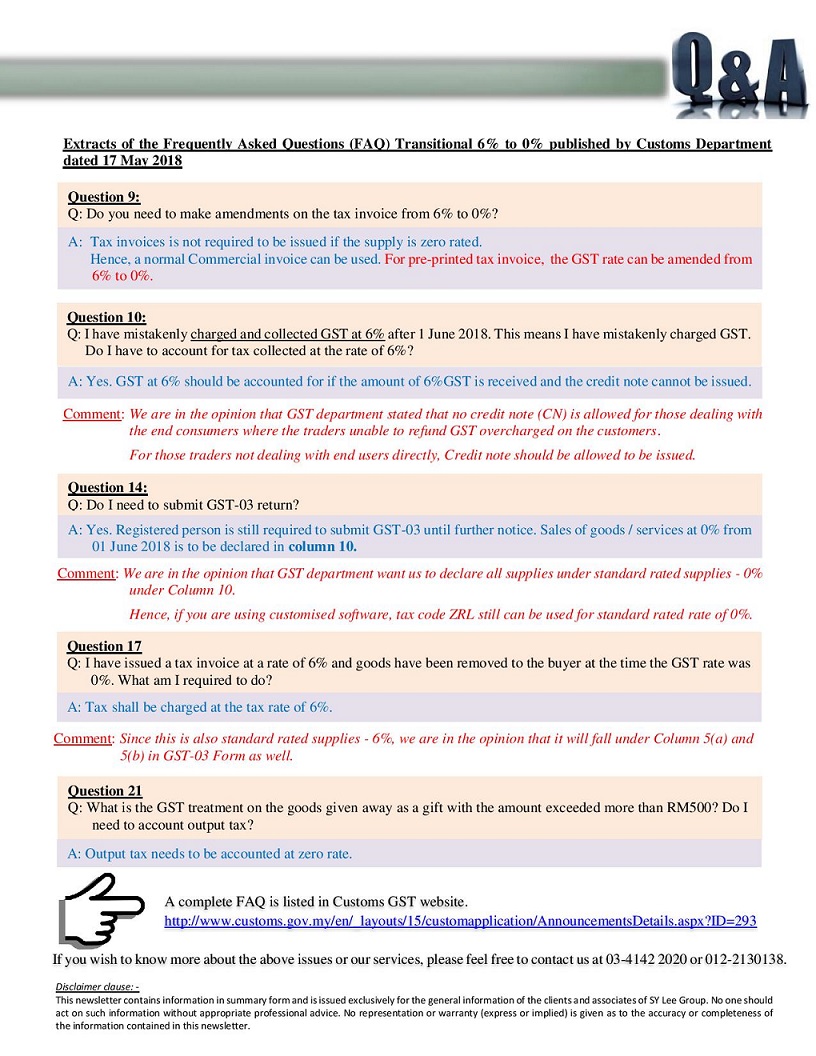

Newsletter-31-2018 - Updated FAQ for Transitional 6 to 0 (30.05.2018) (Part III)

04.Jun.2018

Newsletter-28-2018 Updated FAQ for transitional 6% to 0% (25.05.2018)(Part II) & Newsletter-29-2018 - Tax Investigation Framework

28.May.2018

Newsletter-27-2018 - Updated FAQ for Transitional 6% to 0%

23.May.2018

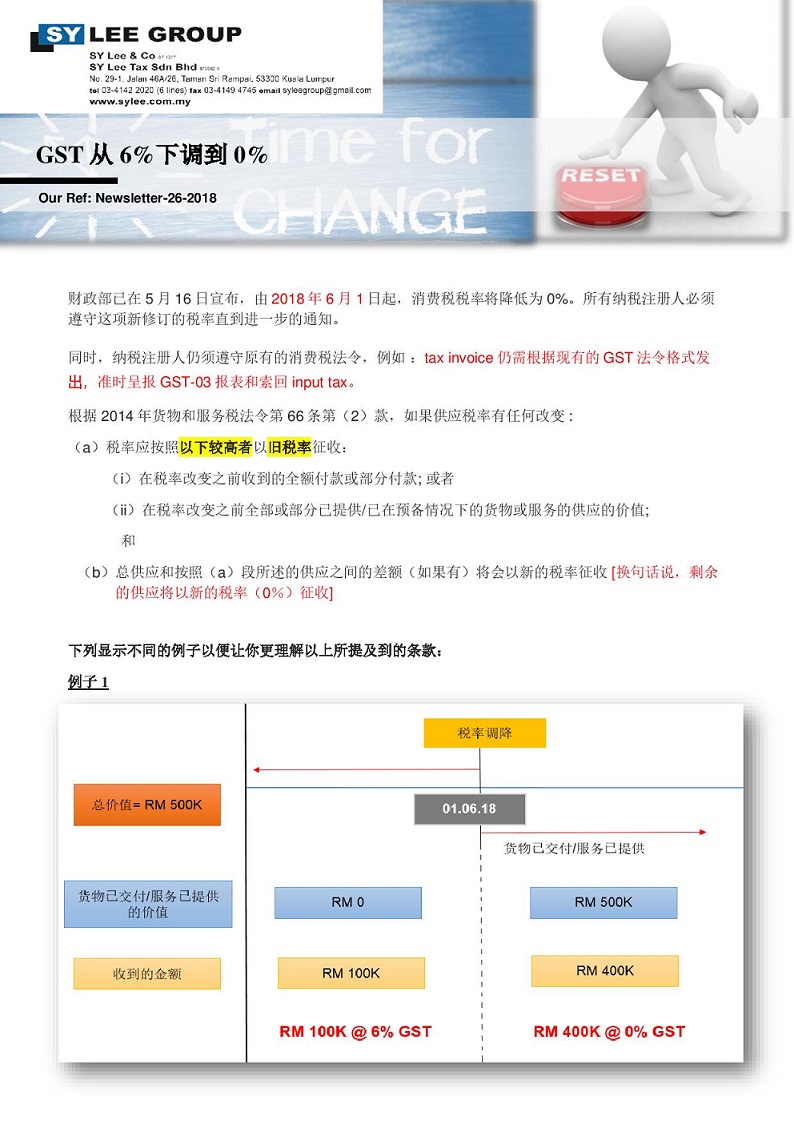

Newsletter-26-2018 - Reduction GST Tax Rate to 0% (Mandarin edition)

19.May.2018

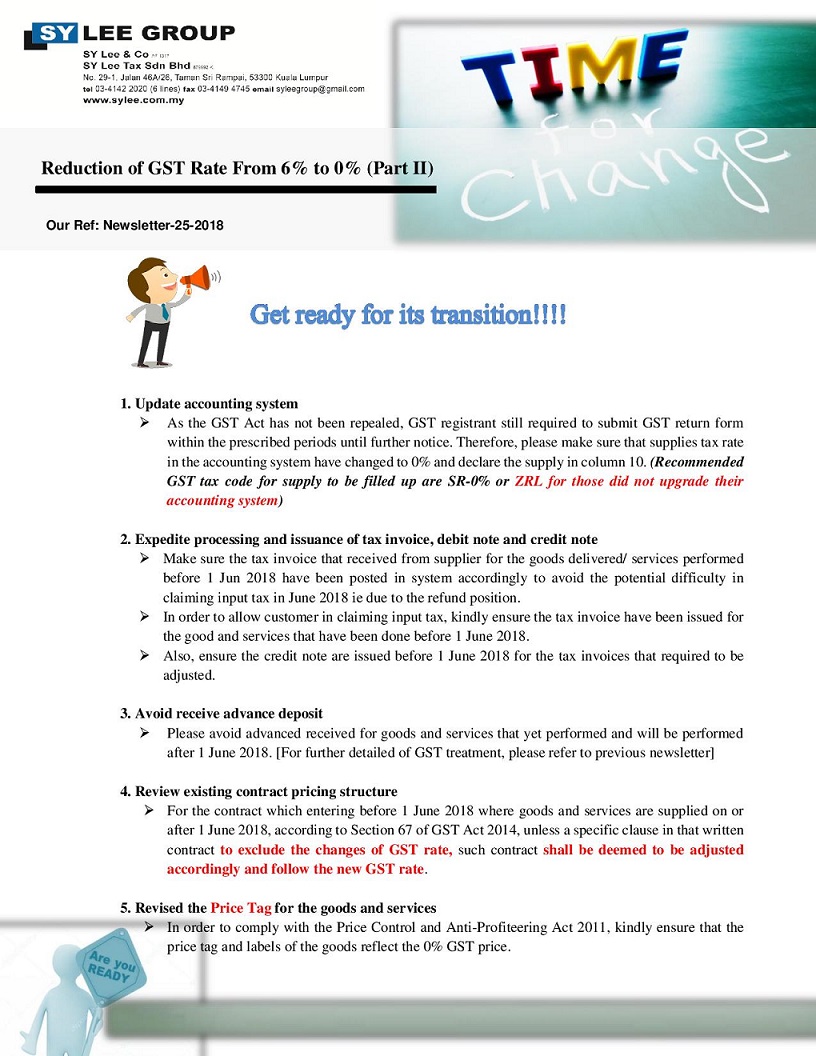

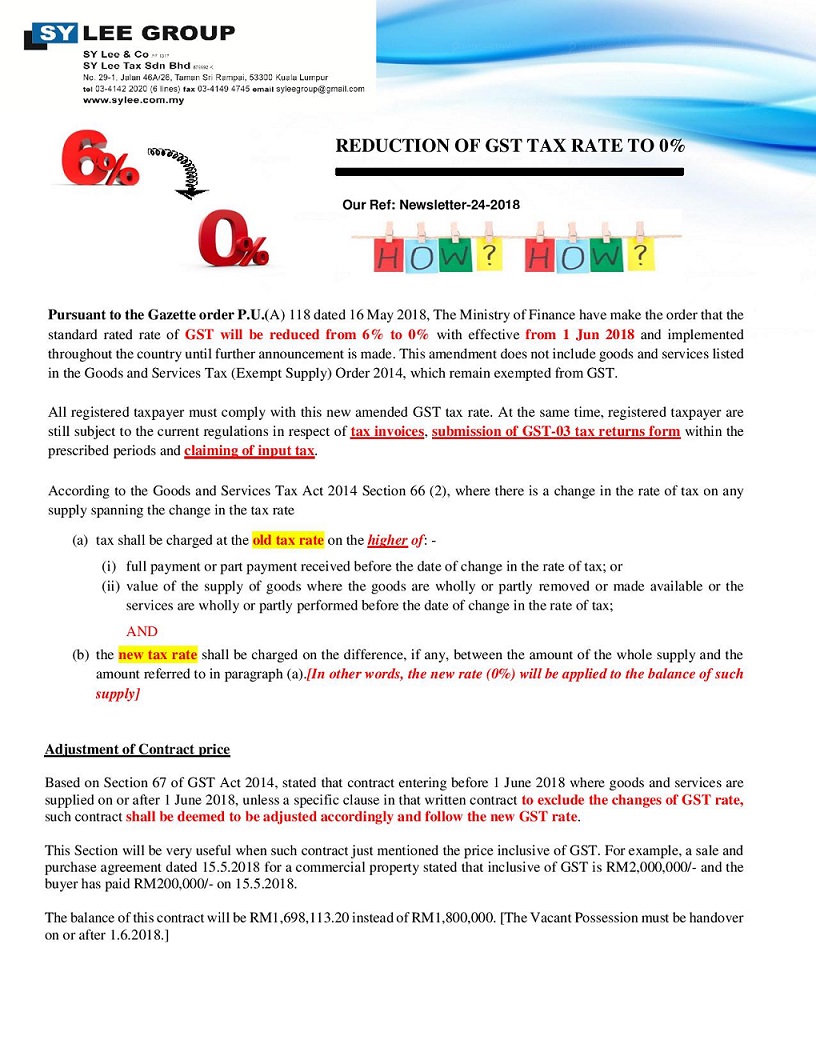

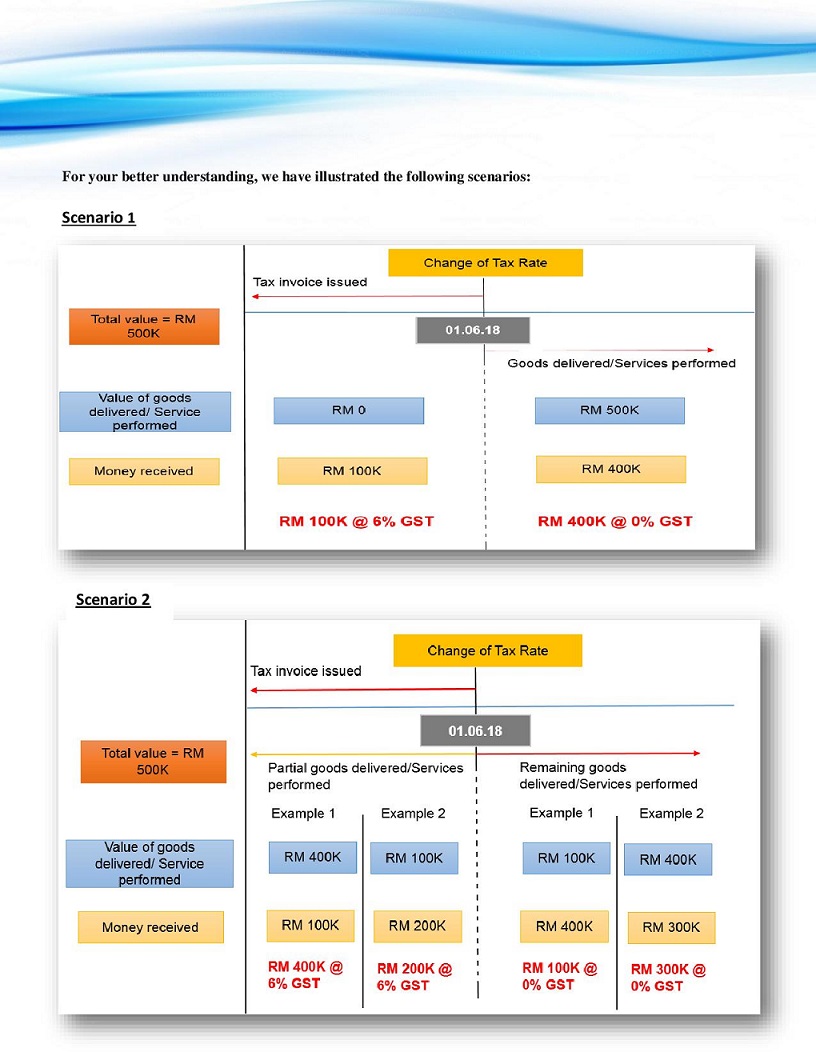

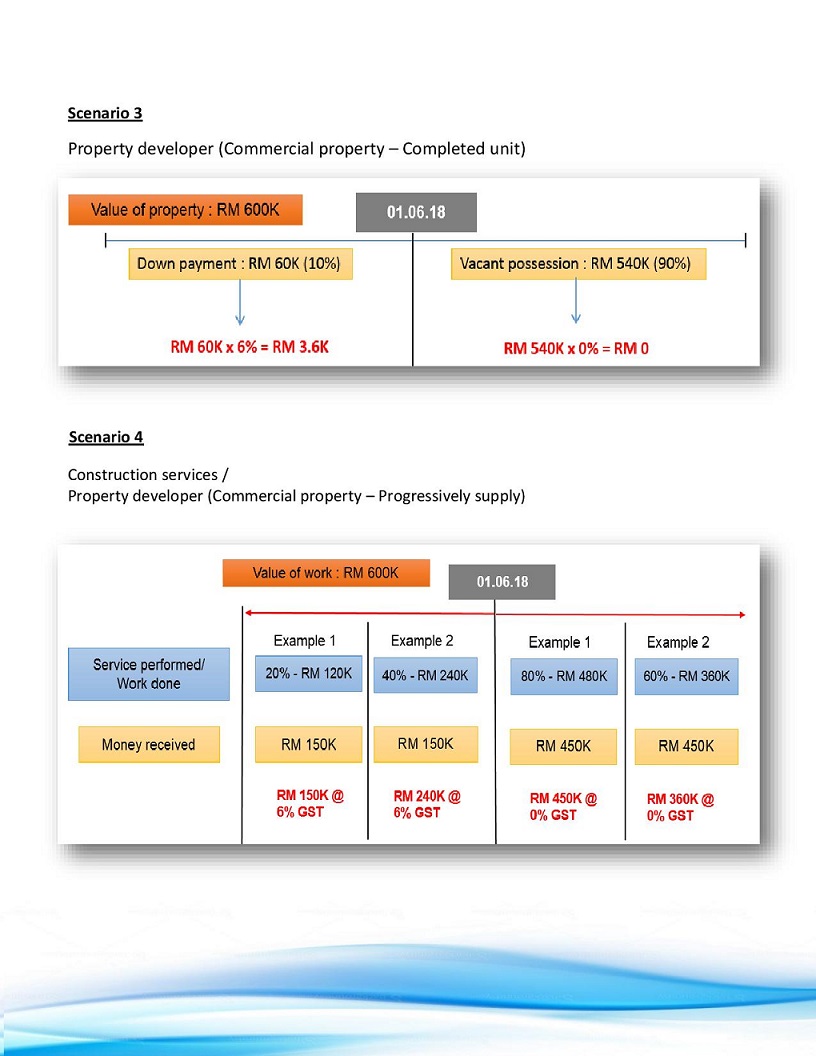

Newsletter-25-2018 - Reduction GST Tax Rate to 0% Part II

19.May.2018

Newsletter-24-2018 - Reduction of GST Tax Rate to 0%

17.May.2018

Newsletter-23-2018- GST still need to submit and pay

14.May.2018

Newsletter-22-2018- GST Treatment in Designated Areas

14.May.2018

Newsletter-18-2018- Remission of late payment penalty under Section 62(2) of Goods & Services Tax Act 2014

03.Apr.2018

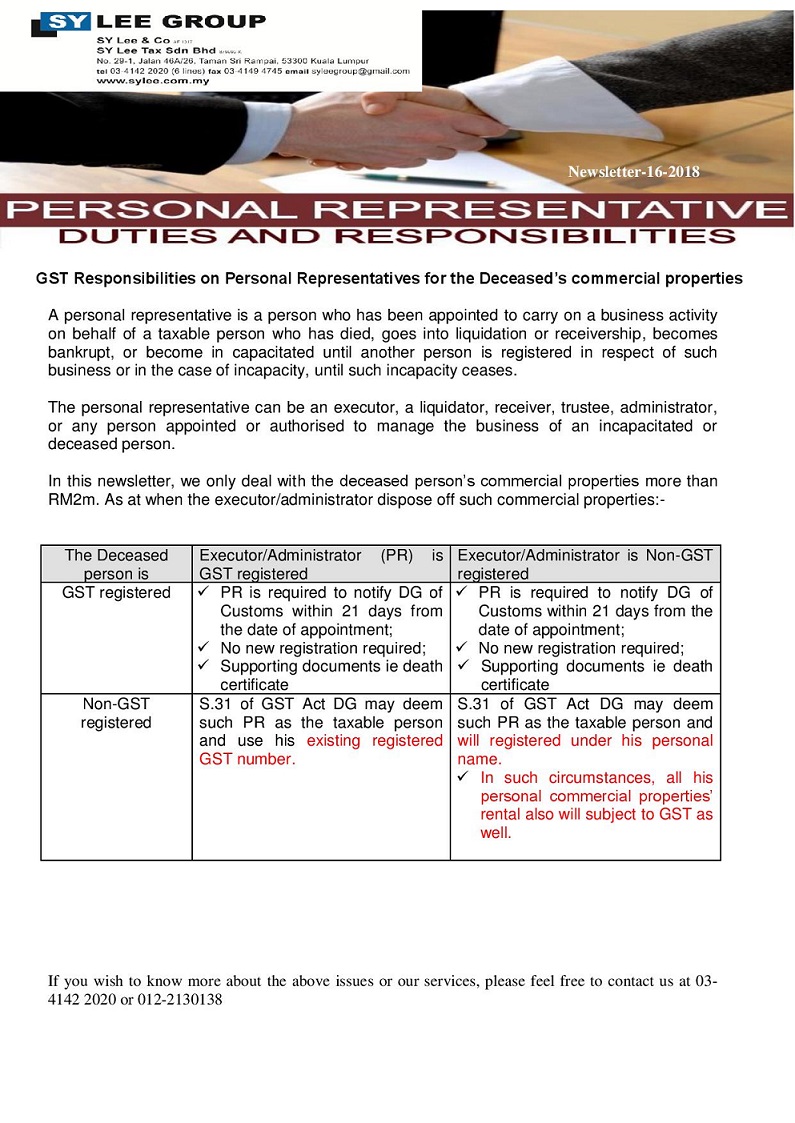

Newsletter-16-2018- GST responsibilities for Personal Representatives in the deceased estate

30.Mar.2018

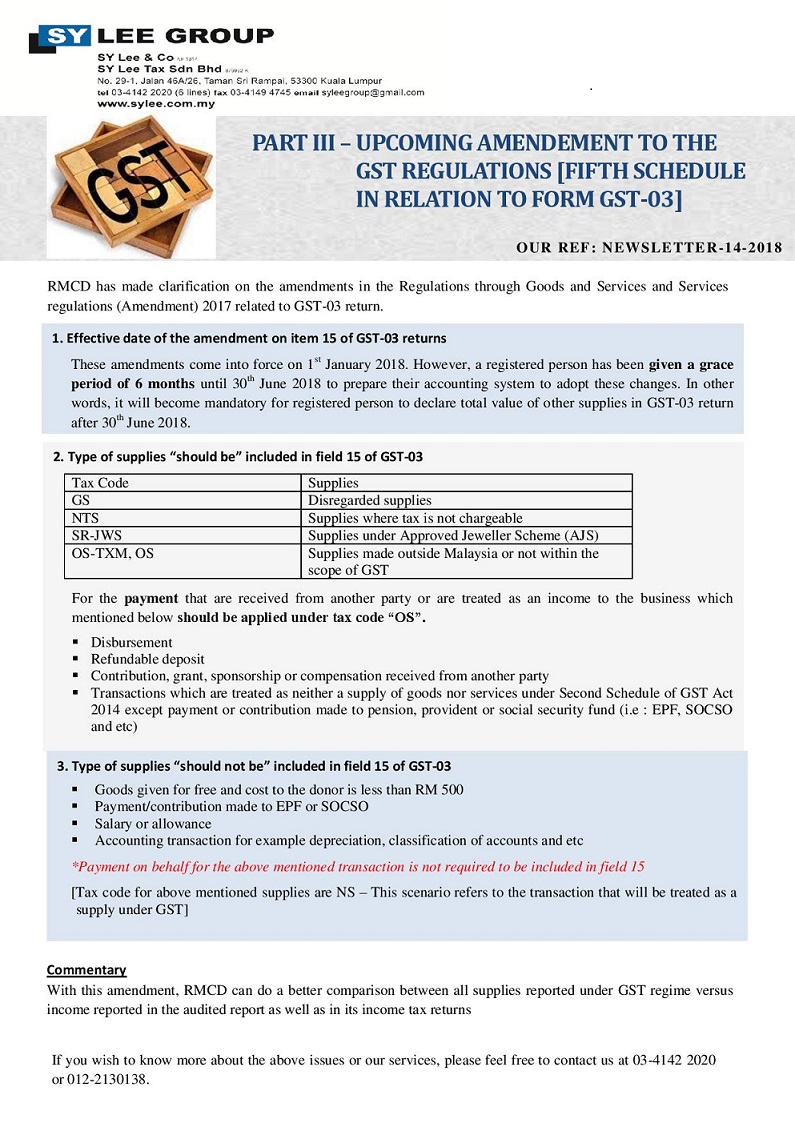

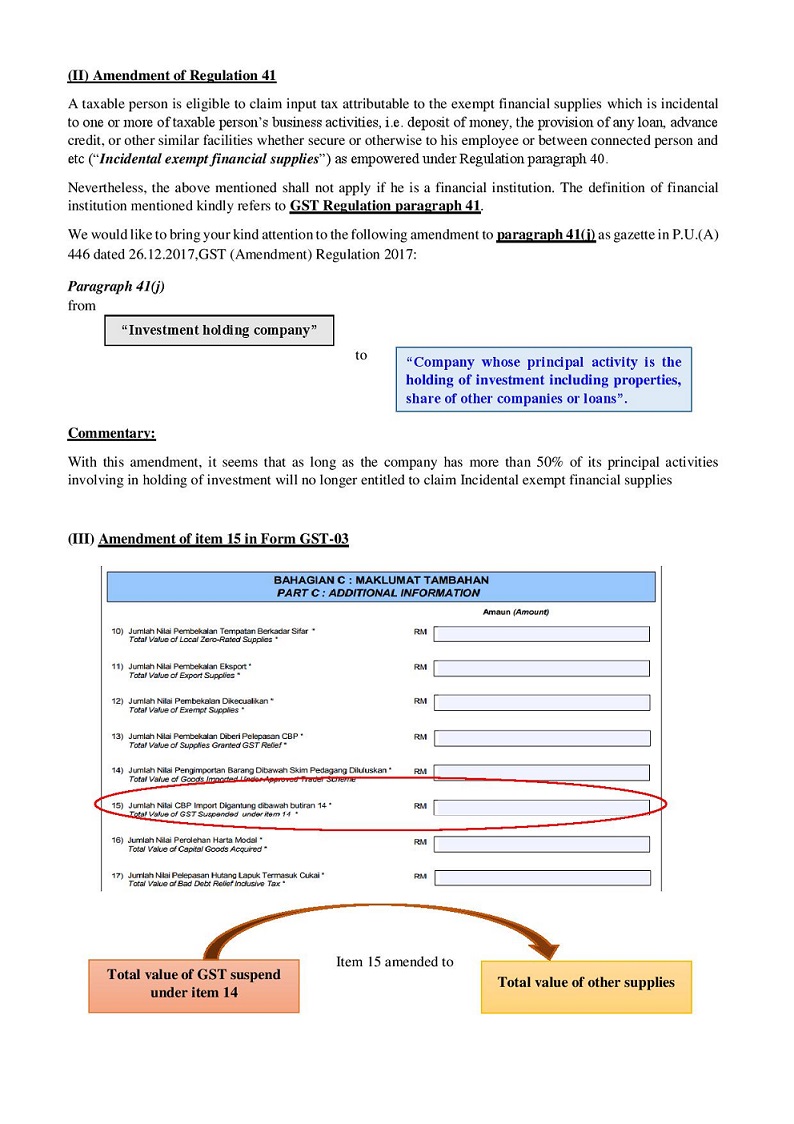

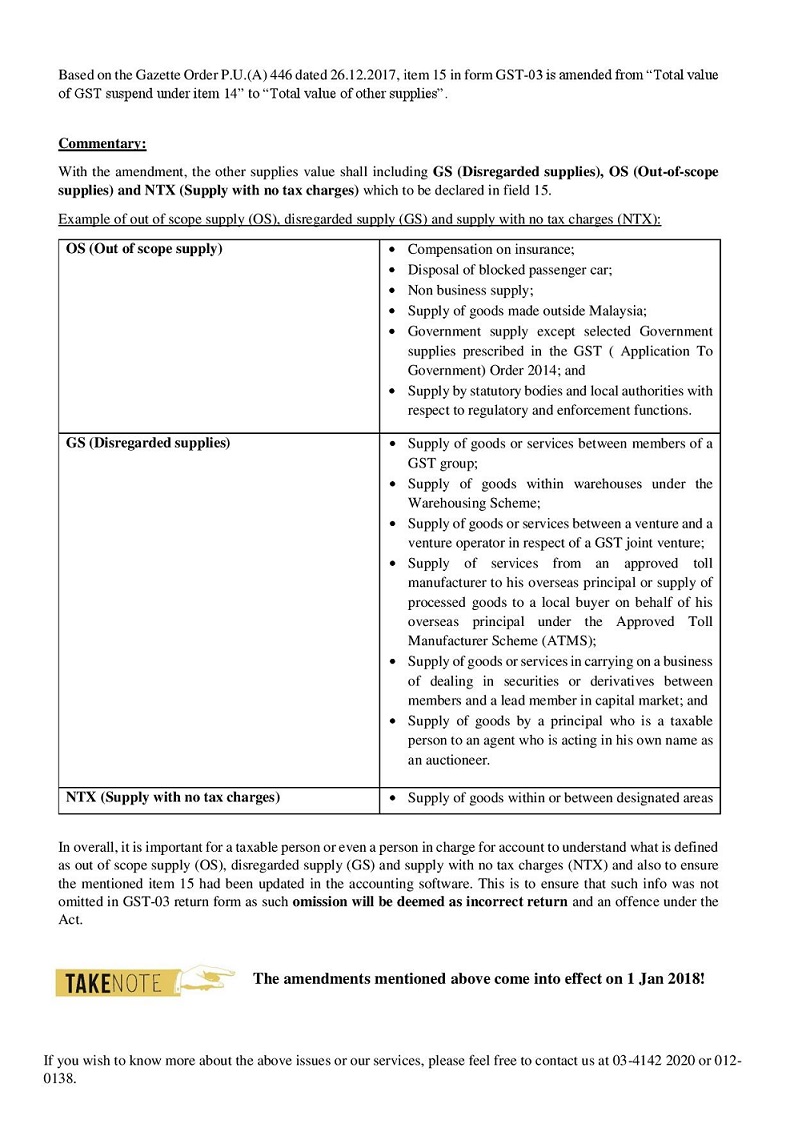

Newsletter-14-2018- Part III Upcoming Amendment to the GST Regulations [Fifth Schedule in relations to Form GST-03]

12.Mar.2018

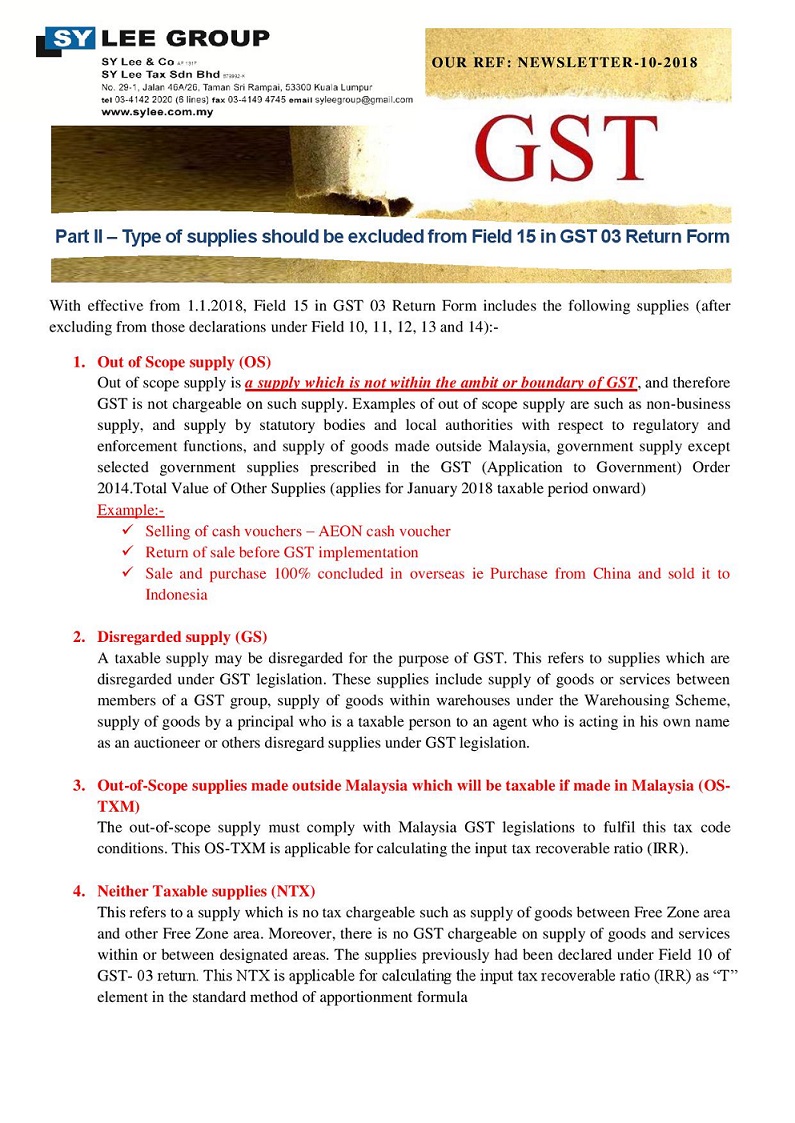

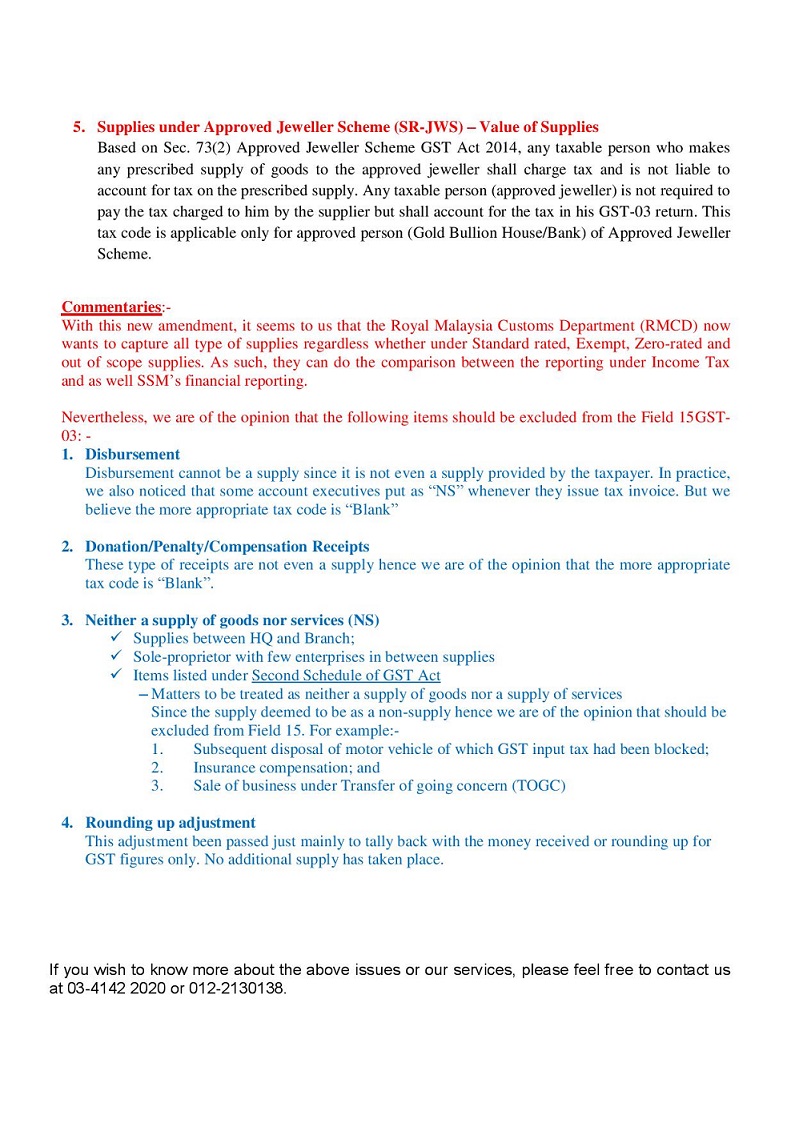

Newsletter-10-2018-GST Tax code part II

09.Feb.2018

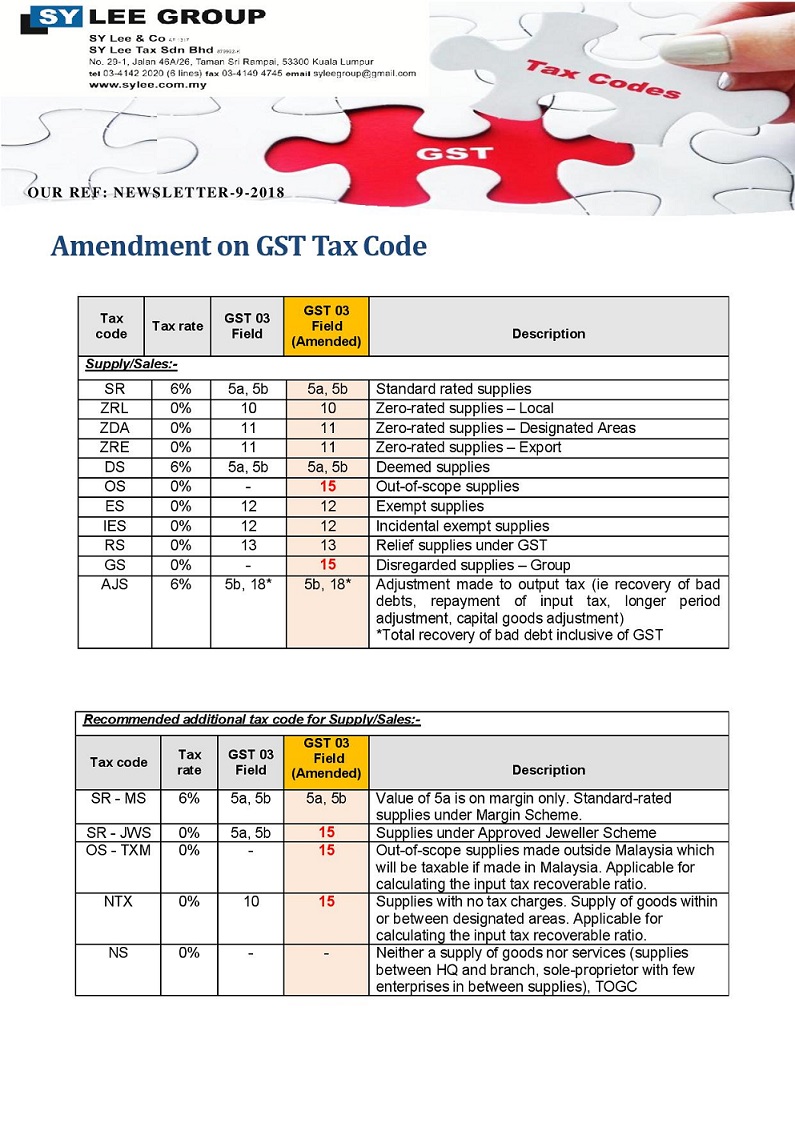

Newsletter-9-2018 -Amendment on GST tax code

06.Feb.2018

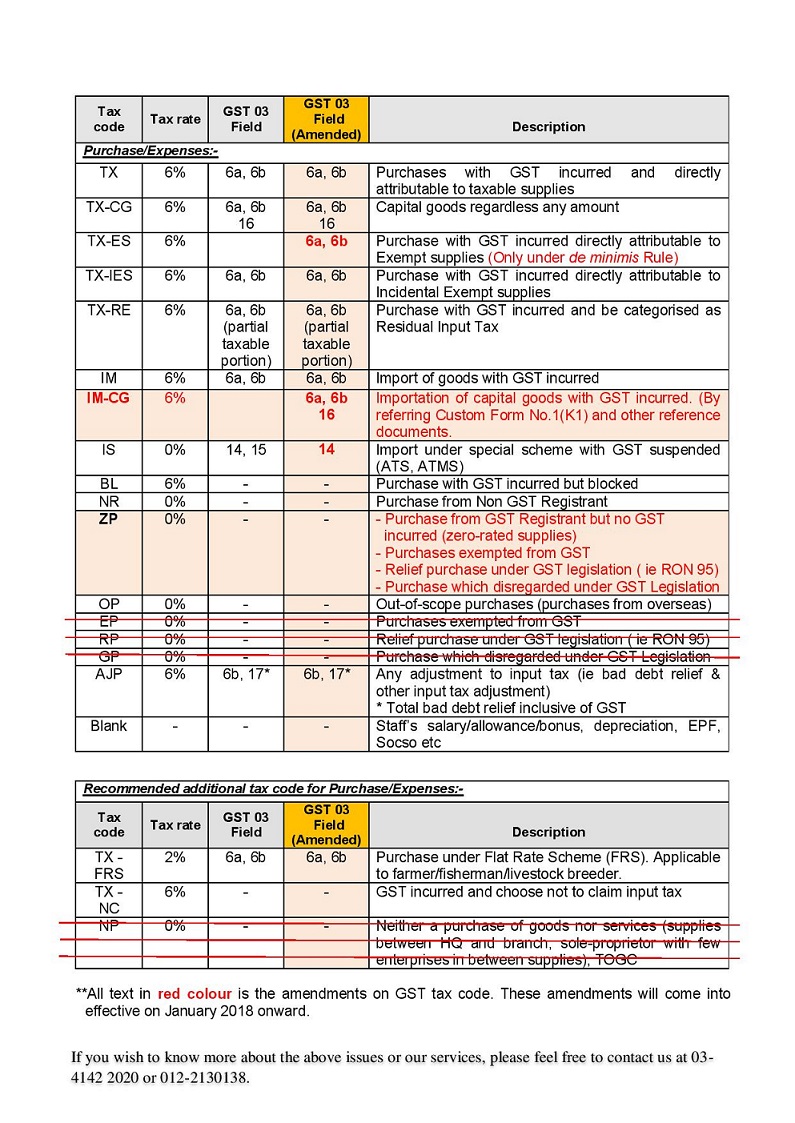

Newsletter-4-2018- Update on GST Taxable Period

16.Jan.2018

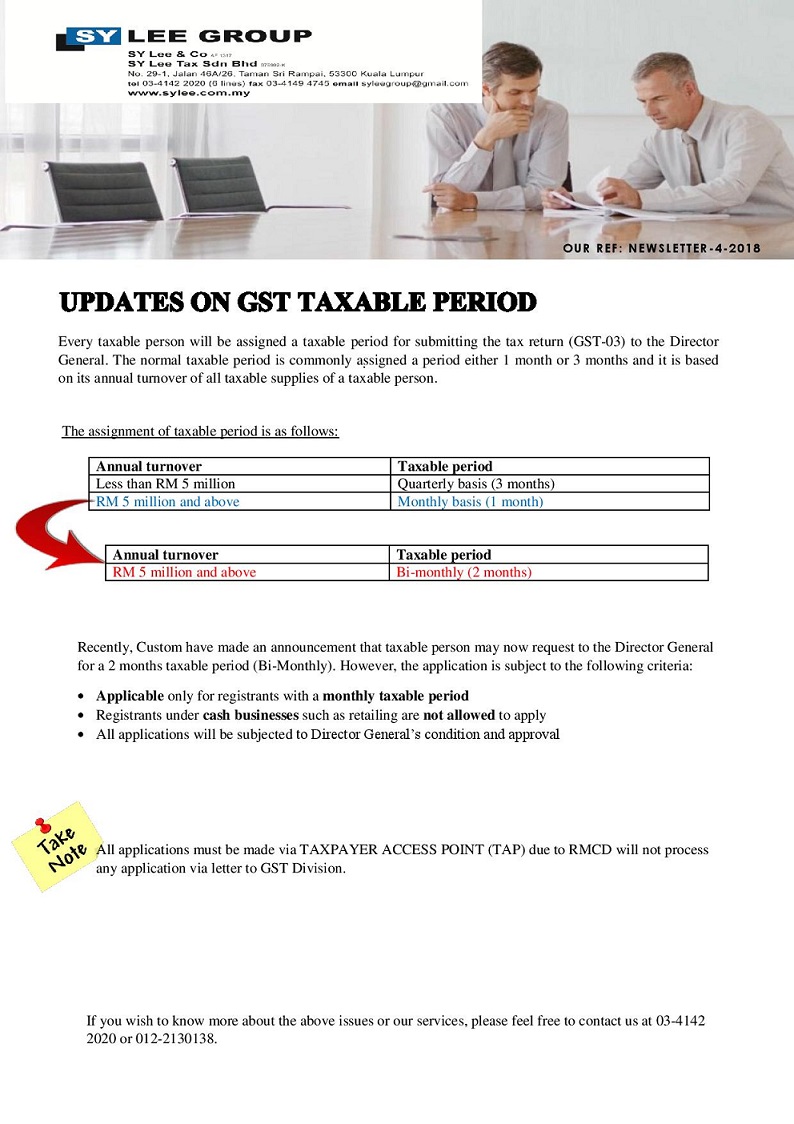

Newsletter-3-2018- Amendment on GST

15.Jan.2018

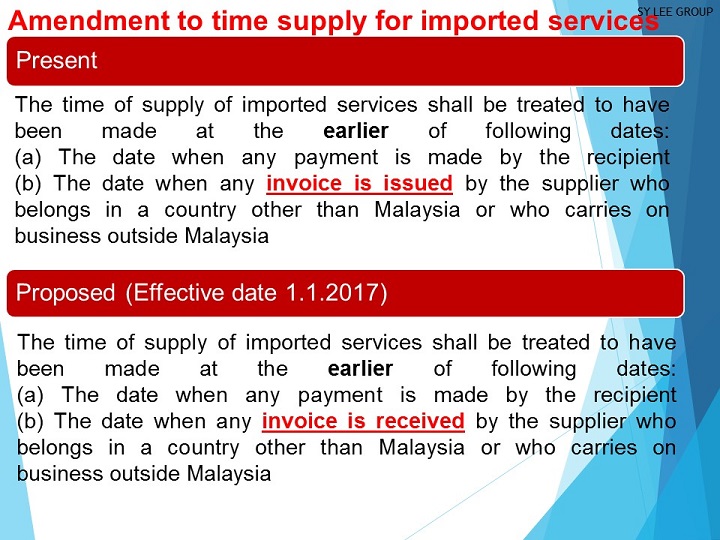

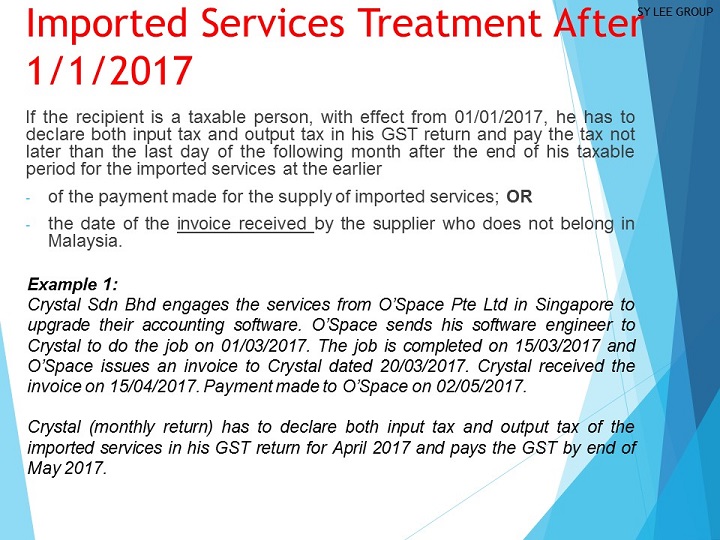

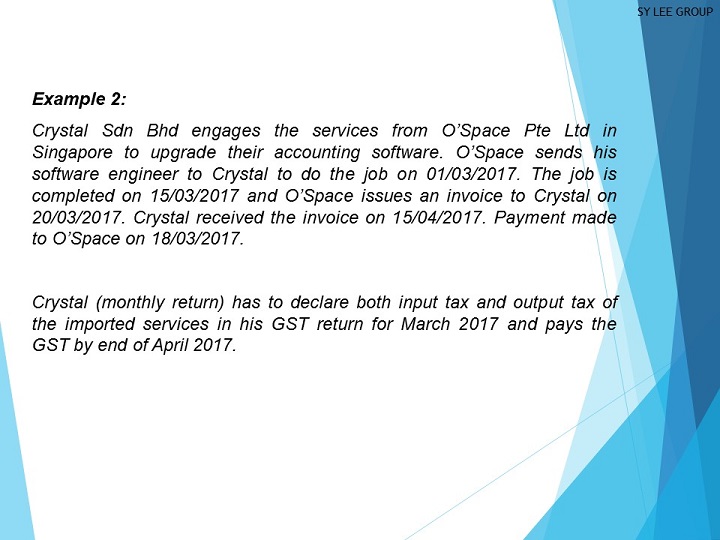

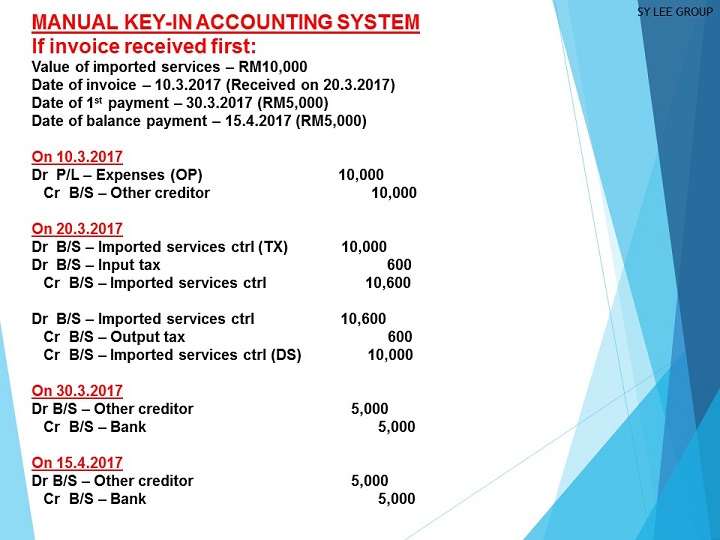

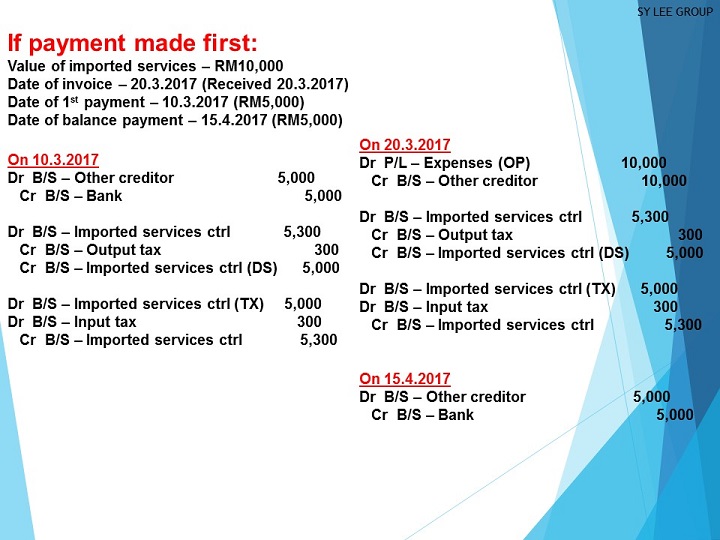

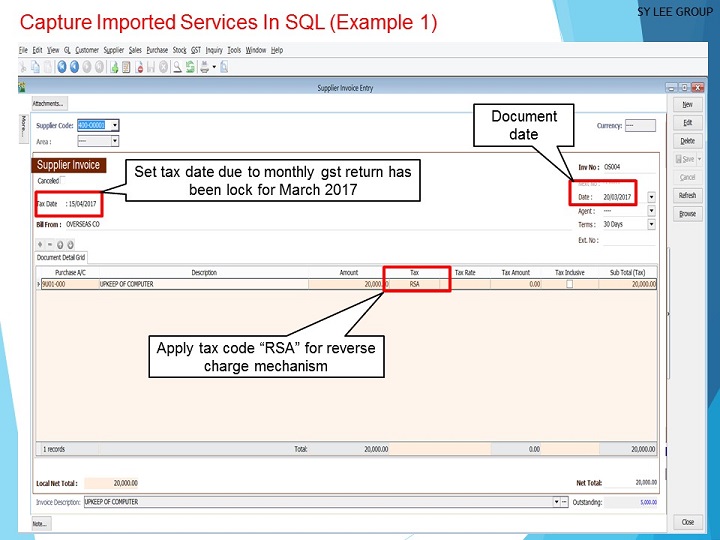

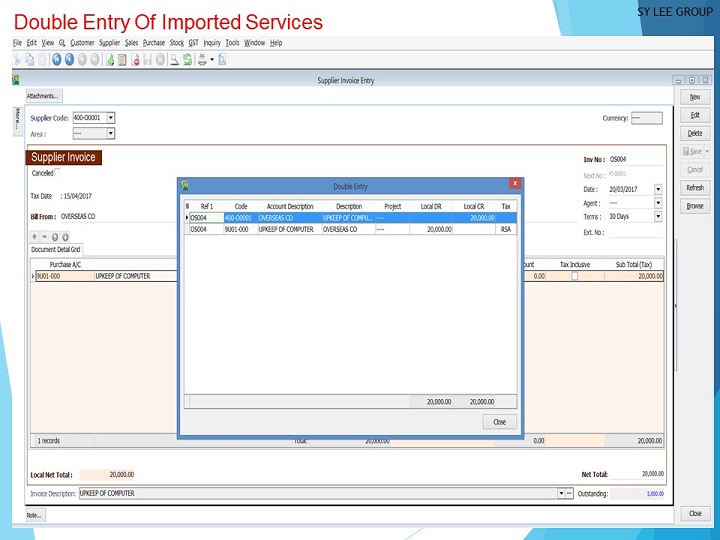

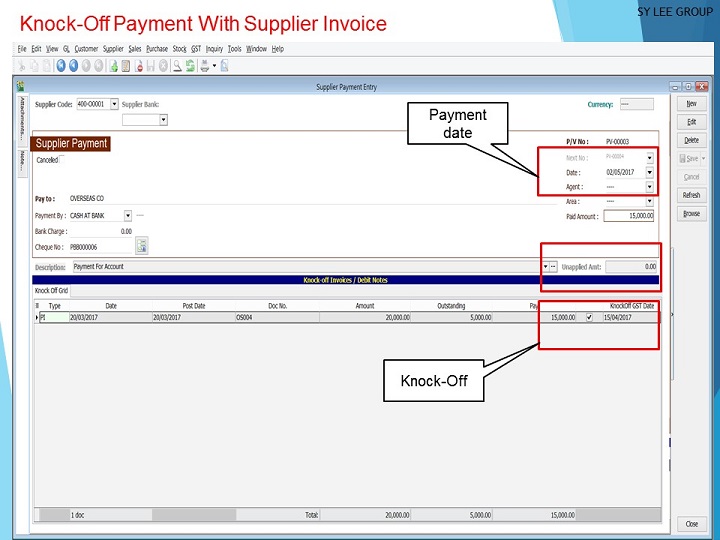

GST UPDATE - IMPORTED SERVICES

28.Nov.2016

%20bill%202018%20-page-001.jpg)

%20(part%20iii)-page-001.jpg)

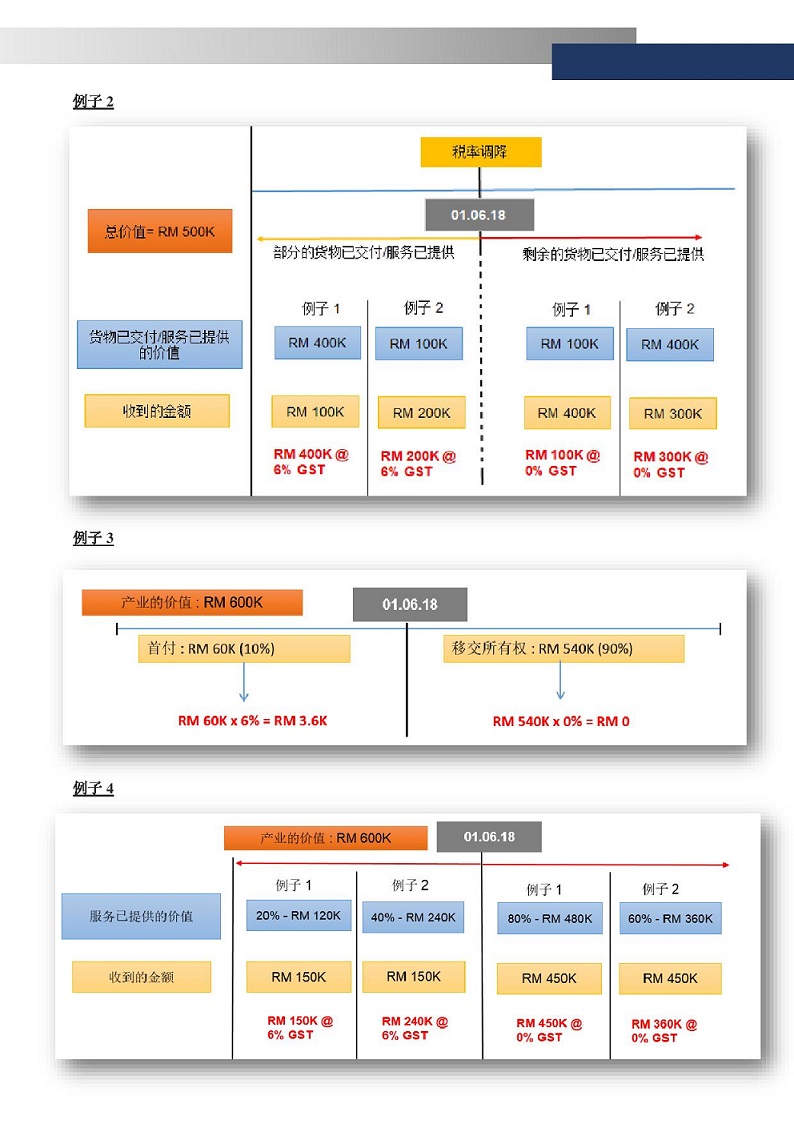

(part%20ii)-page-001.jpg)

(part%20ii)-page-002.jpg)

(part%20ii)-page-003.jpg)

(part%20ii)-page-004.jpg)

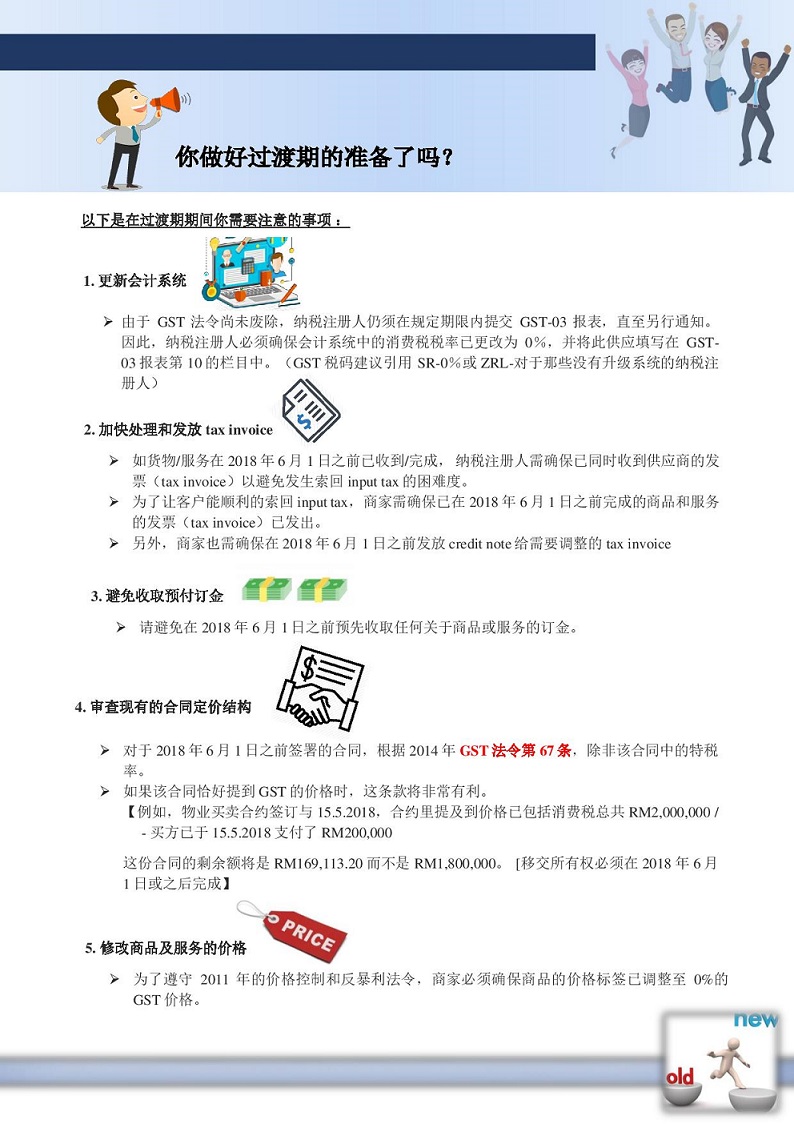

(part%20ii)-page-005.jpg)

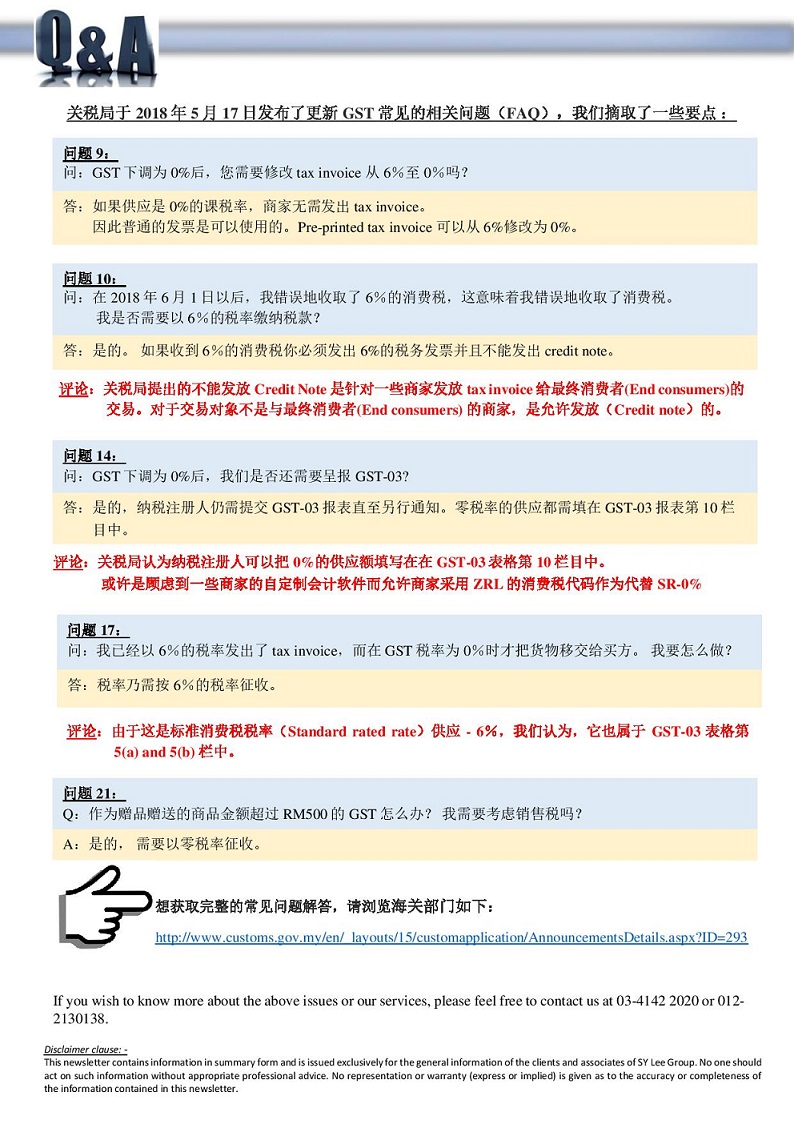

-page-001.jpg)

-page-002.jpg)

%20of%20goods%20&%20services%20tax%20act%202014-page-001.jpg)

%20of%20goods%20&%20services%20tax%20act%202014-page-002.jpg)

%20of%20goods%20&%20services%20tax%20act%202014-page-003.jpg)

%20of%20goods%20&%20services%20tax%20act%202014-page-004.jpg)

%20of%20goods%20&%20services%20tax%20act%202014-page-005.jpg)